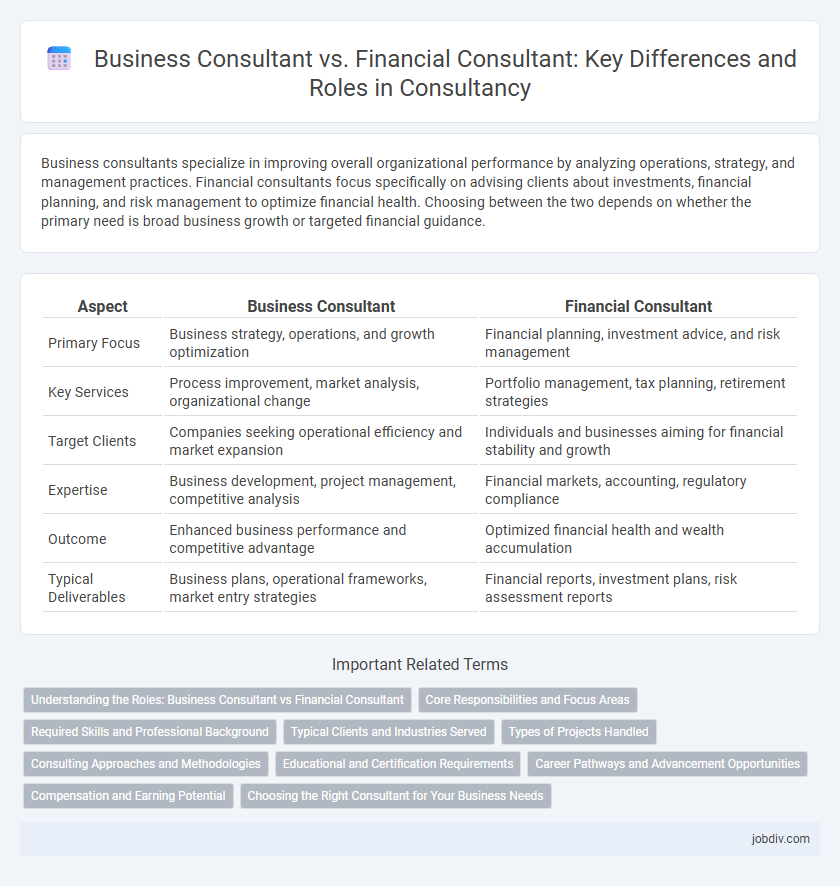

Business consultants specialize in improving overall organizational performance by analyzing operations, strategy, and management practices. Financial consultants focus specifically on advising clients about investments, financial planning, and risk management to optimize financial health. Choosing between the two depends on whether the primary need is broad business growth or targeted financial guidance.

Table of Comparison

| Aspect | Business Consultant | Financial Consultant |

|---|---|---|

| Primary Focus | Business strategy, operations, and growth optimization | Financial planning, investment advice, and risk management |

| Key Services | Process improvement, market analysis, organizational change | Portfolio management, tax planning, retirement strategies |

| Target Clients | Companies seeking operational efficiency and market expansion | Individuals and businesses aiming for financial stability and growth |

| Expertise | Business development, project management, competitive analysis | Financial markets, accounting, regulatory compliance |

| Outcome | Enhanced business performance and competitive advantage | Optimized financial health and wealth accumulation |

| Typical Deliverables | Business plans, operational frameworks, market entry strategies | Financial reports, investment plans, risk assessment reports |

Understanding the Roles: Business Consultant vs Financial Consultant

Business consultants specialize in improving overall business performance by analyzing operations, strategy, and management to drive growth and efficiency. Financial consultants focus specifically on managing finances, including investment strategies, budgeting, and financial planning to enhance an organization's financial health. Understanding the distinct expertise and objectives of business consultants versus financial consultants helps companies choose the right advisor for targeted improvements.

Core Responsibilities and Focus Areas

Business consultants specialize in improving overall organizational performance by analyzing business processes, developing strategies, and implementing operational changes to enhance efficiency and growth. Financial consultants concentrate on managing clients' financial health through budgeting, investment planning, risk assessment, and advising on financial decisions to maximize wealth and ensure fiscal stability. Both roles require strong analytical skills but differ in scope, with business consultants addressing broad strategic challenges and financial consultants focusing on detailed financial management.

Required Skills and Professional Background

Business consultants require strong analytical skills, strategic thinking, and expertise in management, marketing, and operations to improve organizational performance. Financial consultants need in-depth knowledge of financial markets, investment strategies, and risk management, alongside certifications like CFA or CPA to advise clients on wealth growth and financial planning. Professional backgrounds for business consultants often include business administration or management degrees, while financial consultants typically hold finance, economics, or accounting qualifications.

Typical Clients and Industries Served

Business consultants typically serve a wide range of industries including retail, manufacturing, healthcare, and technology, advising corporations, startups, and non-profits on improving organizational performance and strategic growth. Financial consultants focus primarily on clients in banking, investment firms, insurance companies, and corporate finance departments, offering expertise in financial planning, risk management, and investment strategies. Both consultants tailor their services to the specific needs of businesses, but business consultants emphasize operational efficiency while financial consultants concentrate on financial health and capital management.

Types of Projects Handled

Business consultants primarily handle projects related to organizational strategy, operational improvement, and market analysis to enhance overall company performance. Financial consultants focus on projects involving investment planning, risk management, and financial reporting to optimize clients' fiscal health. Projects for business consultants often involve cross-functional teams, while financial consultants typically collaborate with accounting and banking sectors.

Consulting Approaches and Methodologies

Business consultants emphasize comprehensive organizational analysis, utilizing strategic frameworks like SWOT and value chain analysis to align operations with market demands. Financial consultants prioritize data-driven methodologies such as financial modeling, risk assessment, and budgeting techniques to optimize fiscal performance and investment strategies. Both consultants apply tailored analytic tools, but business consultants focus on operational efficiency while financial consultants concentrate on monetary health and compliance.

Educational and Certification Requirements

Business consultants typically require a bachelor's degree in business administration, management, or a related field, with many pursuing an MBA for advanced expertise. Financial consultants often hold degrees in finance, accounting, economics, or certifications such as CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) to demonstrate specialized financial knowledge. Both roles benefit from professional certifications and continuous education to stay current with industry regulations and best practices.

Career Pathways and Advancement Opportunities

A Business Consultant typically advances by gaining expertise in strategy, operations, and management across diverse industries, often progressing to senior roles such as Principal or Partner in management consulting firms. In contrast, a Financial Consultant specializes in investment, asset management, and financial planning, with career pathways leading to Certified Financial Planner (CFP) status, portfolio manager positions, or Chief Financial Officer (CFO) roles. Both career paths benefit from continuous professional development, sector-specific certifications, and proven client relationship management for advancement.

Compensation and Earning Potential

Business consultants typically earn an average annual salary ranging from $70,000 to $150,000, with compensation varying based on industry, project complexity, and client size. Financial consultants often command higher earnings, with salaries frequently exceeding $90,000 and total compensation including bonuses and commissions potentially reaching $200,000 or more. Earnings potential in both roles is influenced by experience, certifications such as CFP or CFA for financial consultants, and the consultant's ability to generate measurable value for clients.

Choosing the Right Consultant for Your Business Needs

Choosing the right consultant for your business involves understanding that a business consultant focuses on improving organizational efficiency, operational strategies, and market positioning, while a financial consultant specializes in managing investments, financial planning, and risk assessment. Evaluating your company's primary challenges, such as operational growth or financial management, will determine which expertise aligns better with your goals. Selecting a consultant with proven industry experience and relevant credentials enhances the potential for targeted solutions and sustainable business success.

Business Consultant vs Financial Consultant Infographic

jobdiv.com

jobdiv.com