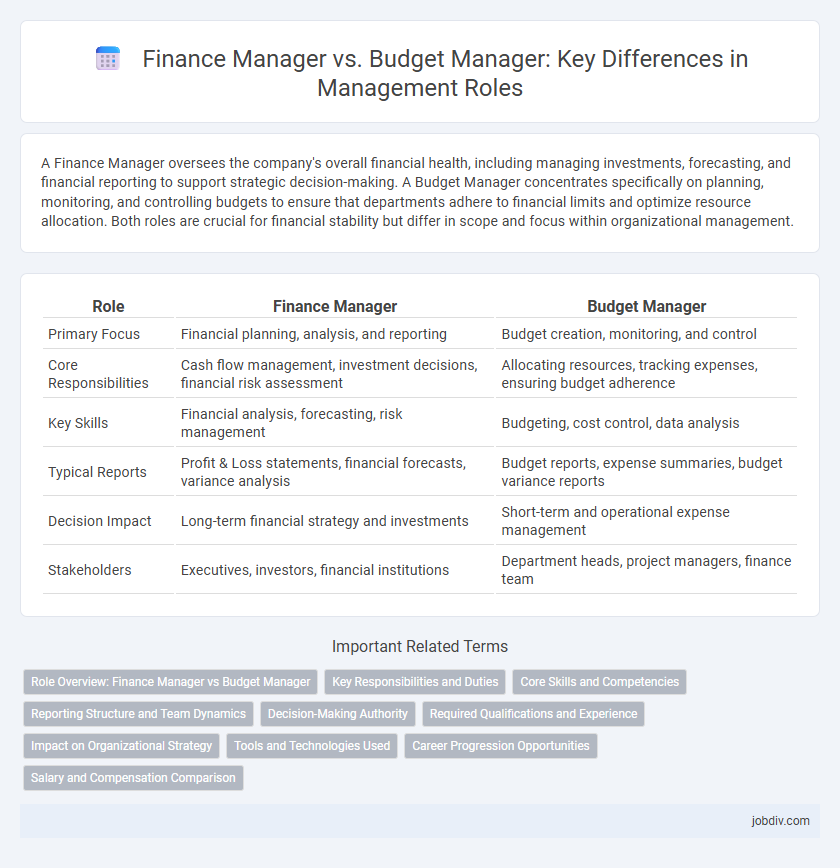

A Finance Manager oversees the company's overall financial health, including managing investments, forecasting, and financial reporting to support strategic decision-making. A Budget Manager concentrates specifically on planning, monitoring, and controlling budgets to ensure that departments adhere to financial limits and optimize resource allocation. Both roles are crucial for financial stability but differ in scope and focus within organizational management.

Table of Comparison

| Role | Finance Manager | Budget Manager |

|---|---|---|

| Primary Focus | Financial planning, analysis, and reporting | Budget creation, monitoring, and control |

| Core Responsibilities | Cash flow management, investment decisions, financial risk assessment | Allocating resources, tracking expenses, ensuring budget adherence |

| Key Skills | Financial analysis, forecasting, risk management | Budgeting, cost control, data analysis |

| Typical Reports | Profit & Loss statements, financial forecasts, variance analysis | Budget reports, expense summaries, budget variance reports |

| Decision Impact | Long-term financial strategy and investments | Short-term and operational expense management |

| Stakeholders | Executives, investors, financial institutions | Department heads, project managers, finance team |

Role Overview: Finance Manager vs Budget Manager

Finance Managers oversee the organization's overall financial health, managing investment strategies, financial reporting, and risk assessment to support long-term growth. Budget Managers focus on planning, allocating, and monitoring the company's budget to ensure expenditures align with financial goals and resource constraints. Both roles require strong analytical skills but differ in scope, with Finance Managers handling broad financial strategies and Budget Managers concentrating on operational budget control.

Key Responsibilities and Duties

A Finance Manager oversees the organization's overall financial health by managing financial planning, analysis, and reporting, ensuring compliance with regulations and optimizing investment strategies. A Budget Manager focuses on preparing, monitoring, and controlling budgets, analyzing variances, and coordinating with departments to adhere to fiscal plans and improve cost efficiency. Both roles require strong analytical skills, but the Finance Manager has a broader scope involving financial strategy, while the Budget Manager concentrates on detailed budget execution and control.

Core Skills and Competencies

Finance Managers excel in financial analysis, forecasting, and strategic planning, utilizing skills in risk management and investment evaluation to drive organizational growth. Budget Managers specialize in budget development, cost control, and variance analysis, demonstrating expertise in resource allocation and financial reporting to ensure operational efficiency. Both roles require strong analytical abilities, proficiency in financial software, and effective communication to support decision-making processes.

Reporting Structure and Team Dynamics

A Finance Manager typically oversees the entire financial operations, reporting directly to the CFO or senior executive, ensuring alignment with corporate strategy and compliance. In contrast, a Budget Manager focuses exclusively on budget preparation, monitoring, and variance analysis, often reporting to the Finance Manager or Controller. Team dynamics vary as Finance Managers lead cross-functional finance teams, while Budget Managers coordinate closely with department heads to enforce budget discipline and optimize financial resource allocation.

Decision-Making Authority

Finance Managers possess broad decision-making authority, overseeing investment strategies, financial planning, and risk management to align with organizational goals. Budget Managers primarily focus on allocating resources within established limits, ensuring compliance and monitoring expenditures to maintain fiscal discipline. The Finance Manager's role often includes approval of large financial decisions, while Budget Managers support by providing detailed budgetary analyses and recommendations.

Required Qualifications and Experience

Finance Managers typically require a bachelor's degree in finance, accounting, or business administration, alongside professional certifications such as CFA or CPA, and five to seven years of experience in financial analysis and corporate finance. Budget Managers often need a background in finance or economics, with proficiency in budgeting software and strong analytical skills, supported by three to five years of experience in budget planning and control. Both roles demand expertise in financial reporting, strategic planning, and regulatory compliance to effectively manage organizational resources.

Impact on Organizational Strategy

A Finance Manager drives organizational strategy by overseeing financial planning, analysis, and investment decisions that align with long-term growth objectives. A Budget Manager impacts strategy through meticulous allocation and monitoring of funds, ensuring efficient resource use and operational cost control. Both roles are critical for strategic financial governance but differ in scope, with Finance Managers influencing broader fiscal policy and Budget Managers focusing on detailed budget execution.

Tools and Technologies Used

Finance Managers primarily use financial analysis software such as SAP, Oracle Financials, and QuickBooks to manage accounting, forecasting, and reporting tasks efficiently. Budget Managers rely on specialized budgeting tools like Adaptive Insights, Anaplan, and Microsoft Excel for detailed budget planning, monitoring, and variance analysis. Both roles increasingly integrate business intelligence platforms like Tableau and Power BI to enhance data visualization and decision-making accuracy.

Career Progression Opportunities

Finance Managers typically advance to senior roles like Financial Director or Chief Financial Officer, leveraging broad financial strategy and analysis expertise. Budget Managers often progress to positions such as Budget Director or Corporate Planning Manager, specializing in financial planning and resource allocation. Both roles offer robust career paths, but Finance Managers generally access wider leadership opportunities across organizational finance functions.

Salary and Compensation Comparison

Finance Managers typically earn higher salaries than Budget Managers due to their broader responsibilities in financial planning, analysis, and risk management. According to data from the U.S. Bureau of Labor Statistics, the median annual salary for Finance Managers is approximately $134,180, whereas Budget Managers usually earn around $85,000 to $110,000 annually depending on industry and experience. Compensation packages for Finance Managers often include bonuses and stock options, reflecting their strategic influence on organizational profitability.

Finance Manager vs Budget Manager Infographic

jobdiv.com

jobdiv.com