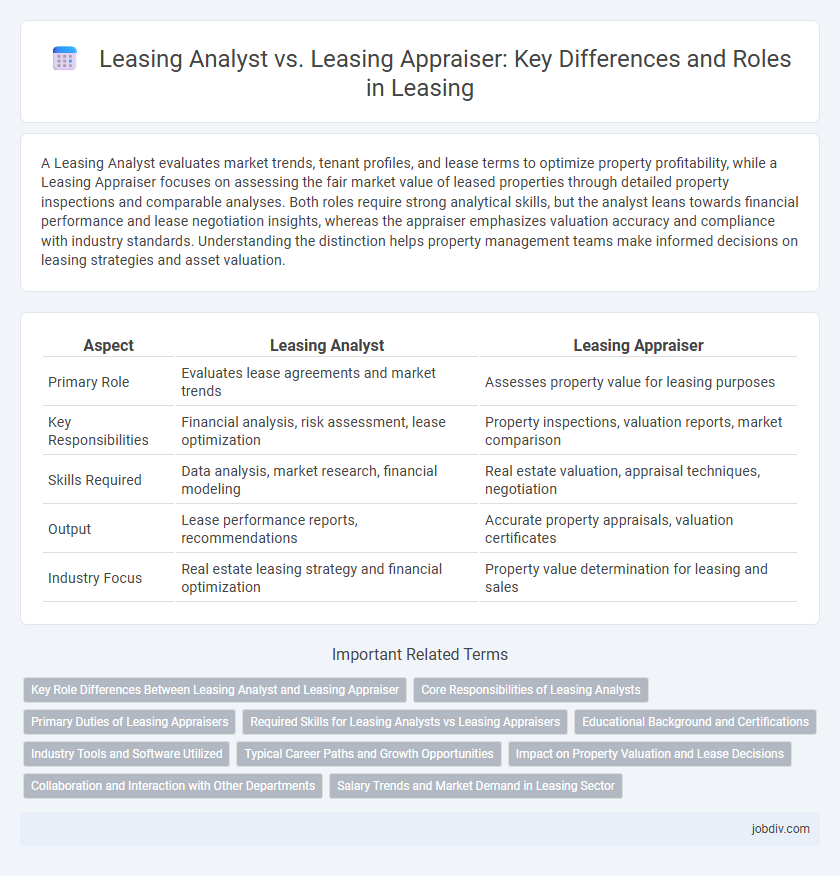

A Leasing Analyst evaluates market trends, tenant profiles, and lease terms to optimize property profitability, while a Leasing Appraiser focuses on assessing the fair market value of leased properties through detailed property inspections and comparable analyses. Both roles require strong analytical skills, but the analyst leans towards financial performance and lease negotiation insights, whereas the appraiser emphasizes valuation accuracy and compliance with industry standards. Understanding the distinction helps property management teams make informed decisions on leasing strategies and asset valuation.

Table of Comparison

| Aspect | Leasing Analyst | Leasing Appraiser |

|---|---|---|

| Primary Role | Evaluates lease agreements and market trends | Assesses property value for leasing purposes |

| Key Responsibilities | Financial analysis, risk assessment, lease optimization | Property inspections, valuation reports, market comparison |

| Skills Required | Data analysis, market research, financial modeling | Real estate valuation, appraisal techniques, negotiation |

| Output | Lease performance reports, recommendations | Accurate property appraisals, valuation certificates |

| Industry Focus | Real estate leasing strategy and financial optimization | Property value determination for leasing and sales |

Key Role Differences Between Leasing Analyst and Leasing Appraiser

Leasing Analysts specialize in reviewing lease agreements, conducting financial modeling, and assessing market trends to advise on lease negotiations and portfolio performance. Leasing Appraisers focus on evaluating property values by analyzing market data, property conditions, and comparable sales to determine accurate lease rates or purchase prices. Key role differences include the Leasing Analyst's emphasis on financial analysis and lease strategy versus the Leasing Appraiser's expertise in property valuation and market pricing.

Core Responsibilities of Leasing Analysts

Leasing Analysts specialize in evaluating lease agreements, conducting financial modeling, and analyzing market trends to optimize leasing strategies. They prepare detailed reports and forecasts on lease performance, tenant creditworthiness, and portfolio profitability. Their core responsibilities center on data-driven decision-making to support lease negotiations and maximize asset value.

Primary Duties of Leasing Appraisers

Leasing Appraisers primarily conduct detailed property valuations to determine fair market rental rates and property values for leasing purposes. They analyze market trends, comparable leases, and property conditions to provide accurate appraisals that support lease negotiations and asset management. Their assessments ensure informed decision-making for landlords, tenants, and investors in lease agreements.

Required Skills for Leasing Analysts vs Leasing Appraisers

Leasing Analysts require strong analytical skills, proficiency in financial modeling, and expertise in market research to evaluate leasing trends and financial performance. Leasing Appraisers need in-depth knowledge of property valuation techniques, attention to detail, and experience with appraisal software to accurately assess property value. Both roles demand excellent communication skills and a solid understanding of real estate market dynamics.

Educational Background and Certifications

Leasing Analysts typically hold degrees in finance, business administration, or real estate, supplemented by certifications such as the Certified Lease Analyst (CLA) or Chartered Financial Analyst (CFA) for advanced financial expertise. Leasing Appraisers often possess educational credentials in real estate, appraisal, or property management, with certifications like the Certified Residential Appraiser (CRA) or the Appraisal Institute's MAI designation to validate market value assessments. Both roles prioritize strong analytical skills but differ in focus: Leasing Analysts concentrate on lease terms and financial implications, while Leasing Appraisers specialize in property valuation accuracy.

Industry Tools and Software Utilized

Leasing Analysts primarily utilize data analytics platforms like Argus Enterprise and Excel for financial modeling, lease analysis, and portfolio management to assess leasing performance. Leasing Appraisers often rely on appraisal software such as CoStar, RealNet, and Marshall & Swift to evaluate property values, market conditions, and comparables for accurate lease valuation. Both roles increasingly integrate geographic information systems (GIS) and automated valuation models (AVMs) for enhanced market insights and decision-making in commercial real estate leasing.

Typical Career Paths and Growth Opportunities

Leasing Analysts typically advance by specializing in financial modeling, portfolio management, and market research, often progressing to roles such as Senior Leasing Analyst or Leasing Manager. Leasing Appraisers usually grow by developing expertise in property valuation, appraisal techniques, and regulatory compliance, leading to positions like Senior Appraiser or Chief Appraiser. Both career paths offer opportunities in real estate investment, asset management, and corporate leasing strategy, with growth driven by analytical skills and industry certifications.

Impact on Property Valuation and Lease Decisions

Leasing Analysts evaluate market trends, tenant demands, and financial data to forecast lease terms that maximize property income, directly influencing lease decisions and rental rates. Leasing Appraisers conduct detailed property valuations, assessing physical conditions and comparable sales to determine accurate market value, impacting investment decisions and lease negotiations. Together, their analyses ensure informed property valuation and optimal lease agreements, balancing financial performance and asset value.

Collaboration and Interaction with Other Departments

Leasing Analysts collaborate closely with finance and legal teams to evaluate lease terms and ensure compliance, providing data-driven insights that support contract negotiations. Leasing Appraisers interact regularly with property management and marketing departments to assess asset values and market trends, facilitating accurate property valuations for strategic leasing decisions. Both roles require strong cross-departmental communication to optimize lease agreements and maximize portfolio performance.

Salary Trends and Market Demand in Leasing Sector

Leasing Analysts typically earn between $55,000 and $75,000 annually, driven by their role in financial modeling and market research, whereas Leasing Appraisers command salaries ranging from $60,000 to $85,000 due to their expertise in property valuation and appraisal accuracy. Market demand for Leasing Analysts is increasing steadily as companies rely on data-driven lease optimization strategies, while Leasing Appraisers face moderate growth aligned with real estate market fluctuations and regulatory requirements. Salary trends indicate that appraisers may see slightly higher compensation growth in regions experiencing real estate booms, while analysts benefit from broader demand across diverse leasing portfolios.

Leasing Analyst vs Leasing Appraiser Infographic

jobdiv.com

jobdiv.com