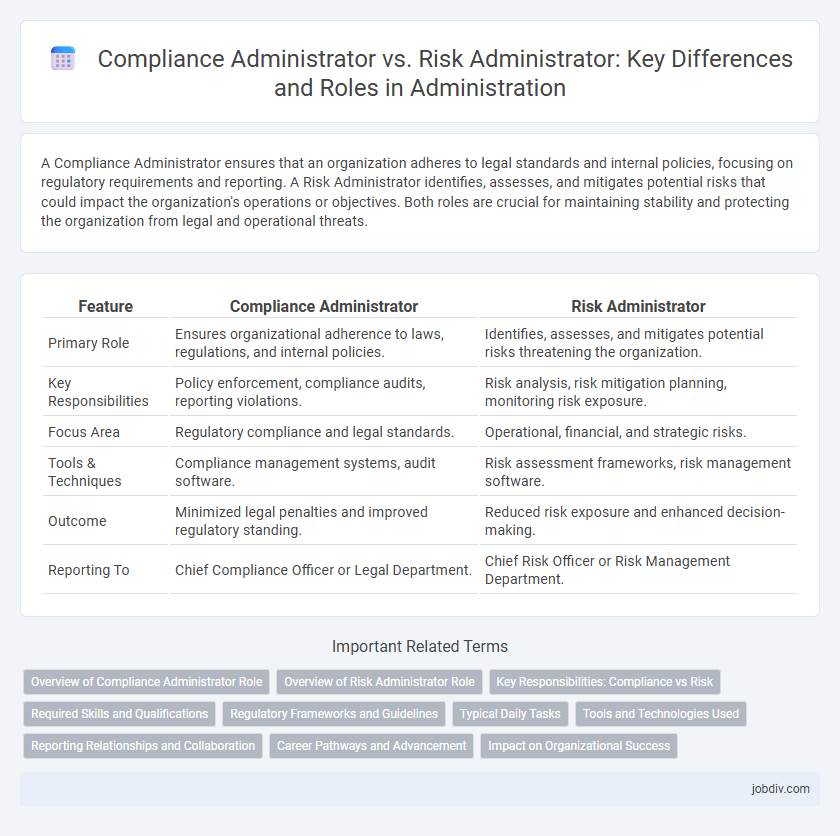

A Compliance Administrator ensures that an organization adheres to legal standards and internal policies, focusing on regulatory requirements and reporting. A Risk Administrator identifies, assesses, and mitigates potential risks that could impact the organization's operations or objectives. Both roles are crucial for maintaining stability and protecting the organization from legal and operational threats.

Table of Comparison

| Feature | Compliance Administrator | Risk Administrator |

|---|---|---|

| Primary Role | Ensures organizational adherence to laws, regulations, and internal policies. | Identifies, assesses, and mitigates potential risks threatening the organization. |

| Key Responsibilities | Policy enforcement, compliance audits, reporting violations. | Risk analysis, risk mitigation planning, monitoring risk exposure. |

| Focus Area | Regulatory compliance and legal standards. | Operational, financial, and strategic risks. |

| Tools & Techniques | Compliance management systems, audit software. | Risk assessment frameworks, risk management software. |

| Outcome | Minimized legal penalties and improved regulatory standing. | Reduced risk exposure and enhanced decision-making. |

| Reporting To | Chief Compliance Officer or Legal Department. | Chief Risk Officer or Risk Management Department. |

Overview of Compliance Administrator Role

A Compliance Administrator ensures organizational adherence to regulatory requirements, implementing policies to mitigate legal risks and maintain ethical standards. This role involves monitoring regulatory changes, conducting compliance audits, and providing staff training to prevent violations. Unlike a Risk Administrator who focuses broadly on identifying and managing business risks, the Compliance Administrator specializes in regulatory frameworks and internal controls essential for corporate governance.

Overview of Risk Administrator Role

A Risk Administrator oversees the identification, assessment, and mitigation of organizational risks to ensure operational continuity and regulatory compliance. They develop risk management frameworks, monitor risk metrics, and collaborate with various departments to implement risk control measures. Proficiency in risk assessment tools, regulatory standards, and incident reporting protocols is essential for effective risk administration.

Key Responsibilities: Compliance vs Risk

Compliance Administrators ensure organizations adhere to legal standards, regulatory requirements, and internal policies by conducting audits, monitoring compliance programs, and managing documentation. Risk Administrators focus on identifying, assessing, and mitigating potential risks that could impact business operations by developing risk management strategies and conducting risk assessments. While Compliance prioritizes maintaining legal and regulatory conformity, Risk emphasizes safeguarding assets and minimizing exposure to financial, operational, and reputational threats.

Required Skills and Qualifications

Compliance Administrators require expertise in regulatory frameworks, attention to detail, and strong analytical skills to ensure organizational adherence to laws and policies. Risk Administrators focus on risk assessment methodologies, problem-solving abilities, and proficiency in risk management software to identify and mitigate potential threats. Both roles demand effective communication skills and a solid understanding of industry-specific standards and best practices.

Regulatory Frameworks and Guidelines

Compliance Administrators specialize in enforcing regulatory frameworks such as GDPR, HIPAA, and SOX, ensuring organizational adherence to legal standards and internal policies. Risk Administrators focus on identifying, assessing, and mitigating potential threats within these frameworks, using guidelines from ISO 31000 and COSO to manage risk exposure effectively. Both roles collaborate closely to maintain governance, reduce liability, and support regulatory audits within complex administrative environments.

Typical Daily Tasks

A Compliance Administrator monitors regulatory requirements, conducts audits, and ensures company policies align with legal standards to prevent violations. A Risk Administrator assesses potential business risks, develops mitigation strategies, and maintains risk management documentation to safeguard organizational assets. Both roles require detailed reporting and collaboration with internal teams to uphold corporate governance.

Tools and Technologies Used

Compliance Administrators leverage regulatory technology (RegTech) platforms such as MetricStream and NAVEX Global to automate compliance tracking, policy management, and audit workflows, enhancing organizational adherence to legal standards. Risk Administrators utilize risk management software like RSA Archer and SAP GRC to identify, assess, and mitigate enterprise risks through data analytics, scenario modeling, and real-time reporting dashboards. Both roles increasingly employ AI-driven analytics and cloud-based solutions to improve accuracy, efficiency, and decision-making in dynamic regulatory environments.

Reporting Relationships and Collaboration

A Compliance Administrator typically reports to the Chief Compliance Officer or Legal Department, ensuring adherence to regulatory standards through detailed reporting and documentation. In contrast, a Risk Administrator often reports to the Risk Manager or Chief Risk Officer, focusing on identifying, assessing, and mitigating organizational risks through collaborative risk analysis. Both roles require close collaboration with various departments such as finance, operations, and audit to ensure comprehensive organizational governance and effective risk management.

Career Pathways and Advancement

Compliance Administrators typically advance by deepening expertise in regulatory standards and auditing processes, often progressing into roles such as Compliance Manager or Regulatory Affairs Specialist. Risk Administrators focus on identifying and mitigating potential threats, leading to career growth opportunities in Risk Management, Chief Risk Officer positions, or enterprise-wide risk strategy roles. Both pathways require strong analytical skills and offer advancement through specialization or broader leadership responsibilities within organizational governance.

Impact on Organizational Success

Compliance Administrators ensure adherence to regulatory standards, reducing legal risks and fostering organizational integrity, which safeguards company reputation and prevents costly penalties. Risk Administrators identify, assess, and mitigate potential threats, enhancing operational resilience and enabling proactive decision-making that protects assets and drives strategic growth. Collaboratively, they fortify organizational success by balancing regulatory compliance with effective risk management strategies, promoting sustainable business performance.

Compliance Administrator vs Risk Administrator Infographic

jobdiv.com

jobdiv.com