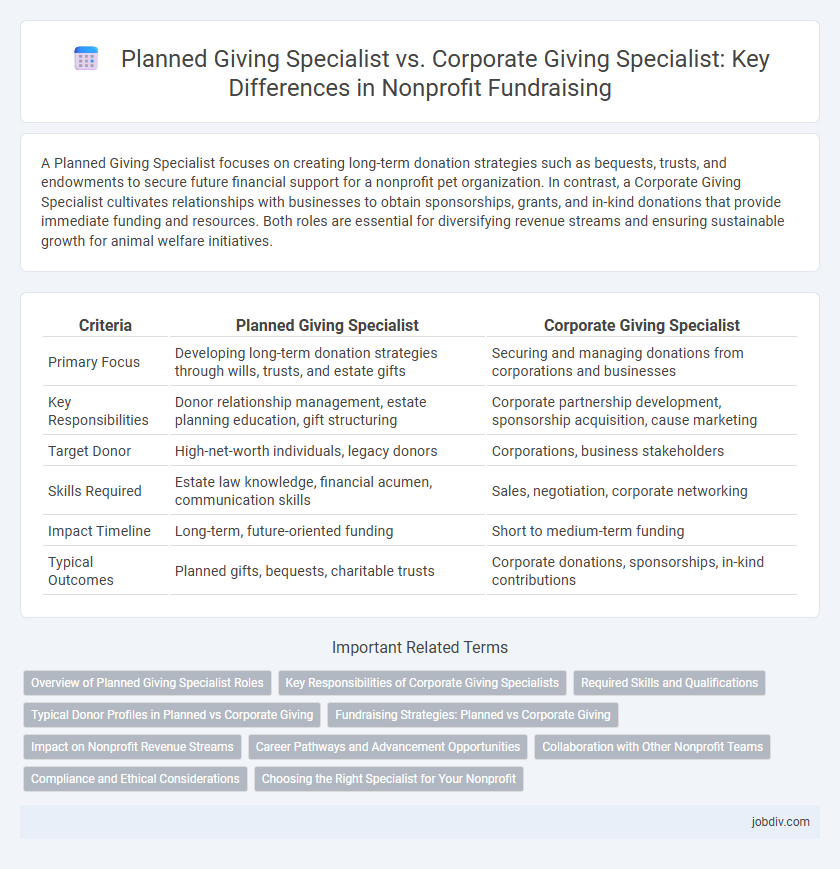

A Planned Giving Specialist focuses on creating long-term donation strategies such as bequests, trusts, and endowments to secure future financial support for a nonprofit pet organization. In contrast, a Corporate Giving Specialist cultivates relationships with businesses to obtain sponsorships, grants, and in-kind donations that provide immediate funding and resources. Both roles are essential for diversifying revenue streams and ensuring sustainable growth for animal welfare initiatives.

Table of Comparison

| Criteria | Planned Giving Specialist | Corporate Giving Specialist |

|---|---|---|

| Primary Focus | Developing long-term donation strategies through wills, trusts, and estate gifts | Securing and managing donations from corporations and businesses |

| Key Responsibilities | Donor relationship management, estate planning education, gift structuring | Corporate partnership development, sponsorship acquisition, cause marketing |

| Target Donor | High-net-worth individuals, legacy donors | Corporations, business stakeholders |

| Skills Required | Estate law knowledge, financial acumen, communication skills | Sales, negotiation, corporate networking |

| Impact Timeline | Long-term, future-oriented funding | Short to medium-term funding |

| Typical Outcomes | Planned gifts, bequests, charitable trusts | Corporate donations, sponsorships, in-kind contributions |

Overview of Planned Giving Specialist Roles

A Planned Giving Specialist focuses on creating and managing long-term donation strategies such as bequests, trusts, and endowments to secure future financial support for nonprofits. They work closely with donors, legal advisors, and financial planners to craft gifts that align with the nonprofit's mission while maximizing tax benefits and donor intentions. Expertise in estate planning and charitable gift annuities distinguishes their role from Corporate Giving Specialists who target business partnerships and sponsorships.

Key Responsibilities of Corporate Giving Specialists

Corporate Giving Specialists manage relationships with businesses to secure financial and in-kind donations, develop customized partnership proposals, and coordinate sponsorship opportunities aligned with corporate social responsibility goals. They analyze corporate giving trends, prepare detailed impact reports for donors, and collaborate with internal teams to integrate corporate contributions into fundraising strategies. Their role includes negotiating agreements, organizing corporate volunteer programs, and ensuring compliance with legal and ethical standards in corporate philanthropy.

Required Skills and Qualifications

Planned Giving Specialists need expertise in estate planning, tax laws, and donor relations, requiring certifications like CFRE or CAP(r) to effectively manage complex donor assets. Corporate Giving Specialists focus on relationship building, corporate social responsibility knowledge, and negotiation skills, often benefiting from experience in business development or marketing. Both roles demand strong communication skills and a deep understanding of nonprofit fundraising strategies to maximize donor engagement and contributions.

Typical Donor Profiles in Planned vs Corporate Giving

Planned Giving Specialists typically engage older donors with substantial assets interested in making legacy gifts through bequests, trusts, or annuities, emphasizing long-term charitable impact. Corporate Giving Specialists work with business entities and their corporate social responsibility (CSR) officers, targeting organizations that allocate budgets for community investment and employee-driven philanthropy. Understanding these distinct donor profiles enables nonprofits to tailor strategies for maximizing donation potential in both planned and corporate giving spheres.

Fundraising Strategies: Planned vs Corporate Giving

Planned Giving Specialists focus on long-term fundraising strategies by securing bequests, charitable trusts, and estate gifts, ensuring sustained organizational funding. Corporate Giving Specialists develop partnerships with businesses to obtain donations, sponsorships, and in-kind support, leveraging corporate social responsibility initiatives. Both roles employ targeted relationship-building, but Planned Giving emphasizes legacy gifts while Corporate Giving centers on immediate and recurring corporate donations.

Impact on Nonprofit Revenue Streams

Planned Giving Specialists secure long-term financial stability by cultivating donor relationships that result in bequests, trusts, and endowments, directly enhancing future revenue streams for nonprofits. Corporate Giving Specialists focus on forging partnerships with businesses to obtain grants, sponsorships, and in-kind contributions, significantly boosting immediate funding and program support. Both roles are crucial for diversifying income sources and ensuring sustained organizational growth and financial resilience.

Career Pathways and Advancement Opportunities

Planned Giving Specialists often advance by gaining expertise in estate planning, tax law, and donor relations, moving toward senior development officer or director roles within nonprofit organizations. Corporate Giving Specialists typically progress by developing strategic partnerships and managing large-scale corporate sponsorships, which can lead to leadership positions in corporate social responsibility or nonprofit partnership departments. Both career paths offer opportunities for specialization and leadership, with advancement driven by proven fundraising success and relationship management skills.

Collaboration with Other Nonprofit Teams

A Planned Giving Specialist collaborates closely with development, finance, and legal teams to design tailored legacy gift strategies that align with donors' long-term philanthropic goals. Corporate Giving Specialists work alongside marketing, community outreach, and executive leadership to develop partnerships and sponsorships that enhance corporate social responsibility initiatives. Both roles require seamless coordination with nonprofit teams to maximize fundraising impact and donor engagement.

Compliance and Ethical Considerations

Planned Giving Specialists ensure compliance with IRS regulations and donor intent by managing complex estate gifts and charitable trusts, safeguarding nonprofit integrity. Corporate Giving Specialists prioritize adherence to corporate policies and legal standards governing sponsorships and employee volunteering, fostering transparent partnerships. Both roles require strict ethical guidelines to maintain donor trust and organizational accountability in nonprofit fundraising.

Choosing the Right Specialist for Your Nonprofit

Selecting the right specialist depends on your nonprofit's fundraising goals and donor base. A Planned Giving Specialist focuses on securing long-term commitments through wills, trusts, and estate gifts, ideal for organizations seeking to build lasting endowments. In contrast, a Corporate Giving Specialist cultivates relationships with businesses for sponsorships, grants, and employee giving programs, which is crucial for nonprofits aiming to enhance corporate partnerships and diversify funding sources.

Planned Giving Specialist vs Corporate Giving Specialist Infographic

jobdiv.com

jobdiv.com