A personal banker offers tailored financial advice, helping manage accounts, loans, and investments to meet individual needs. In contrast, a teller primarily handles routine transactions such as deposits, withdrawals, and check cashing. Choosing between the two depends on whether you need personalized financial guidance or basic banking services.

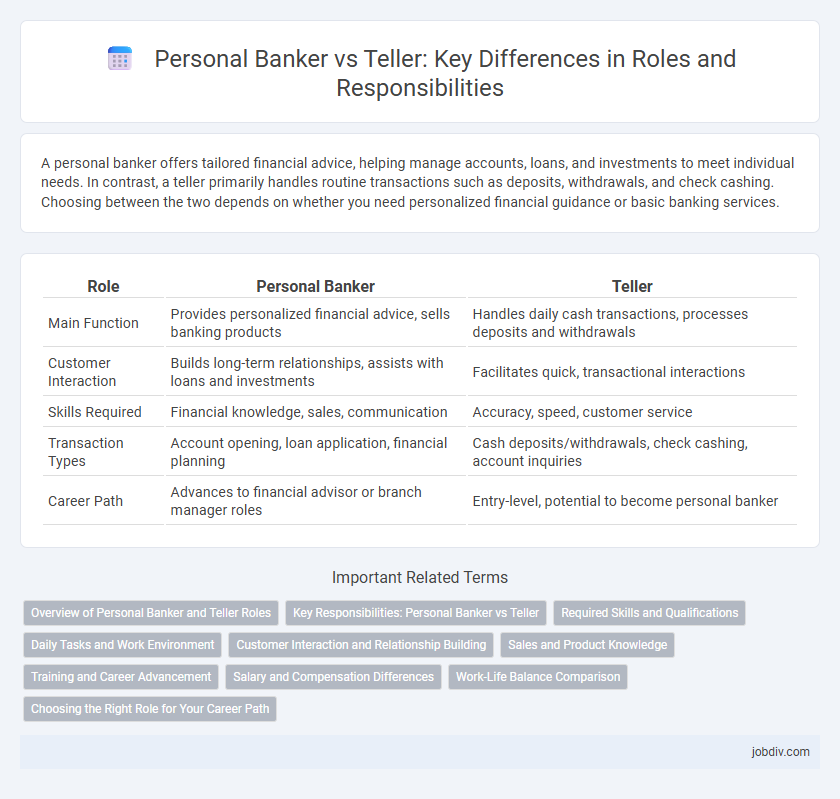

Table of Comparison

| Role | Personal Banker | Teller |

|---|---|---|

| Main Function | Provides personalized financial advice, sells banking products | Handles daily cash transactions, processes deposits and withdrawals |

| Customer Interaction | Builds long-term relationships, assists with loans and investments | Facilitates quick, transactional interactions |

| Skills Required | Financial knowledge, sales, communication | Accuracy, speed, customer service |

| Transaction Types | Account opening, loan application, financial planning | Cash deposits/withdrawals, check cashing, account inquiries |

| Career Path | Advances to financial advisor or branch manager roles | Entry-level, potential to become personal banker |

Overview of Personal Banker and Teller Roles

A Personal Banker provides tailored financial advice, manages client accounts, and offers personalized solutions such as loans and investment products. A Teller primarily handles routine transactions like deposits, withdrawals, and check processing while ensuring accuracy and customer service at the branch level. Both roles are essential for customer support but differ in complexity and scope within banking operations.

Key Responsibilities: Personal Banker vs Teller

Personal Bankers manage more complex customer needs, including financial advice, loan processing, and personalized account management, while Tellers primarily handle routine transactions such as deposits, withdrawals, and cash handling. Personal Bankers focus on building client relationships and cross-selling banking products, whereas Tellers ensure accuracy and efficiency in daily cash transactions. The key responsibilities differentiate by scope, with Personal Bankers addressing broader financial services and Tellers concentrating on transactional operations.

Required Skills and Qualifications

Personal Bankers require strong sales and customer service skills, along with in-depth knowledge of banking products, financial regulations, and credit processes to effectively advise clients on loans and investment options. Tellers need excellent attention to detail, basic math proficiency, and strong communication skills to accurately process transactions and handle customer inquiries. Both roles demand high integrity, reliability, and the ability to operate banking software, but Personal Bankers typically hold a bachelor's degree or relevant certifications, whereas Tellers often qualify with a high school diploma or equivalent.

Daily Tasks and Work Environment

Personal bankers provide tailored financial advice, manage client accounts, and assist with loan applications in a more private office setting. Tellers handle routine transactions such as deposits, withdrawals, and check cashing at the bank counter in a fast-paced, customer-facing environment. Both roles require strong customer service skills, but personal bankers engage in more complex financial discussions while tellers focus on efficient transaction processing.

Customer Interaction and Relationship Building

Personal bankers prioritize deep customer interaction by offering tailored financial advice and long-term relationship building, enhancing client trust and loyalty. Tellers focus on transactional tasks like cash handling and deposit processing, providing quick and efficient service for daily banking needs. The personal banker's role involves proactive financial planning, while tellers ensure smooth execution of routine banking operations.

Sales and Product Knowledge

Personal bankers excel in sales by offering tailored financial solutions and extensive product knowledge, helping clients with loans, investments, and account management. Tellers perform routine transactions with limited sales responsibilities and basic product understanding. Personal bankers engage more deeply with customers to cross-sell services and build long-term relationships, driving bank revenue.

Training and Career Advancement

Personal bankers receive extensive training in financial products, customer relationship management, and sales techniques, enabling them to offer tailored advice and complex services. Tellers undergo focused training on transaction processing and cash handling, often serving as the entry point for a banking career. Career advancement for personal bankers typically leads to roles such as financial advisor or branch manager, while tellers may progress by gaining experience and training to become personal bankers.

Salary and Compensation Differences

Personal bankers typically earn higher salaries than tellers due to their expanded responsibilities, including financial advising and managing client portfolios. While tellers focus on daily transaction processing with an average annual salary around $30,000 to $40,000, personal bankers often receive compensation ranging from $45,000 to $65,000, supplemented by commissions and bonuses. Performance-based incentives for personal bankers significantly boost overall earnings compared to the more standardized pay structure of tellers.

Work-Life Balance Comparison

Personal bankers often experience more flexible schedules and opportunities to manage client relationships remotely, contributing to improved work-life balance compared to tellers. Tellers typically work fixed shifts with less flexibility, which can limit personal time and increase stress during peak banking hours. The ability for personal bankers to tailor their work hours around client needs usually results in a more balanced integration between professional responsibilities and personal life.

Choosing the Right Role for Your Career Path

A Personal Banker offers tailored financial advice and manages client relationships, ideal for those seeking a customer-focused career with growth opportunities in wealth management. In contrast, a Teller primarily handles routine transactions and cash management, providing valuable frontline banking experience with a focus on accuracy and efficiency. Assess your long-term goals and prefer customer interaction type when choosing between these roles to align with your career path in the financial sector.

Personal Banker vs Teller Infographic

jobdiv.com

jobdiv.com