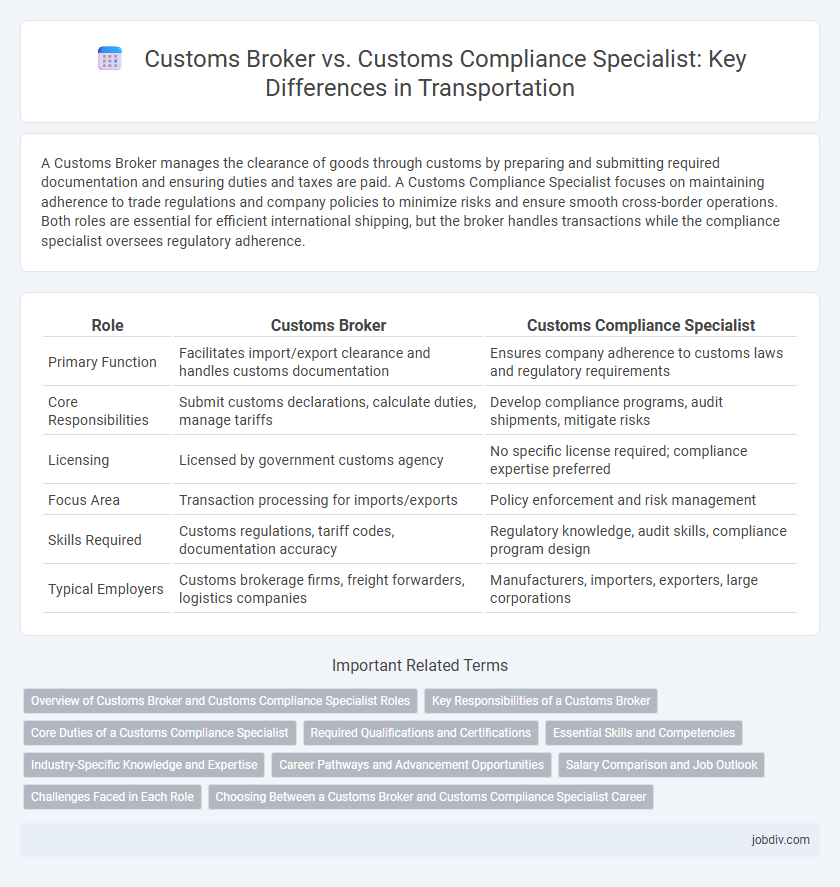

A Customs Broker manages the clearance of goods through customs by preparing and submitting required documentation and ensuring duties and taxes are paid. A Customs Compliance Specialist focuses on maintaining adherence to trade regulations and company policies to minimize risks and ensure smooth cross-border operations. Both roles are essential for efficient international shipping, but the broker handles transactions while the compliance specialist oversees regulatory adherence.

Table of Comparison

| Role | Customs Broker | Customs Compliance Specialist |

|---|---|---|

| Primary Function | Facilitates import/export clearance and handles customs documentation | Ensures company adherence to customs laws and regulatory requirements |

| Core Responsibilities | Submit customs declarations, calculate duties, manage tariffs | Develop compliance programs, audit shipments, mitigate risks |

| Licensing | Licensed by government customs agency | No specific license required; compliance expertise preferred |

| Focus Area | Transaction processing for imports/exports | Policy enforcement and risk management |

| Skills Required | Customs regulations, tariff codes, documentation accuracy | Regulatory knowledge, audit skills, compliance program design |

| Typical Employers | Customs brokerage firms, freight forwarders, logistics companies | Manufacturers, importers, exporters, large corporations |

Overview of Customs Broker and Customs Compliance Specialist Roles

Customs brokers act as licensed intermediaries who facilitate the clearance of goods through customs by preparing and submitting required documentation, ensuring compliance with import/export regulations. Customs compliance specialists focus on developing and managing internal policies to ensure organizations adhere to customs laws, minimizing risks of penalties and shipment delays. Both roles are critical in international trade, with brokers handling transactional processes and compliance specialists overseeing regulatory adherence.

Key Responsibilities of a Customs Broker

Customs brokers are responsible for preparing and submitting documentation required for importing and exporting goods, ensuring compliance with all applicable customs laws and regulations. They communicate directly with government agencies to facilitate the clearance of shipments, calculate duties and tariffs, and advise clients on import-export restrictions. Efficient customs brokers help minimize delays and penalties by accurately classifying goods and managing risk in the customs process.

Core Duties of a Customs Compliance Specialist

A Customs Compliance Specialist ensures adherence to import and export regulations by conducting thorough audits, preparing accurate documentation, and maintaining updated knowledge of trade laws and tariffs. They develop compliance programs to mitigate risks related to customs penalties and ensure company operations align with government policies. Their role is critical in preventing delays, fines, and legal issues by proactively managing regulatory changes and facilitating smooth customs clearance processes.

Required Qualifications and Certifications

Customs brokers require a U.S. Customs and Border Protection (CBP) license, gained through passing the Customs Broker License Examination, and must have in-depth knowledge of import/export regulations and tariff classifications. Customs compliance specialists typically hold certifications like Certified Customs Specialist (CCS) or Certified Export Specialist (CES) and must be proficient in regulatory compliance, international trade laws, and documentation requirements. Both roles demand strong analytical skills and familiarity with Automated Commercial Environment (ACE) systems to ensure lawful and efficient customs processing.

Essential Skills and Competencies

Customs brokers require expert knowledge in tariff classification, import/export documentation, and regulatory requirements to efficiently clear goods through customs. Customs compliance specialists possess strong analytical skills, risk management expertise, and a deep understanding of trade laws to ensure organizations adhere to international trade regulations. Both roles demand attention to detail, effective communication, and proficiency in customs software systems to streamline global shipping operations.

Industry-Specific Knowledge and Expertise

Customs brokers possess in-depth knowledge of import-export regulations, tariffs, and documentation required for smooth border clearance, ensuring shipments comply with international trade laws. Customs compliance specialists focus on developing and enforcing internal policies to maintain adherence to customs regulations, often working to minimize financial risks and avoid penalties through detailed audits and training. Both roles require expertise in trade agreements, classification codes, and regulatory updates, but customs brokers are more transaction-focused, whereas compliance specialists concentrate on organizational adherence and risk management.

Career Pathways and Advancement Opportunities

Customs brokers specialize in facilitating the clearance of goods through customs by preparing and submitting required documentation, offering a clear progression from entry-level clerk roles to licensed broker status and management positions. Customs compliance specialists focus on ensuring organizational adherence to trade regulations and policies, with career advancement paths leading to senior compliance analyst roles, compliance manager, and risk management director positions. Both career paths offer opportunities for specialization in international trade, regulatory consulting, and logistics management, enhancing long-term growth and expertise in transportation and global supply chain sectors.

Salary Comparison and Job Outlook

Customs brokers earn an average salary ranging from $45,000 to $75,000 annually, reflecting their role in facilitating import/export documentation and regulatory adherence. Customs compliance specialists typically command higher salaries, averaging between $55,000 and $85,000, due to their focus on ensuring organizational adherence to trade laws and internal audit processes. The job outlook for both positions remains strong, with demand fueled by increasing global trade complexities and heightened regulatory requirements.

Challenges Faced in Each Role

Customs brokers face challenges such as navigating complex tariff classifications and ensuring timely clearance of shipments amid evolving international trade regulations. Customs compliance specialists struggle with maintaining up-to-date knowledge of changing compliance requirements and implementing comprehensive audit practices to prevent costly penalties. Both roles require meticulous attention to detail and continuous adaptation to global trade policy shifts to minimize risks and enhance supply chain efficiency.

Choosing Between a Customs Broker and Customs Compliance Specialist Career

Choosing between a Customs Broker and a Customs Compliance Specialist career depends on your interest in direct regulatory negotiation or internal compliance strategy. Customs Brokers focus on facilitating the clearance of goods through customs, requiring deep knowledge of import/export laws and tariff classifications. Customs Compliance Specialists develop and implement policies to ensure ongoing adherence to trade regulations, minimizing risk and avoiding penalties within corporations.

Customs Broker vs Customs Compliance Specialist Infographic

jobdiv.com

jobdiv.com