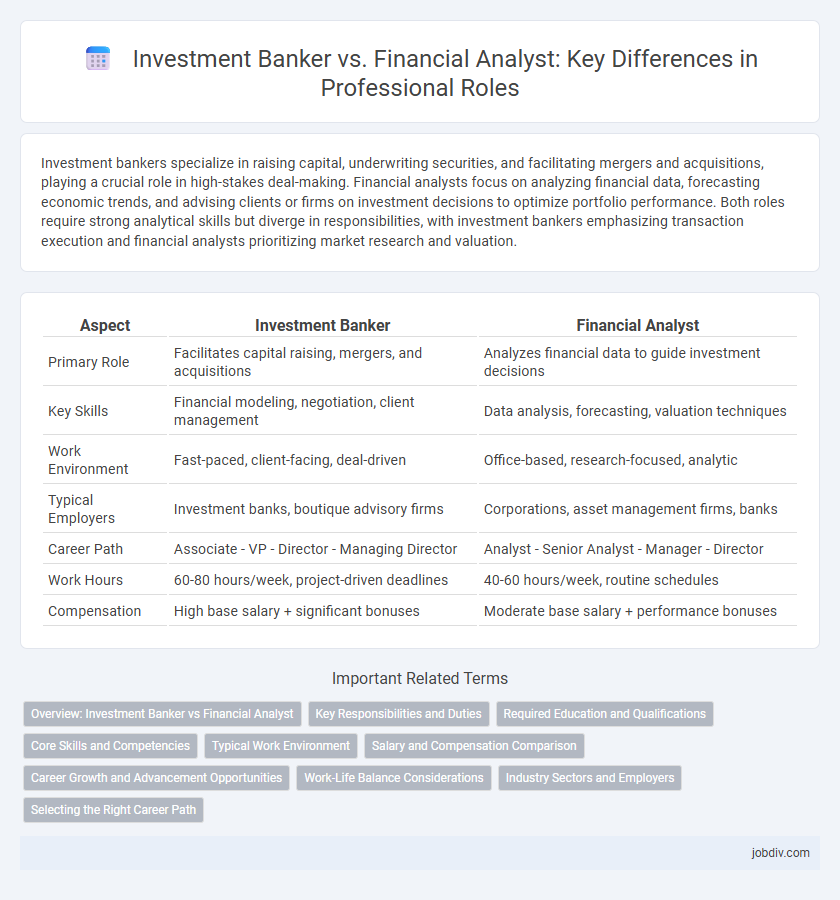

Investment bankers specialize in raising capital, underwriting securities, and facilitating mergers and acquisitions, playing a crucial role in high-stakes deal-making. Financial analysts focus on analyzing financial data, forecasting economic trends, and advising clients or firms on investment decisions to optimize portfolio performance. Both roles require strong analytical skills but diverge in responsibilities, with investment bankers emphasizing transaction execution and financial analysts prioritizing market research and valuation.

Table of Comparison

| Aspect | Investment Banker | Financial Analyst |

|---|---|---|

| Primary Role | Facilitates capital raising, mergers, and acquisitions | Analyzes financial data to guide investment decisions |

| Key Skills | Financial modeling, negotiation, client management | Data analysis, forecasting, valuation techniques |

| Work Environment | Fast-paced, client-facing, deal-driven | Office-based, research-focused, analytic |

| Typical Employers | Investment banks, boutique advisory firms | Corporations, asset management firms, banks |

| Career Path | Associate - VP - Director - Managing Director | Analyst - Senior Analyst - Manager - Director |

| Work Hours | 60-80 hours/week, project-driven deadlines | 40-60 hours/week, routine schedules |

| Compensation | High base salary + significant bonuses | Moderate base salary + performance bonuses |

Overview: Investment Banker vs Financial Analyst

Investment Bankers specialize in raising capital, facilitating mergers and acquisitions, and providing strategic financial advisory services to corporations and governments. Financial Analysts focus on evaluating investment opportunities, analyzing financial data, and preparing reports to guide portfolio management and decision-making processes. Both roles require strong financial modeling skills, but Investment Bankers operate more in client-facing transactions while Financial Analysts work primarily in market research and asset valuation.

Key Responsibilities and Duties

Investment Bankers primarily focus on raising capital through debt or equity offerings, advising corporations on mergers and acquisitions, and structuring complex financial transactions. Financial Analysts are responsible for examining financial data, conducting valuation models, and preparing detailed investment reports to guide business decisions. Both roles require strong quantitative skills, but Investment Bankers emphasize client management and deal execution, while Financial Analysts concentrate on in-depth financial analysis and forecasting.

Required Education and Qualifications

Investment bankers typically require a bachelor's degree in finance, economics, or business, often supplemented by an MBA or relevant certifications like the CFA to advance in their careers. Financial analysts generally need a bachelor's degree in finance, accounting, or related fields, with certifications such as the CFA or CFP enhancing job prospects and credibility. Both roles demand strong analytical skills and proficiency in financial modeling, but investment bankers often have more rigorous requirements to handle complex deal structuring and client advisory services.

Core Skills and Competencies

Investment bankers excel in deal structuring, financial modeling, and client relationship management, driving mergers, acquisitions, and capital raising activities. Financial analysts specialize in data analysis, forecasting, and performance evaluation to guide investment decisions and portfolio management. Both roles demand strong quantitative abilities, attention to detail, and proficiency in financial software but differ in their strategic focus and client interaction levels.

Typical Work Environment

Investment bankers typically work in high-pressure environments such as large financial institutions or boutique advisory firms, often requiring long hours and frequent client interactions. Financial analysts usually operate within corporate finance departments, asset management firms, or investment research firms, focusing on data analysis and market research in a more structured office setting. Both roles demand strong analytical skills but differ significantly in pace and client engagement levels.

Salary and Compensation Comparison

Investment bankers typically earn higher base salaries and bonuses, with average total compensation ranging from $120,000 to over $250,000 annually, depending on experience and deal flow. Financial analysts, while earning lower average salaries--generally between $60,000 and $100,000--benefit from more stable compensation structures and incremental raises. The significant variance in investment banker compensation is largely driven by performance-based bonuses linked to deal closures and market conditions.

Career Growth and Advancement Opportunities

Investment bankers typically experience rapid career growth through structured promotion paths from analyst to managing director, driven by deal-making success and client acquisition. Financial analysts often advance by specializing in sectors or moving into portfolio management, corporate finance, or strategy roles, with certifications like CFA enhancing prospects. Both careers demand strong analytical skills, but investment banking offers higher immediate financial rewards while financial analysis provides broader long-term career flexibility.

Work-Life Balance Considerations

Investment bankers often face demanding hours with frequent overnight work and intense deadlines, which can significantly impact work-life balance. Financial analysts typically maintain more regular hours and experience less travel, allowing for greater personal time and flexibility. Understanding these differences is critical for professionals prioritizing lifestyle alongside career growth in finance.

Industry Sectors and Employers

Investment bankers primarily serve corporate clients, private equity firms, and governments across sectors such as mergers and acquisitions, capital markets, and corporate finance, often employed by bulge bracket banks, boutique investment firms, and major financial institutions. Financial analysts work extensively in asset management, mutual funds, hedge funds, insurance companies, and corporate finance departments, analyzing data to guide investment decisions in industries like technology, healthcare, energy, and consumer goods. Employers for financial analysts include investment management firms, commercial banks, corporations, and credit rating agencies, where sector-specific expertise is critical for portfolio management and risk assessment.

Selecting the Right Career Path

Investment bankers focus on raising capital, mergers and acquisitions, and advising corporations on complex financial transactions, requiring strong negotiation and client management skills. Financial analysts concentrate on evaluating investment opportunities, analyzing financial data, and forecasting future performance to guide portfolio decisions, emphasizing analytical and quantitative expertise. Choosing the right career path depends on whether one prefers client-facing strategic advisory roles or detailed financial research and data modeling within investment environments.

Investment Banker vs Financial Analyst Infographic

jobdiv.com

jobdiv.com