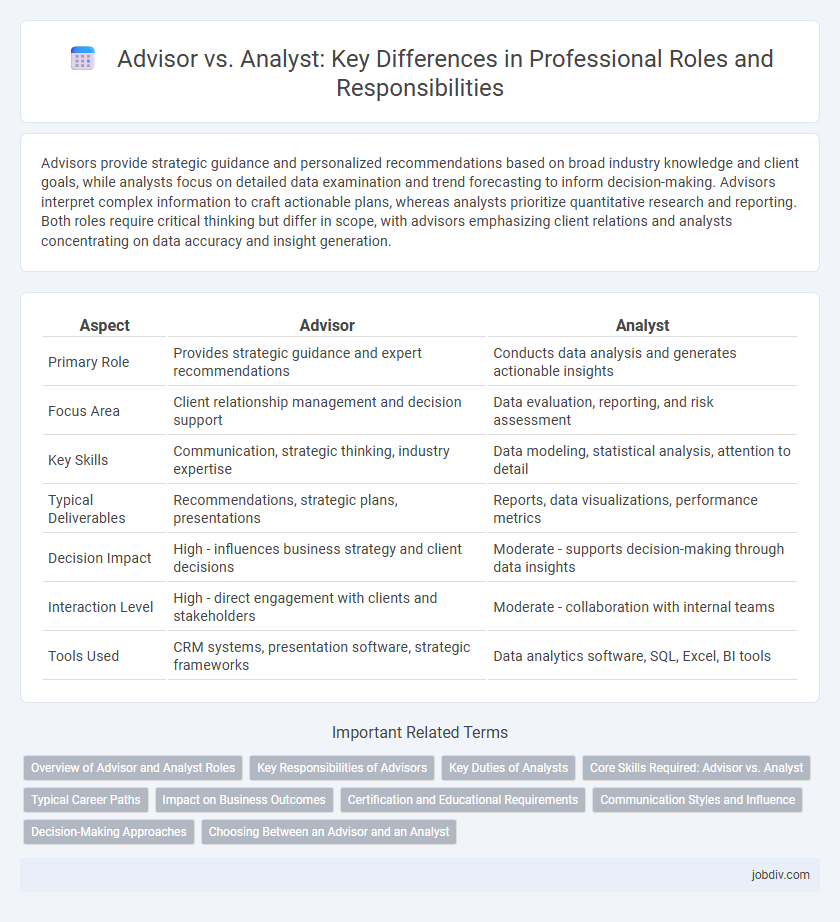

Advisors provide strategic guidance and personalized recommendations based on broad industry knowledge and client goals, while analysts focus on detailed data examination and trend forecasting to inform decision-making. Advisors interpret complex information to craft actionable plans, whereas analysts prioritize quantitative research and reporting. Both roles require critical thinking but differ in scope, with advisors emphasizing client relations and analysts concentrating on data accuracy and insight generation.

Table of Comparison

| Aspect | Advisor | Analyst |

|---|---|---|

| Primary Role | Provides strategic guidance and expert recommendations | Conducts data analysis and generates actionable insights |

| Focus Area | Client relationship management and decision support | Data evaluation, reporting, and risk assessment |

| Key Skills | Communication, strategic thinking, industry expertise | Data modeling, statistical analysis, attention to detail |

| Typical Deliverables | Recommendations, strategic plans, presentations | Reports, data visualizations, performance metrics |

| Decision Impact | High - influences business strategy and client decisions | Moderate - supports decision-making through data insights |

| Interaction Level | High - direct engagement with clients and stakeholders | Moderate - collaboration with internal teams |

| Tools Used | CRM systems, presentation software, strategic frameworks | Data analytics software, SQL, Excel, BI tools |

Overview of Advisor and Analyst Roles

Advisors provide strategic guidance and expert recommendations based on their in-depth knowledge and experience to help clients or organizations make informed decisions. Analysts collect, interpret, and analyze data to identify trends, forecast outcomes, and support decision-making processes with quantitative insights. Both roles require strong analytical skills, but advisors emphasize personalized consultation whereas analysts focus on data-driven evaluation.

Key Responsibilities of Advisors

Advisors provide strategic guidance and personalized recommendations to clients, leveraging their expertise to influence decision-making and optimize business outcomes. They assess client needs, develop tailored plans, and support implementation through continuous monitoring and adjustment. Their role includes building strong client relationships, ensuring compliance, and anticipating market trends to offer proactive solutions.

Key Duties of Analysts

Analysts primarily focus on data collection, interpretation, and presenting actionable insights to support decision-making processes, leveraging statistical tools and software for accuracy. They conduct market research, financial modeling, and performance analysis to identify trends and potential risks. Their role involves creating detailed reports and dashboards that inform strategic planning and operational improvements across various industries.

Core Skills Required: Advisor vs. Analyst

Advisors require strong interpersonal communication, strategic thinking, and client relationship management skills to provide tailored guidance and foster trust. Analysts excel in data analysis, critical thinking, and problem-solving abilities to interpret complex information and generate actionable insights. Both roles demand proficiency in industry knowledge, but advisors prioritize consultative expertise while analysts emphasize quantitative and technical competencies.

Typical Career Paths

Advisors typically advance through roles emphasizing client relationship management, strategic planning, and personalized financial guidance, often progressing into senior advisory or wealth management positions. Analysts tend to follow a career path rooted in data evaluation, financial modeling, and market research, moving toward specialized analyst roles or portfolio management. Both career trajectories offer opportunities in financial institutions, consulting firms, and corporate strategy departments, but differ in skill specialization and client interaction levels.

Impact on Business Outcomes

Advisors influence business outcomes by providing strategic guidance rooted in industry expertise, enabling informed decision-making and long-term value creation. Analysts impact outcomes through data-driven insights, performance metrics, and trend analysis that optimize operational efficiency and risk management. Both roles complement each other, with advisors shaping vision and analysts delivering actionable intelligence for measurable business growth.

Certification and Educational Requirements

Advisors typically require certifications such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC) alongside a bachelor's degree in finance or business, emphasizing client relationship management and strategic planning. Analysts often pursue Chartered Financial Analyst (CFA) certification or a master's degree in finance or economics, focusing on quantitative analysis, financial modeling, and market research. Both roles demand strong analytical skills, but certifications highlight the professional's specific expertise and commitment to industry standards.

Communication Styles and Influence

Advisors prioritize consultative communication, leveraging persuasive language and active listening to influence decision-makers effectively. Analysts focus on data-driven communication, presenting detailed reports and objective insights to support strategic planning. The advisor's style fosters relationship-building and strategic guidance, while the analyst emphasizes accuracy and evidence-based recommendations.

Decision-Making Approaches

Advisors emphasize strategic decision-making by integrating experience, intuition, and stakeholder insights to guide long-term objectives. Analysts leverage data-driven methodologies, quantitative models, and statistical tools to deliver evidence-based evaluations and recommendations. Combining advisory intuition with analytical rigor enhances informed decision-making processes in complex business environments.

Choosing Between an Advisor and an Analyst

Choosing between an advisor and an analyst depends on whether you need personalized guidance or detailed data interpretation. Advisors offer strategic advice based on experience and client goals, while analysts provide in-depth analysis and quantitative insights to inform decisions. Evaluate your organizational needs to determine if actionable recommendations or comprehensive data evaluation is more critical for your objectives.

Advisor vs Analyst Infographic

jobdiv.com

jobdiv.com