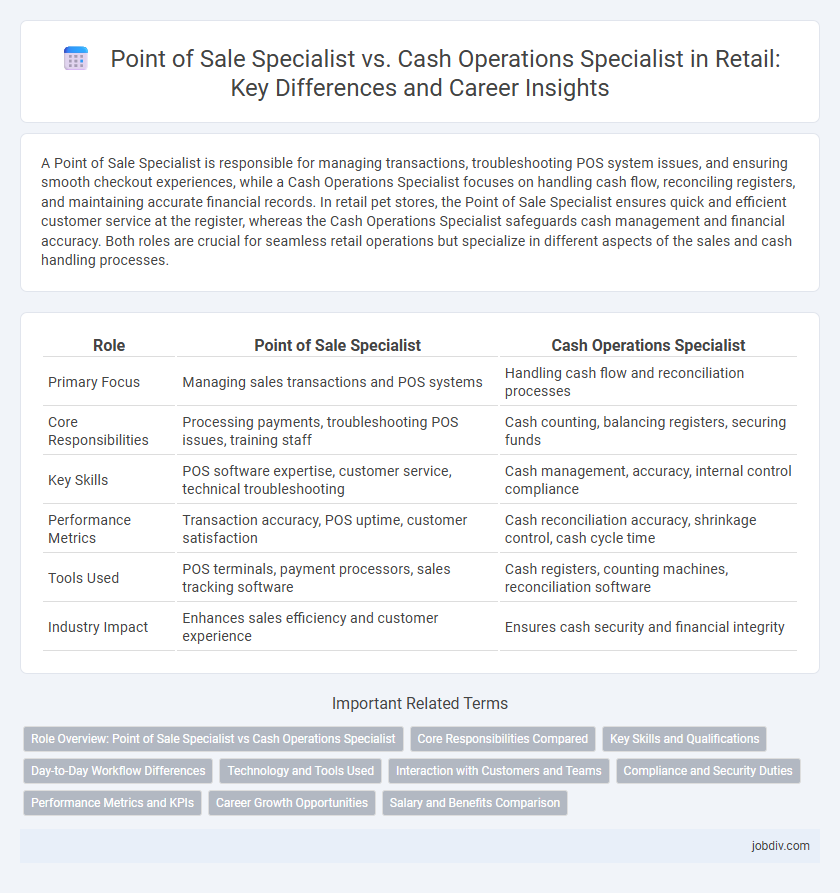

A Point of Sale Specialist is responsible for managing transactions, troubleshooting POS system issues, and ensuring smooth checkout experiences, while a Cash Operations Specialist focuses on handling cash flow, reconciling registers, and maintaining accurate financial records. In retail pet stores, the Point of Sale Specialist ensures quick and efficient customer service at the register, whereas the Cash Operations Specialist safeguards cash management and financial accuracy. Both roles are crucial for seamless retail operations but specialize in different aspects of the sales and cash handling processes.

Table of Comparison

| Role | Point of Sale Specialist | Cash Operations Specialist |

|---|---|---|

| Primary Focus | Managing sales transactions and POS systems | Handling cash flow and reconciliation processes |

| Core Responsibilities | Processing payments, troubleshooting POS issues, training staff | Cash counting, balancing registers, securing funds |

| Key Skills | POS software expertise, customer service, technical troubleshooting | Cash management, accuracy, internal control compliance |

| Performance Metrics | Transaction accuracy, POS uptime, customer satisfaction | Cash reconciliation accuracy, shrinkage control, cash cycle time |

| Tools Used | POS terminals, payment processors, sales tracking software | Cash registers, counting machines, reconciliation software |

| Industry Impact | Enhances sales efficiency and customer experience | Ensures cash security and financial integrity |

Role Overview: Point of Sale Specialist vs Cash Operations Specialist

Point of Sale Specialists manage transaction systems, ensuring accurate processing of sales, refunds, and exchanges while maintaining customer service efficiency at retail locations. Cash Operations Specialists focus on overseeing cash flow management, including cash handling, reconciliation, and compliance with internal financial controls to prevent discrepancies. Both roles are crucial for seamless retail operations, with Point of Sale Specialists emphasizing front-end transaction accuracy and Cash Operations Specialists ensuring financial integrity behind the scenes.

Core Responsibilities Compared

Point of Sale Specialists primarily manage transaction processing, ensuring the accuracy of sales data and customer payment handling at checkout terminals. Cash Operations Specialists focus on overseeing cash flow management, including cash reconciliation, audit compliance, and secure handling of physical currency within retail stores. Both roles require attention to detail, but Point of Sale Specialists emphasize customer interaction and transaction efficiency, while Cash Operations Specialists specialize in financial accuracy and cash security protocols.

Key Skills and Qualifications

Point of Sale Specialists require expertise in POS systems, customer service, transaction processing, and inventory management software, ensuring accurate sales data and efficient checkout experiences. Cash Operations Specialists focus on cash handling, reconciliation, fraud prevention, financial reporting, and compliance with cash management policies to maintain operational accuracy. Both roles demand attention to detail, analytical skills, and proficiency with retail technology platforms to optimize store financial operations.

Day-to-Day Workflow Differences

Point of Sale Specialists manage the setup, maintenance, and troubleshooting of POS systems, ensuring seamless transaction processing and real-time inventory updates. Cash Operations Specialists oversee cash handling protocols, including cash reconciliations, deposit preparation, and compliance with security procedures to prevent discrepancies. While POS Specialists focus on technology and system efficiency, Cash Operations Specialists prioritize cash accuracy and operational safeguarding.

Technology and Tools Used

Point of Sale Specialists utilize advanced POS systems like Square, Shopify POS, and Clover to streamline transaction processing, inventory management, and customer data analytics. Cash Operations Specialists rely on secure cash handling tools, including automated cash recyclers, counterfeit detection devices, and cash management software such as Diebold Nixdorf solutions to ensure accuracy and compliance. Both roles integrate technology to enhance retail efficiency, but POS Specialists focus more on front-end sales interfaces while Cash Operations Specialists prioritize back-end cash control and reconciliation.

Interaction with Customers and Teams

Point of Sale Specialists excel in direct customer interactions, managing transactions efficiently while addressing inquiries and resolving payment issues to ensure a seamless checkout experience. Cash Operations Specialists primarily focus on internal collaboration, working closely with finance and inventory teams to reconcile cash flow and maintain accurate records. Both roles require strong communication skills, but Point of Sale Specialists engage more with customers, whereas Cash Operations Specialists coordinate with team members behind the scenes.

Compliance and Security Duties

A Point of Sale Specialist ensures compliance by accurately processing transactions and maintaining system integrity to prevent fraud, while a Cash Operations Specialist focuses on securing cash flow by reconciling cash drawers and monitoring cash handling procedures. Both roles implement strict adherence to retail compliance standards and internal controls to mitigate risks. Security duties include regular audits, detection of suspicious activities, and enforcing policies to safeguard financial assets.

Performance Metrics and KPIs

Point of Sale Specialists are evaluated based on transaction accuracy, average checkout time, and customer satisfaction scores, ensuring efficient and error-free sales processing. Cash Operations Specialists focus on cash reconciliation accuracy, cash variance percentages, and compliance with cash handling procedures to minimize financial discrepancies and fraud risks. Both roles contribute to retail performance, with POS Specialists driving frontline transaction efficiency while Cash Operations Specialists safeguard cash integrity through precise control measures.

Career Growth Opportunities

Point of Sale Specialists gain expertise in transaction processing, customer service, and system troubleshooting, which lays a strong foundation for advancing into retail management or technology-focused roles. Cash Operations Specialists develop advanced skills in cash handling, fraud prevention, and financial reporting, positioning them well for careers in audit, finance, or compliance departments. Both roles offer distinct pathways, with Point of Sale Specialists trending towards operational leadership and Cash Operations Specialists moving towards financial oversight and risk management.

Salary and Benefits Comparison

Point of Sale Specialists typically earn an average salary ranging from $30,000 to $45,000 annually, with benefits including retail discounts and employee health plans, reflecting their frontline customer interaction role. Cash Operations Specialists command higher salaries, generally between $40,000 and $60,000 per year, complemented by benefits like performance bonuses, comprehensive health insurance, and retirement plans due to their responsibility for managing cash flow and financial accuracy. Both positions offer distinct advantages, yet Cash Operations Specialists benefit from greater financial incentives and advanced benefits tied to their specialized expertise in cash management.

Point of Sale Specialist vs Cash Operations Specialist Infographic

jobdiv.com

jobdiv.com