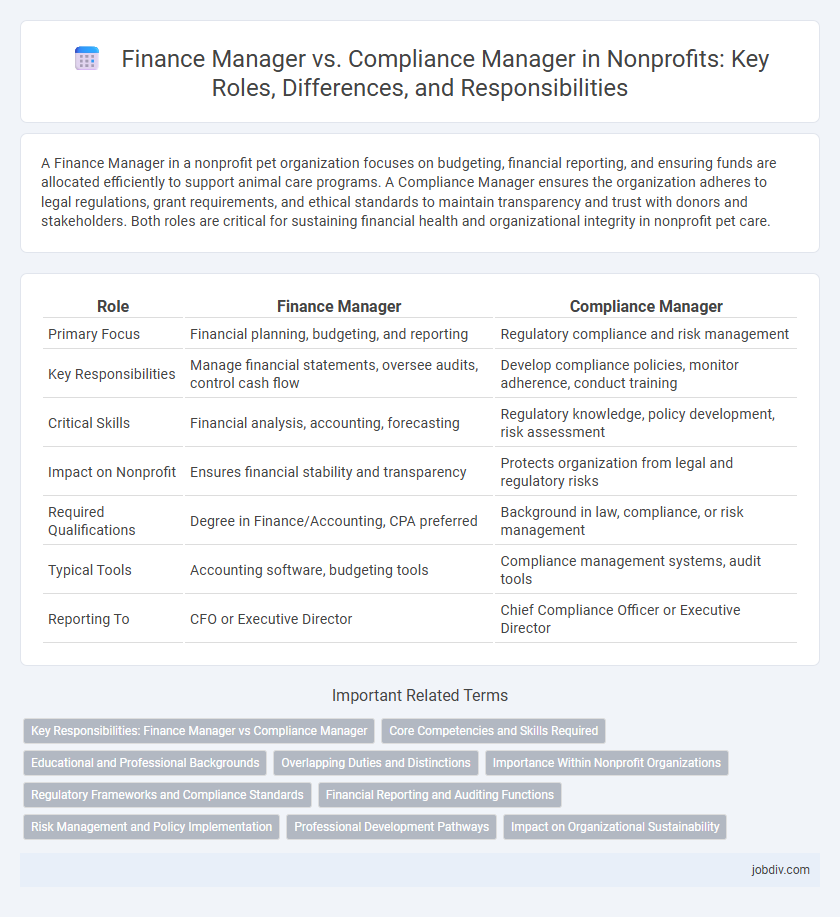

A Finance Manager in a nonprofit pet organization focuses on budgeting, financial reporting, and ensuring funds are allocated efficiently to support animal care programs. A Compliance Manager ensures the organization adheres to legal regulations, grant requirements, and ethical standards to maintain transparency and trust with donors and stakeholders. Both roles are critical for sustaining financial health and organizational integrity in nonprofit pet care.

Table of Comparison

| Role | Finance Manager | Compliance Manager |

|---|---|---|

| Primary Focus | Financial planning, budgeting, and reporting | Regulatory compliance and risk management |

| Key Responsibilities | Manage financial statements, oversee audits, control cash flow | Develop compliance policies, monitor adherence, conduct training |

| Critical Skills | Financial analysis, accounting, forecasting | Regulatory knowledge, policy development, risk assessment |

| Impact on Nonprofit | Ensures financial stability and transparency | Protects organization from legal and regulatory risks |

| Required Qualifications | Degree in Finance/Accounting, CPA preferred | Background in law, compliance, or risk management |

| Typical Tools | Accounting software, budgeting tools | Compliance management systems, audit tools |

| Reporting To | CFO or Executive Director | Chief Compliance Officer or Executive Director |

Key Responsibilities: Finance Manager vs Compliance Manager

A Finance Manager in a nonprofit oversees budgeting, financial reporting, and fund allocation to ensure the organization's fiscal health and sustainability. In contrast, a Compliance Manager focuses on adherence to legal regulations, internal policies, and grant requirements to mitigate risks and maintain organizational integrity. Both roles require detailed record-keeping and collaboration with auditors, but the Finance Manager prioritizes financial strategy while the Compliance Manager emphasizes regulatory adherence.

Core Competencies and Skills Required

Finance Managers in nonprofits excel in budgeting, financial reporting, and cash flow management, ensuring sustainable resource allocation aligned with organizational goals. Compliance Managers specialize in regulatory knowledge, risk assessment, and internal audit processes to maintain adherence to legal standards and donor requirements. Both roles demand strong analytical abilities, attention to detail, and proficiency in financial software, but Finance Managers prioritize financial strategy while Compliance Managers focus on governance and ethical standards.

Educational and Professional Backgrounds

Finance Managers in nonprofits typically hold degrees in finance, accounting, or business administration, often complemented by CPA or CFA certifications, reflecting strong expertise in financial management and reporting. Compliance Managers usually possess educational backgrounds in law, regulatory affairs, or public administration, coupled with certifications such as Certified Compliance and Ethics Professional (CCEP), emphasizing their knowledge of legal regulations and ethical standards. Both roles require substantial experience in nonprofit operations, but Finance Managers focus on fiscal strategy and budgeting, while Compliance Managers specialize in policy adherence and risk mitigation.

Overlapping Duties and Distinctions

Finance Managers in nonprofits oversee budgeting, financial reporting, and fund allocation, ensuring resources are used efficiently to support organizational goals. Compliance Managers focus on regulatory adherence, risk management, and internal audits to guarantee the nonprofit meets legal and ethical standards. Both roles collaborate on financial transparency and accountability, but Finance Managers prioritize financial strategy while Compliance Managers emphasize regulatory compliance.

Importance Within Nonprofit Organizations

Finance Managers in nonprofit organizations ensure accurate budgeting, financial reporting, and resource allocation to sustain program funding and uphold donor trust. Compliance Managers play a critical role in maintaining adherence to legal regulations, grant requirements, and internal policies, preventing legal penalties and safeguarding the organization's reputation. Both roles are essential for financial integrity and operational transparency, directly influencing nonprofit sustainability and stakeholder confidence.

Regulatory Frameworks and Compliance Standards

Finance Managers in nonprofits focus primarily on budgeting, financial reporting, and ensuring accuracy in financial statements, aligning with accounting regulations and grant requirements. Compliance Managers oversee adherence to legal regulations such as IRS rules for 501(c)(3) organizations, state fundraising laws, and donor privacy standards, ensuring operational practices meet regulatory frameworks like Sarbanes-Oxley and GAAP. Both roles require collaboration to maintain transparent financial practices and uphold regulatory compliance, minimizing risks of legal penalties and enhancing organizational credibility.

Financial Reporting and Auditing Functions

Finance Managers in nonprofits oversee financial reporting accuracy, ensuring compliance with accounting standards and preparing detailed budget analyses to support organizational goals. Compliance Managers focus on auditing functions, monitoring adherence to regulatory requirements, and implementing internal controls to mitigate financial risks. Both roles collaborate closely to maintain transparency, uphold donor trust, and ensure the integrity of financial operations.

Risk Management and Policy Implementation

Finance Managers in nonprofits focus on risk management by overseeing budgetary controls, financial reporting accuracy, and ensuring fiduciary responsibility to mitigate financial risks. Compliance Managers prioritize policy implementation by enforcing regulatory standards, monitoring adherence to grant requirements, and managing internal audits to prevent legal and ethical violations. Both roles collaborate to create a robust framework that safeguards organizational assets and ensures sustainability through proactive risk assessment and strict compliance protocols.

Professional Development Pathways

Finance Manager roles in nonprofits emphasize mastery in budgeting, financial reporting, and grant management, leading to certifications such as CPA or CGFM for career advancement. Compliance Managers concentrate on regulatory adherence, risk assessment, and policy implementation, often pursuing certifications like CCEP or CISA to enhance expertise. Both pathways offer unique opportunities for growth, with Finance Managers typically progressing to CFO positions and Compliance Managers advancing to Director of Compliance roles.

Impact on Organizational Sustainability

A Finance Manager in a nonprofit ensures effective budget allocation, financial reporting, and resource optimization, directly supporting long-term organizational sustainability through sound fiscal management. A Compliance Manager safeguards the nonprofit's adherence to legal regulations and ethical standards, minimizing risks that could threaten its reputation and operational continuity. Both roles are critical; finance management secures economic viability, while compliance management protects the organization from legal and regulatory setbacks, collectively enhancing sustainable impact.

Finance Manager vs Compliance Manager Infographic

jobdiv.com

jobdiv.com