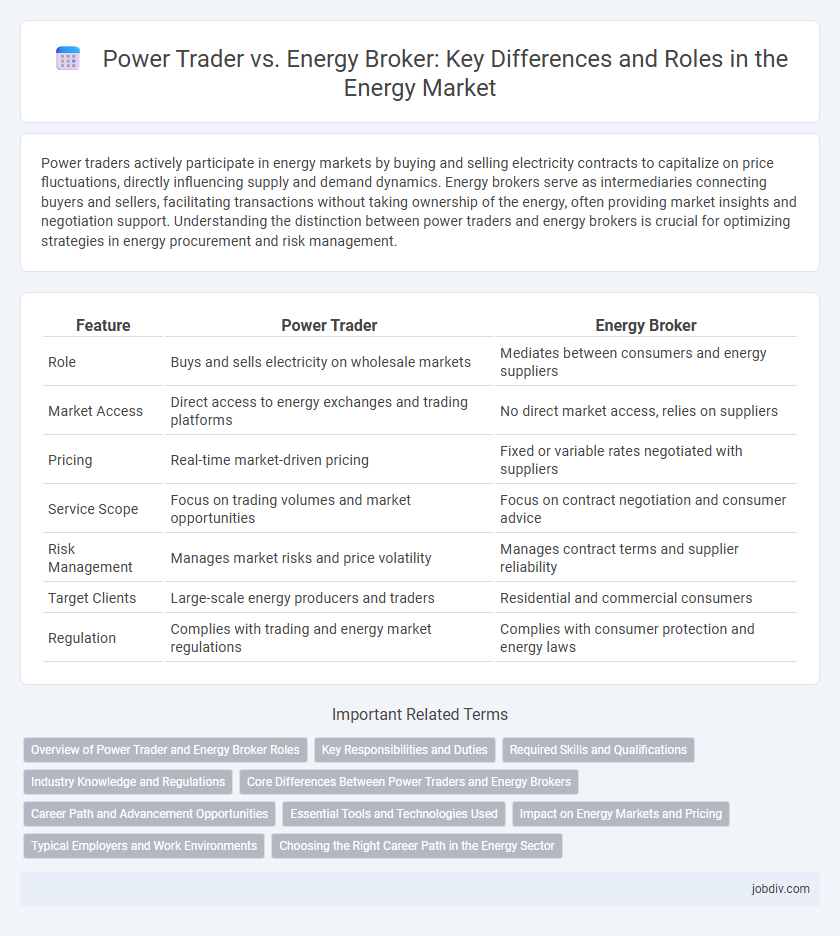

Power traders actively participate in energy markets by buying and selling electricity contracts to capitalize on price fluctuations, directly influencing supply and demand dynamics. Energy brokers serve as intermediaries connecting buyers and sellers, facilitating transactions without taking ownership of the energy, often providing market insights and negotiation support. Understanding the distinction between power traders and energy brokers is crucial for optimizing strategies in energy procurement and risk management.

Table of Comparison

| Feature | Power Trader | Energy Broker |

|---|---|---|

| Role | Buys and sells electricity on wholesale markets | Mediates between consumers and energy suppliers |

| Market Access | Direct access to energy exchanges and trading platforms | No direct market access, relies on suppliers |

| Pricing | Real-time market-driven pricing | Fixed or variable rates negotiated with suppliers |

| Service Scope | Focus on trading volumes and market opportunities | Focus on contract negotiation and consumer advice |

| Risk Management | Manages market risks and price volatility | Manages contract terms and supplier reliability |

| Target Clients | Large-scale energy producers and traders | Residential and commercial consumers |

| Regulation | Complies with trading and energy market regulations | Complies with consumer protection and energy laws |

Overview of Power Trader and Energy Broker Roles

Power traders engage directly in buying and selling electricity on wholesale markets, managing risks and optimizing profits through market analysis and price forecasting. Energy brokers act as intermediaries between energy consumers and suppliers, negotiating contracts and securing favorable rates without taking ownership of the energy itself. Power traders require in-depth market knowledge and analytical skills, while energy brokers focus on customer service and contract negotiation expertise.

Key Responsibilities and Duties

Power traders analyze market trends and negotiate wholesale energy contracts to optimize profitability and manage risk exposure in volatile electricity markets. Energy brokers act as intermediaries connecting consumers with energy suppliers, advising on contract options to secure competitive rates and favorable terms. Both roles require in-depth knowledge of energy markets, but power traders focus on market strategy and trading execution while brokers emphasize customer service and contract facilitation.

Required Skills and Qualifications

Power traders require strong analytical skills, expertise in market dynamics, risk management, and proficiency with trading platforms and financial instruments. Energy brokers need excellent negotiation abilities, deep knowledge of energy markets, regulatory frameworks, and strong communication skills to connect suppliers with clients effectively. Both roles demand a solid understanding of energy policies, market trends, and relevant certifications such as the Certified Energy Manager (CEM) for brokers or Chartered Financial Analyst (CFA) for traders.

Industry Knowledge and Regulations

Power traders possess in-depth industry knowledge and expertise in market dynamics, enabling them to analyze risks and execute strategic energy transactions. Energy brokers facilitate deals by connecting buyers and sellers without holding market positions, requiring strong regulatory compliance and understanding of contractual frameworks. Both roles demand familiarity with complex regulations such as FERC rules and regional transmission organization guidelines to ensure lawful and efficient energy trade.

Core Differences Between Power Traders and Energy Brokers

Power traders primarily engage in buying and selling electricity on wholesale markets, leveraging market fluctuations to maximize profits, while energy brokers act as intermediaries who facilitate contracts between energy suppliers and consumers without owning the commodity. Power traders use complex algorithms and real-time market data to execute trades quickly, whereas energy brokers focus on negotiating rates and terms to secure the best deals for their clients. The core difference lies in ownership and risk exposure: power traders assume market risk by holding positions in energy commodities, whereas brokers earn commissions through service fees without direct market risk.

Career Path and Advancement Opportunities

Power traders typically follow a career path that emphasizes analytical skills, risk management, and market strategy, often progressing to senior trading roles or portfolio management within energy firms. Energy brokers focus on client relationship management, negotiation expertise, and market knowledge, advancing towards senior brokerage positions or mentorship roles in trading firms or consulting agencies. Career growth in power trading may lead to higher financial rewards, while energy brokerage offers opportunities to build extensive networks and advisory roles within the energy sector.

Essential Tools and Technologies Used

Power traders employ advanced algorithmic trading platforms and real-time market analytics software to optimize energy asset portfolios and forecast price fluctuations, leveraging machine learning and big data for rapid decision-making. Energy brokers utilize customer relationship management (CRM) systems and contract management tools to facilitate negotiations and secure favorable energy supply agreements, often relying on communication platforms for seamless client interactions. Both roles depend heavily on energy market information systems and regulatory compliance software to navigate complex pricing structures and market regulations effectively.

Impact on Energy Markets and Pricing

Power traders directly influence energy markets by leveraging real-time data and market volatility to optimize buying and selling strategies, driving price liquidity and efficiency. Energy brokers facilitate transactions between suppliers and consumers, enhancing market access but exerting less influence on price formation compared to traders. The dynamic activities of power traders contribute to more efficient price discovery and market responsiveness, while brokers primarily support market connectivity and contract negotiation.

Typical Employers and Work Environments

Power traders typically work for energy generation companies, utilities, investment firms, and large-scale energy trading houses, operating in fast-paced trading floors or virtual trading platforms where real-time market analysis is crucial. Energy brokers are commonly employed by brokerage firms, consulting companies, or independent agencies, functioning within office settings that emphasize client interaction, contract negotiation, and market research. Both roles require strong knowledge of energy markets, but power traders are more focused on financial risk management and speculation, while energy brokers prioritize facilitating transactions between buyers and sellers.

Choosing the Right Career Path in the Energy Sector

Power traders engage in buying and selling electricity and other energy commodities to maximize profits by analyzing market trends and price fluctuations. Energy brokers facilitate transactions between buyers and sellers, focusing on negotiating contracts and maintaining client relationships without taking ownership of the energy. Choosing the right career path depends on whether you prefer a fast-paced, analytical trading environment or a client-oriented role centered on negotiation and market expertise.

Power Trader vs Energy Broker Infographic

jobdiv.com

jobdiv.com