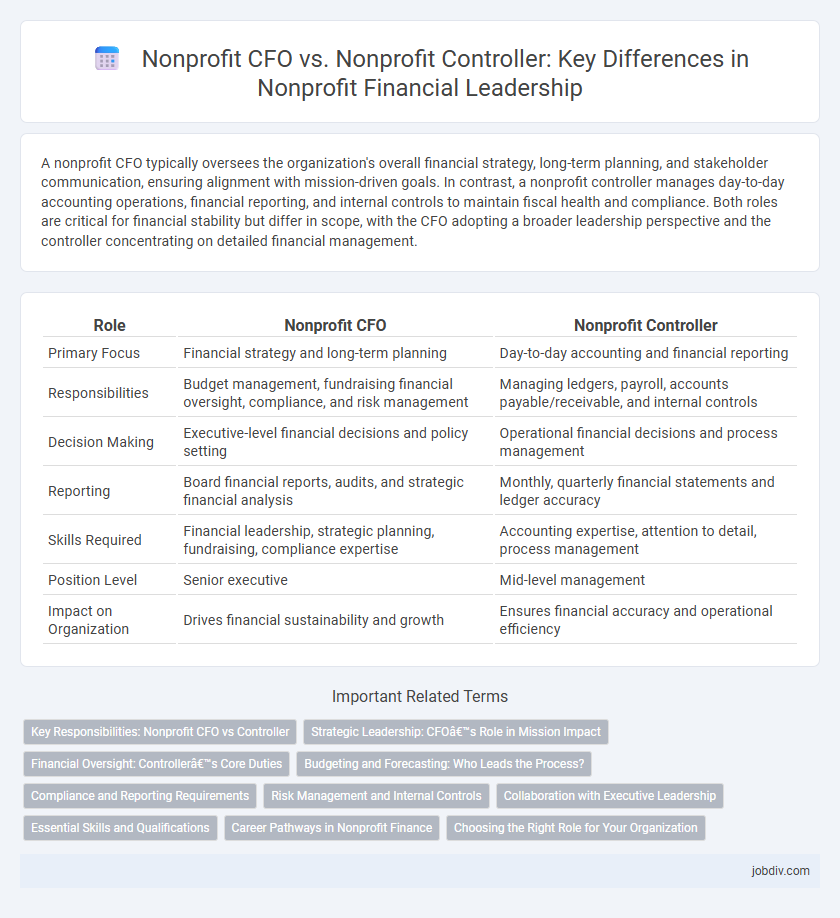

A nonprofit CFO typically oversees the organization's overall financial strategy, long-term planning, and stakeholder communication, ensuring alignment with mission-driven goals. In contrast, a nonprofit controller manages day-to-day accounting operations, financial reporting, and internal controls to maintain fiscal health and compliance. Both roles are critical for financial stability but differ in scope, with the CFO adopting a broader leadership perspective and the controller concentrating on detailed financial management.

Table of Comparison

| Role | Nonprofit CFO | Nonprofit Controller |

|---|---|---|

| Primary Focus | Financial strategy and long-term planning | Day-to-day accounting and financial reporting |

| Responsibilities | Budget management, fundraising financial oversight, compliance, and risk management | Managing ledgers, payroll, accounts payable/receivable, and internal controls |

| Decision Making | Executive-level financial decisions and policy setting | Operational financial decisions and process management |

| Reporting | Board financial reports, audits, and strategic financial analysis | Monthly, quarterly financial statements and ledger accuracy |

| Skills Required | Financial leadership, strategic planning, fundraising, compliance expertise | Accounting expertise, attention to detail, process management |

| Position Level | Senior executive | Mid-level management |

| Impact on Organization | Drives financial sustainability and growth | Ensures financial accuracy and operational efficiency |

Key Responsibilities: Nonprofit CFO vs Controller

A Nonprofit CFO leads financial strategy, budgeting, and long-term fiscal planning, ensuring compliance with regulatory requirements and donor reporting. The Nonprofit Controller manages day-to-day accounting operations, including overseeing accounts payable/receivable, payroll, and preparing financial statements. While the CFO focuses on external financial relations and strategic growth, the Controller ensures internal financial accuracy and operational efficiency.

Strategic Leadership: CFO’s Role in Mission Impact

The Nonprofit CFO drives strategic leadership by aligning financial planning with the organization's mission impact, ensuring sustainable growth and resource allocation. Unlike the Nonprofit Controller, who focuses primarily on financial reporting and compliance, the CFO integrates financial data with long-term strategic goals. This role is critical for navigating funding challenges, maximizing operational efficiency, and enhancing stakeholder confidence to advance the nonprofit's mission.

Financial Oversight: Controller’s Core Duties

The Nonprofit Controller is responsible for core financial oversight tasks such as managing daily accounting operations, ensuring accurate financial reporting, and maintaining compliance with regulatory standards. This role focuses on budgeting, internal controls, and financial data analysis to support organizational transparency and fiscal responsibility. Unlike the CFO, the Controller's duties are more operational, concentrating on detail-oriented financial recordkeeping and transactional integrity.

Budgeting and Forecasting: Who Leads the Process?

The Nonprofit CFO leads budgeting and forecasting by setting strategic financial goals and ensuring alignment with the organization's mission. The Nonprofit Controller supports this process through detailed data analysis, managing accounting records, and preparing financial reports. Together, they collaborate to create accurate, actionable budgets that guide fiscal decision-making and resource allocation.

Compliance and Reporting Requirements

Nonprofit CFOs oversee the strategic financial compliance, ensuring adherence to IRS regulations and grant stipulations critical for tax-exempt status maintenance. Nonprofit Controllers manage day-to-day financial reporting, including fund accounting and preparing detailed compliance reports for auditors and regulatory agencies. Both roles collaborate to guarantee accurate financial disclosures and timely submission of Form 990 and other regulatory filings.

Risk Management and Internal Controls

A Nonprofit CFO drives strategic risk management by evaluating financial risks and establishing comprehensive internal controls to safeguard organizational assets and ensure regulatory compliance. The Nonprofit Controller implements and monitors these internal controls daily, managing financial reporting accuracy and operational efficiency. Effective collaboration between the CFO and Controller strengthens risk mitigation frameworks, enhances transparency, and promotes fiscal responsibility in nonprofit organizations.

Collaboration with Executive Leadership

Nonprofit CFOs and Controllers play distinct but complementary roles in collaborating with executive leadership to ensure financial health and strategic growth. CFOs focus on high-level financial strategy, risk management, and aligning financial goals with the organization's mission, while Controllers manage day-to-day accounting operations, compliance, and internal controls. Effective collaboration between these roles enhances transparent reporting, informed decision-making, and sustainable nonprofit performance.

Essential Skills and Qualifications

Nonprofit CFOs require strategic financial leadership skills, expertise in budgeting, financial planning, risk management, and the ability to communicate complex financial data to boards and stakeholders effectively. Nonprofit Controllers focus on strong accounting proficiency, regulatory compliance, internal controls, and detailed financial reporting ensuring accuracy and transparency. Both roles demand experience with nonprofit accounting standards, grant management, and a commitment to the mission-driven financial stewardship.

Career Pathways in Nonprofit Finance

Nonprofit CFOs typically ascend from senior finance roles, leveraging extensive experience in strategic financial planning, risk management, and organizational leadership to guide nonprofit fiscal health. Nonprofit Controllers often begin their careers in accounting or financial analysis, focusing on maintaining accurate financial records, compliance, and internal controls before advancing into broader financial management responsibilities. Career pathways in nonprofit finance reflect a progression from technical expertise in financial operations to executive decision-making roles that influence overall mission-driven financial strategy.

Choosing the Right Role for Your Organization

Selecting the right financial leadership role depends on your nonprofit's size, complexity, and strategic goals. A Nonprofit CFO focuses on long-term financial planning, risk management, and organizational growth, while a Nonprofit Controller handles day-to-day accounting, compliance, and financial reporting. Evaluate whether your organization needs a strategic visionary or an operational expert to guide financial health and mission success.

Nonprofit CFO vs Nonprofit Controller Infographic

jobdiv.com

jobdiv.com