A Mergers & Acquisitions Consultant specializes in guiding companies through the complexities of buying, selling, or merging businesses, focusing on deal structuring, valuation, and negotiation strategies. In contrast, a Corporate Finance Consultant provides broader financial advisory services including capital raising, investment analysis, and financial planning to optimize a company's financial performance. Both roles require strong analytical skills, but M&A consultants concentrate specifically on transactional activities, while corporate finance consultants address overall financial strategy and management.

Table of Comparison

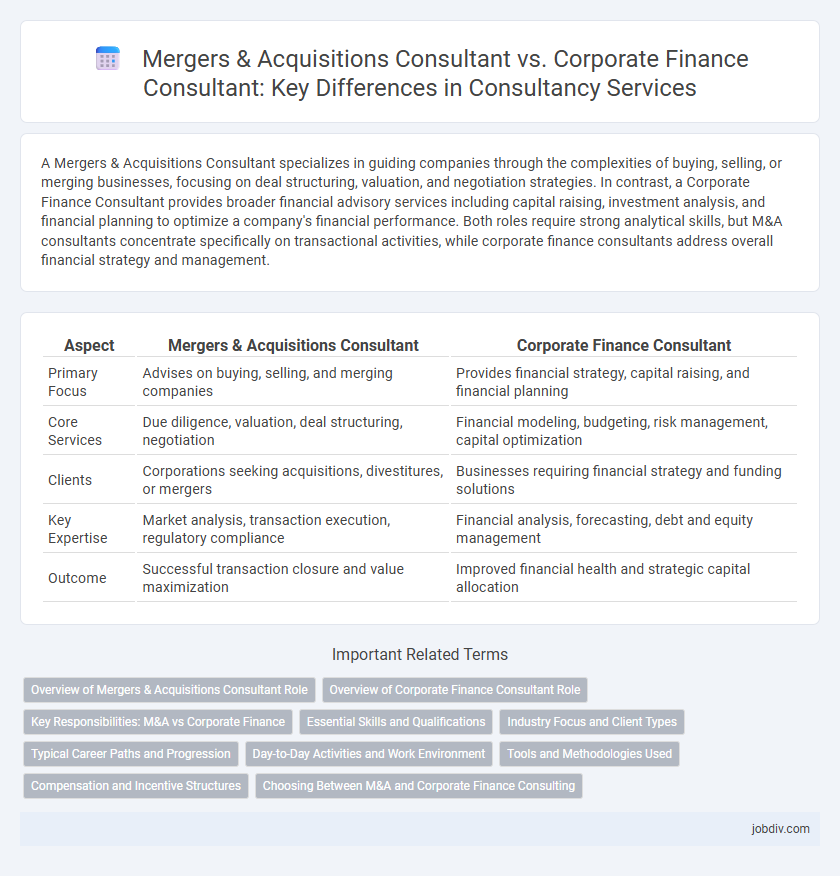

| Aspect | Mergers & Acquisitions Consultant | Corporate Finance Consultant |

|---|---|---|

| Primary Focus | Advises on buying, selling, and merging companies | Provides financial strategy, capital raising, and financial planning |

| Core Services | Due diligence, valuation, deal structuring, negotiation | Financial modeling, budgeting, risk management, capital optimization |

| Clients | Corporations seeking acquisitions, divestitures, or mergers | Businesses requiring financial strategy and funding solutions |

| Key Expertise | Market analysis, transaction execution, regulatory compliance | Financial analysis, forecasting, debt and equity management |

| Outcome | Successful transaction closure and value maximization | Improved financial health and strategic capital allocation |

Overview of Mergers & Acquisitions Consultant Role

Mergers & Acquisitions Consultants specialize in advising companies on the strategic planning, valuation, negotiation, and execution of mergers, acquisitions, divestitures, and joint ventures to maximize shareholder value. Their role involves conducting due diligence, assessing financial risks, and identifying synergies between merging entities to ensure successful integration. They collaborate closely with legal, financial, and operational teams to structure deals that align with the client's long-term business objectives.

Overview of Corporate Finance Consultant Role

Corporate Finance Consultants specialize in managing a company's capital structure, funding strategies, and financial risk to maximize shareholder value. They provide expertise in financial planning, budgeting, and analysis, facilitating mergers, acquisitions, and capital raising activities. Their role is integral in advising businesses on strategic investments, liquidity management, and long-term financial sustainability.

Key Responsibilities: M&A vs Corporate Finance

Mergers & Acquisitions Consultants specialize in advising clients on the identification, valuation, negotiation, and integration of business mergers, acquisitions, and divestitures to maximize shareholder value. Corporate Finance Consultants focus on capital structure optimization, financial planning, fundraising, and risk management to enhance overall corporate financial health. Both roles require deep financial analysis expertise and strategic advisory skills but differ in focus: M&A consultants prioritize transactional deal-making, while corporate finance consultants emphasize broader capital and financial strategy.

Essential Skills and Qualifications

Mergers & Acquisitions Consultants require expertise in deal structuring, valuation, financial modeling, and negotiation to effectively manage complex transactions and due diligence processes. Corporate Finance Consultants must possess strong analytical skills, proficiency in capital budgeting, risk assessment, and a deep understanding of market trends to advise on funding strategies and corporate restructuring. Both roles demand advanced degrees such as an MBA or CFA certification, with experience in financial analysis and strategic planning essential for driving successful financial outcomes.

Industry Focus and Client Types

Mergers & Acquisitions Consultants primarily serve clients in industries undergoing consolidation such as technology, healthcare, and manufacturing, advising corporations, private equity firms, and strategic buyers on deal structuring and valuation. Corporate Finance Consultants focus on a broader range of sectors including retail, real estate, and energy, working with small to large enterprises, family businesses, and financial institutions to optimize capital raising, financial planning, and restructuring. Both roles require deep industry expertise but diverge in client engagement, with M&A consultants concentrating on transactional execution and Corporate Finance consultants emphasizing long-term financial strategy.

Typical Career Paths and Progression

Mergers & Acquisitions Consultants typically start as analysts or associates, progressing to roles such as M&A Manager, Director, and eventually Partner or Senior Advisor, specializing in deal structuring, valuation, and negotiation. Corporate Finance Consultants often begin in financial analysis or advisory roles, advancing to positions like Finance Manager, Corporate Development Director, and CFO, focusing on capital raising, financial planning, and risk management. Both career paths emphasize strong financial acumen, strategic decision-making skills, and experience with complex transactions, but M&A Consultants usually have a more deal-centric trajectory, while Corporate Finance Consultants pursue broader financial strategy roles.

Day-to-Day Activities and Work Environment

Mergers & Acquisitions Consultants primarily engage in deal sourcing, financial modeling, due diligence, and negotiation support, often working closely with legal teams and corporate executives in high-pressure environments with tight deadlines. Corporate Finance Consultants focus on capital raising, financial planning, risk management, and advising on capital structure optimization, typically operating within broader financial advisory teams and interacting regularly with investors and financial institutions. Both roles require strong analytical skills and client management but differ in their day-to-day emphasis, with M&A consultants concentrating on transaction execution and corporate finance consultants emphasizing strategic financial advisory.

Tools and Methodologies Used

Mergers & Acquisitions Consultants utilize advanced valuation models, due diligence frameworks, and negotiation tactics to assess target companies and optimize deal structures. Corporate Finance Consultants leverage financial analysis software, capital budgeting tools, and risk assessment methodologies to advise on funding strategies and enhance financial performance. Both roles rely heavily on Excel-based financial modeling and scenario analysis to support strategic decision-making.

Compensation and Incentive Structures

Mergers & Acquisitions Consultants typically earn higher base salaries and substantial performance-based bonuses tied to deal closures and transaction values, reflecting the high-stakes nature of M&A projects. Corporate Finance Consultants receive competitive fixed salaries with incentives linked to financial targets, budgeting accuracy, and strategic advisory outcomes. Both roles may include equity participation or profit-sharing plans, but M&A consultants often benefit from more variable compensation aligned with deal success and client impact.

Choosing Between M&A and Corporate Finance Consulting

Choosing between Mergers & Acquisitions (M&A) consulting and Corporate Finance consulting depends on your career goals, as M&A consultants specialize in deal structuring, valuation, and negotiation processes, while Corporate Finance consultants focus on capital raising, financial planning, and risk management. M&A roles demand expertise in strategic transactions and market analysis, whereas Corporate Finance roles require deep knowledge of financial modeling and corporate budgeting. Evaluating your strengths in transactional work versus broader financial strategy helps determine the optimal consulting path.

Mergers & Acquisitions Consultant vs Corporate Finance Consultant Infographic

jobdiv.com

jobdiv.com