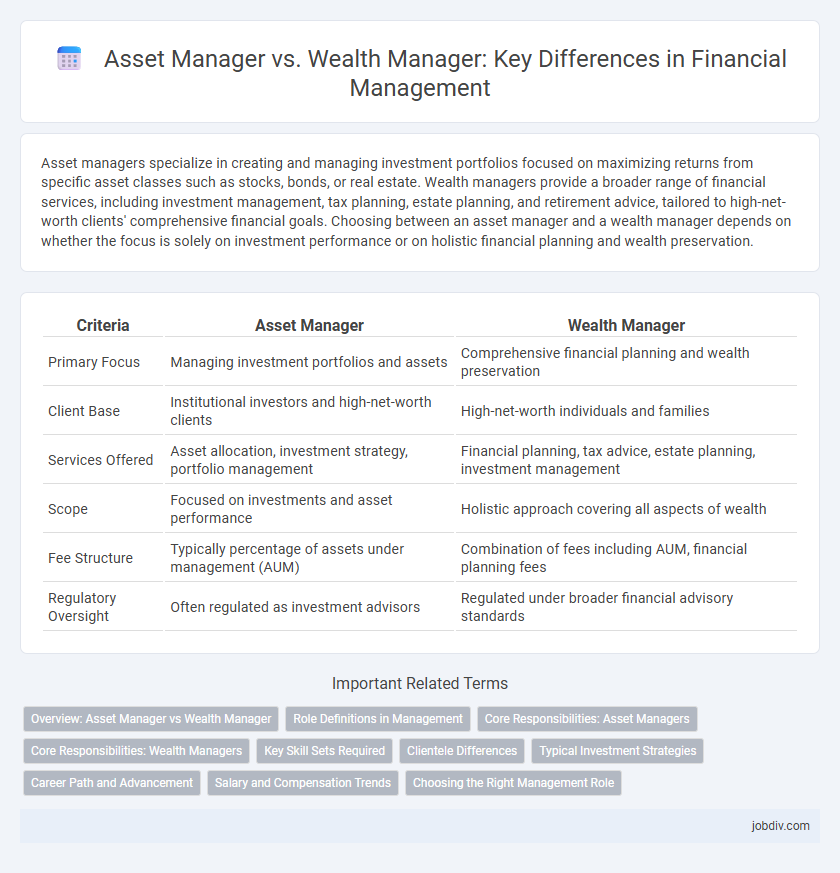

Asset managers specialize in creating and managing investment portfolios focused on maximizing returns from specific asset classes such as stocks, bonds, or real estate. Wealth managers provide a broader range of financial services, including investment management, tax planning, estate planning, and retirement advice, tailored to high-net-worth clients' comprehensive financial goals. Choosing between an asset manager and a wealth manager depends on whether the focus is solely on investment performance or on holistic financial planning and wealth preservation.

Table of Comparison

| Criteria | Asset Manager | Wealth Manager |

|---|---|---|

| Primary Focus | Managing investment portfolios and assets | Comprehensive financial planning and wealth preservation |

| Client Base | Institutional investors and high-net-worth clients | High-net-worth individuals and families |

| Services Offered | Asset allocation, investment strategy, portfolio management | Financial planning, tax advice, estate planning, investment management |

| Scope | Focused on investments and asset performance | Holistic approach covering all aspects of wealth |

| Fee Structure | Typically percentage of assets under management (AUM) | Combination of fees including AUM, financial planning fees |

| Regulatory Oversight | Often regulated as investment advisors | Regulated under broader financial advisory standards |

Overview: Asset Manager vs Wealth Manager

Asset managers primarily focus on managing investment portfolios and optimizing asset performance for institutional clients, corporations, or high-net-worth individuals by selecting stocks, bonds, and other securities. Wealth managers provide comprehensive financial services including estate planning, tax advice, retirement planning, and investment management tailored to the overall financial goals of affluent clients. The key distinction lies in asset managers concentrating on asset allocation and returns, while wealth managers integrate a broader range of personalized financial strategies.

Role Definitions in Management

An Asset Manager specializes in managing investment portfolios by selecting and monitoring assets to maximize returns based on client-specific risk profiles and financial goals. A Wealth Manager provides a broader range of financial services, including estate planning, tax optimization, retirement planning, and investment management, tailored to high-net-worth individuals. Both roles require comprehensive financial acumen, but Asset Managers focus primarily on asset allocation and performance, while Wealth Managers deliver holistic financial strategies.

Core Responsibilities: Asset Managers

Asset managers focus on overseeing investment portfolios by selecting, acquiring, and managing assets such as stocks, bonds, real estate, and other securities to maximize returns. They analyze market trends, conduct risk assessments, and rebalance portfolios to meet specific investment goals. Their core responsibilities include asset allocation, performance monitoring, and ensuring compliance with regulatory requirements.

Core Responsibilities: Wealth Managers

Wealth managers focus on creating personalized financial strategies that encompass investment management, estate planning, tax optimization, and retirement planning to grow and protect clients' wealth. They provide holistic advice tailored to high-net-worth individuals, addressing both financial goals and lifestyle needs. Wealth managers also coordinate with legal and tax professionals to ensure comprehensive wealth preservation and transfer.

Key Skill Sets Required

Asset managers require expertise in portfolio analysis, risk assessment, and market trends to optimize investment performance. Wealth managers focus on comprehensive financial planning, tax strategy, and personalized client relationship management to meet broader financial goals. Both roles demand strong analytical skills, but wealth managers emphasize client advisory and holistic asset allocation.

Clientele Differences

Asset managers primarily serve institutional clients such as pension funds, corporations, and insurance companies, focusing on managing large-scale investment portfolios and optimizing asset allocation. Wealth managers cater mainly to high-net-worth individuals and families, offering personalized financial planning, estate planning, and investment advisory services tailored to individual goals. The distinct clientele influences the scope of services, with asset managers emphasizing portfolio performance and risk management, while wealth managers prioritize comprehensive wealth preservation and growth strategies.

Typical Investment Strategies

Asset managers typically implement diversified portfolios focused on maximizing returns through equity, fixed income, and alternative investments tailored to institutional clients or high-net-worth individuals. Wealth managers adopt a holistic approach integrating investment strategies with financial planning, tax optimization, and estate planning to preserve and grow client wealth over the long term. Both utilize risk assessment and asset allocation models, but asset managers concentrate more on active portfolio management, while wealth managers emphasize personalized financial goals.

Career Path and Advancement

Asset managers typically start their careers with a strong background in finance or investment analysis, focusing on managing portfolios and maximizing returns for institutional clients. Wealth managers often enter the field through financial planning or private banking, emphasizing personalized strategies for high-net-worth individuals and family offices. Career advancement for asset managers usually involves moving into senior analyst or portfolio management roles, while wealth managers progress by building client relationships and potentially becoming partners or directors in advisory firms.

Salary and Compensation Trends

Asset managers typically earn higher base salaries, with median annual pay ranging from $90,000 to $150,000, reflecting the intensive portfolio management responsibilities and rigorous financial analysis involved. Wealth managers' compensation often includes substantial client-based commissions and performance bonuses, pushing total earnings between $80,000 and $140,000, particularly when managing high-net-worth individuals. Recent trends show increasing reliance on variable compensation tied to assets under management (AUM) growth, aligning incentives with client wealth accumulation and market performance.

Choosing the Right Management Role

Asset managers focus on maximizing returns through strategic investment of client portfolios, emphasizing portfolio diversification and risk management across various asset classes. Wealth managers provide a holistic approach, integrating estate planning, tax strategies, and personalized financial advice to preserve and grow overall client wealth. Selecting the right management role depends on whether the priority lies in specialized investment management or comprehensive financial planning tailored to long-term wealth accumulation.

Asset Manager vs Wealth Manager Infographic

jobdiv.com

jobdiv.com