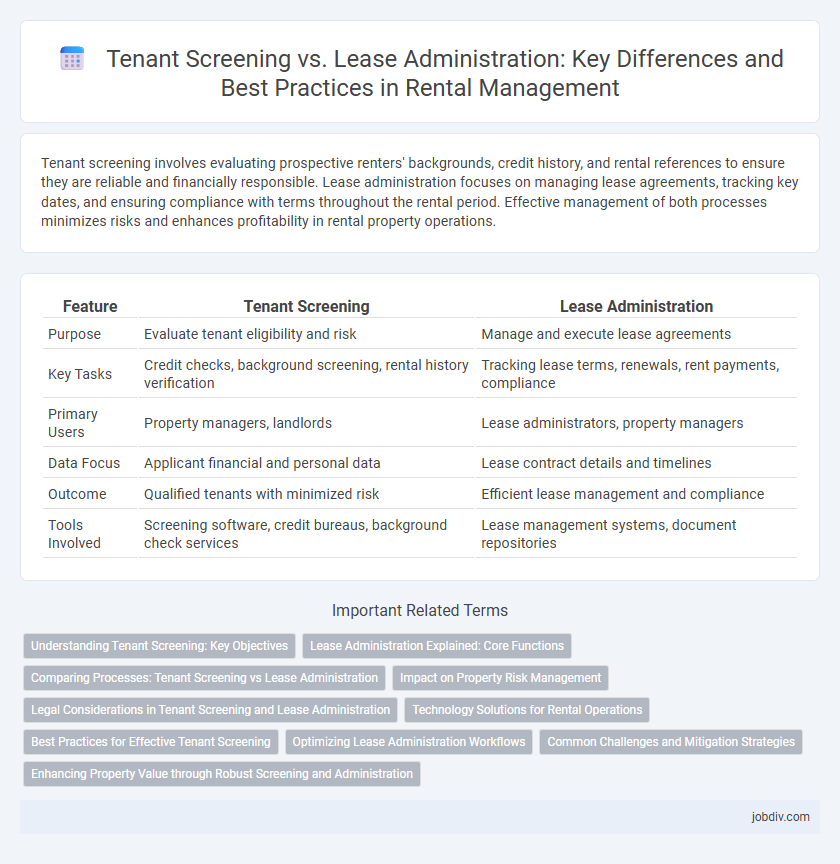

Tenant screening involves evaluating prospective renters' backgrounds, credit history, and rental references to ensure they are reliable and financially responsible. Lease administration focuses on managing lease agreements, tracking key dates, and ensuring compliance with terms throughout the rental period. Effective management of both processes minimizes risks and enhances profitability in rental property operations.

Table of Comparison

| Feature | Tenant Screening | Lease Administration |

|---|---|---|

| Purpose | Evaluate tenant eligibility and risk | Manage and execute lease agreements |

| Key Tasks | Credit checks, background screening, rental history verification | Tracking lease terms, renewals, rent payments, compliance |

| Primary Users | Property managers, landlords | Lease administrators, property managers |

| Data Focus | Applicant financial and personal data | Lease contract details and timelines |

| Outcome | Qualified tenants with minimized risk | Efficient lease management and compliance |

| Tools Involved | Screening software, credit bureaus, background check services | Lease management systems, document repositories |

Understanding Tenant Screening: Key Objectives

Tenant screening focuses on evaluating potential renters by verifying credit history, employment status, and rental background to mitigate risks and ensure reliable tenancy. The process aims to identify red flags such as criminal records, poor credit scores, or previous evictions, which could impact lease fulfillment. Effective tenant screening enhances property management by selecting responsible tenants who are likely to comply with lease terms and maintain timely rent payments.

Lease Administration Explained: Core Functions

Lease administration involves managing the full lifecycle of lease agreements, including drafting, negotiating, and ensuring compliance with terms and conditions. It centralizes rent collection, monitors renewal deadlines, and maintains accurate documentation to avoid disputes and optimize lease portfolio performance. Effective lease administration streamlines communication between landlords and tenants while reducing financial risks associated with lease violations.

Comparing Processes: Tenant Screening vs Lease Administration

Tenant screening involves evaluating prospective renters through background checks, credit reports, employment verification, and rental history to ensure reliable tenancy and reduce risk. Lease administration focuses on managing lease agreements, including document preparation, rent collection, compliance monitoring, and renewal tracking to maintain smooth tenancy operations. Comparing these processes highlights tenant screening as a risk mitigation step before occupancy, while lease administration ensures ongoing management and enforcement of lease terms throughout the rental period.

Impact on Property Risk Management

Tenant screening reduces property risk by evaluating credit history, criminal background, and rental references to identify reliable tenants, minimizing the likelihood of defaults and property damage. Lease administration manages contractual obligations, ensuring timely rent collection and compliance with lease terms, which safeguards revenue streams and legal protections. Combining thorough tenant screening with effective lease administration optimizes property risk management by preventing financial losses and maintaining asset integrity.

Legal Considerations in Tenant Screening and Lease Administration

Legal considerations in tenant screening include compliance with the Fair Housing Act, adherence to the Fair Credit Reporting Act, and ensuring non-discriminatory practices during background checks. Lease administration requires strict enforcement of lease terms, proper handling of security deposits in accordance with state laws, and timely management of lease renewals and terminations to avoid legal disputes. Both processes demand thorough documentation to protect landlords from potential liabilities and ensure regulatory compliance throughout the rental lifecycle.

Technology Solutions for Rental Operations

Technology solutions for rental operations increasingly integrate tenant screening and lease administration to streamline workflows and enhance accuracy. Advanced tenant screening software uses AI-driven data analytics to assess credit history, criminal background, and eviction records quickly, reducing the risk of bad tenants. Lease administration platforms automate document management, rent tracking, and compliance monitoring, improving operational efficiency and reducing manual errors in rental property management.

Best Practices for Effective Tenant Screening

Effective tenant screening involves thorough background checks, credit history analysis, and verification of employment to reduce the risk of rent defaults and property damage. Utilizing standardized screening criteria ensures consistency and legal compliance while enhancing decision-making accuracy. Integrating digital screening tools accelerates the process, improves data accuracy, and protects landlords from fraudulent applications.

Optimizing Lease Administration Workflows

Tenant screening ensures qualified renters by verifying credit, background, and rental history, while lease administration focuses on managing lease documentation and compliance throughout the tenancy. Optimizing lease administration workflows involves automating lease tracking, renewals, and rent collections to reduce errors and improve efficiency. Integrating tenant screening data with lease administration systems enhances decision-making and streamlines overall property management processes.

Common Challenges and Mitigation Strategies

Tenant screening often faces challenges such as inaccurate background checks, incomplete financial verifications, and bias in tenant selection, which can lead to unsuitable tenants and increased risk for landlords. Lease administration struggles with maintaining up-to-date lease data, ensuring compliance with lease terms, and managing timely renewals or terminations, potentially resulting in legal disputes and financial losses. Mitigation strategies include adopting automated tenant screening software with integrated credit and criminal check APIs, and utilizing centralized lease management platforms that provide real-time alerts, standardized document storage, and compliance tracking to enhance accuracy and efficiency.

Enhancing Property Value through Robust Screening and Administration

Robust tenant screening reduces the risk of defaults and property damage, ensuring consistent rental income and preserving asset value. Effective lease administration streamlines rent collection, enforces lease terms, and minimizes vacancies, directly impacting profitability and long-term property appreciation. Combining thorough screening with efficient lease management enhances overall property value by maintaining financial stability and tenant satisfaction.

Tenant Screening vs Lease Administration Infographic

jobdiv.com

jobdiv.com