Actuarial consulting specializes in analyzing financial risks using mathematics, statistics, and financial theory to assess insurance liabilities and pension plans. Insurance consulting focuses on advising clients on policy selection, claims management, and regulatory compliance to optimize coverage and cost-efficiency. Both fields require expertise in risk assessment but differ in their primary objectives and methodologies.

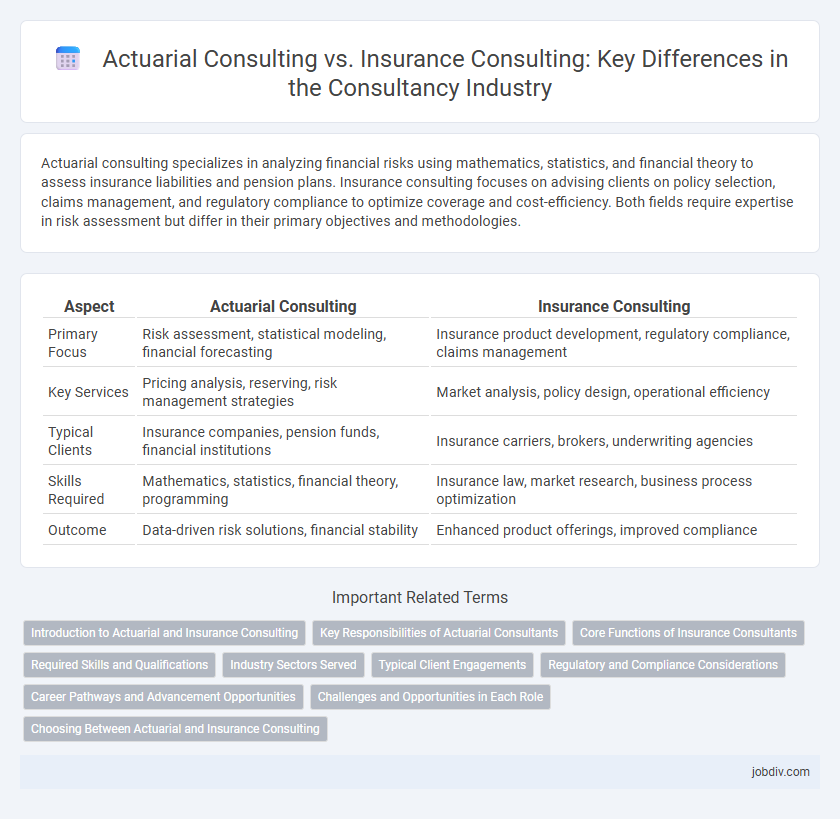

Table of Comparison

| Aspect | Actuarial Consulting | Insurance Consulting |

|---|---|---|

| Primary Focus | Risk assessment, statistical modeling, financial forecasting | Insurance product development, regulatory compliance, claims management |

| Key Services | Pricing analysis, reserving, risk management strategies | Market analysis, policy design, operational efficiency |

| Typical Clients | Insurance companies, pension funds, financial institutions | Insurance carriers, brokers, underwriting agencies |

| Skills Required | Mathematics, statistics, financial theory, programming | Insurance law, market research, business process optimization |

| Outcome | Data-driven risk solutions, financial stability | Enhanced product offerings, improved compliance |

Introduction to Actuarial and Insurance Consulting

Actuarial consulting specializes in analyzing financial risks using mathematics, statistics, and financial theory to evaluate insurance policies, pension plans, and investment strategies. Insurance consulting focuses on advising companies on risk management, regulatory compliance, and claims management to optimize underwriting and policy administration. Both fields leverage expertise in risk assessment but differ in their approach, with actuarial consulting emphasizing quantitative modeling and insurance consulting prioritizing operational and strategic guidance.

Key Responsibilities of Actuarial Consultants

Actuarial consultants specialize in analyzing financial risks using statistical models to assess insurance liabilities, pension obligations, and investment risks. They develop pricing strategies, reserve calculations, and risk management frameworks vital for insurers and pension funds. Their expertise enables clients to make informed decisions on product design, regulatory compliance, and capital management.

Core Functions of Insurance Consultants

Insurance consultants specialize in risk assessment, policy design, and claims management to optimize insurance portfolios for clients. Their core functions include analyzing insurance needs, negotiating with insurers, and ensuring regulatory compliance to minimize financial exposure. Unlike actuarial consultants, who focus primarily on statistical risk modeling and pricing, insurance consultants provide strategic advice to improve insurance coverage and claims outcomes.

Required Skills and Qualifications

Actuarial consulting requires strong expertise in mathematics, statistics, and financial theory, coupled with professional actuarial certifications such as ASA or FSA from recognized bodies like the Society of Actuaries. Insurance consulting demands a deep understanding of insurance products, regulatory environments, risk management, and often qualifications like CPCU or insurance-specific licenses. Both fields value analytical skills, problem-solving abilities, and proficiency in data analysis software, but actuarial consulting emphasizes predictive modeling, while insurance consulting focuses more on strategic business advice and compliance.

Industry Sectors Served

Actuarial consulting primarily serves financial sectors such as life insurance, pensions, and investment firms by analyzing risk and uncertainty through statistical models. Insurance consulting extends across multiple industry sectors including property and casualty, health, and reinsurance, offering strategic advice on underwriting, claims management, and regulatory compliance. Both consulting types provide critical insights, but actuarial consulting is more focused on risk quantification while insurance consulting emphasizes operational and business improvements within insurance companies.

Typical Client Engagements

Actuarial consulting typically involves client engagements focused on risk assessment, financial modeling, and insurance pricing strategies for life, health, and pension plans. Insurance consulting engagements often center on policy design, claims management, and regulatory compliance support for property and casualty insurers. Both fields prioritize data analytics and risk management but address different aspects of the insurance value chain.

Regulatory and Compliance Considerations

Actuarial consulting emphasizes risk assessment, financial modeling, and compliance with solvency regulations such as Solvency II and IFRS 17 to ensure accurate reserves and capital adequacy. Insurance consulting focuses on regulatory compliance related to product approvals, policyholder protections, and adherence to insurance laws like the Insurance Distribution Directive (IDD) and local market conduct regulations. Both disciplines require deep knowledge of regulatory frameworks but differ in application scope, with actuarial consulting prioritizing quantitative risk and insurance consulting targeting operational and legal compliance.

Career Pathways and Advancement Opportunities

Actuarial consulting offers a career pathway centered on risk assessment, statistical modeling, and financial forecasting, often requiring professional actuarial certifications such as ASA or CFA for advancement to senior roles. Insurance consulting focuses on advising clients about policy design, regulatory compliance, and claims management, with progression typically involving expertise in insurance law and market analysis. Both fields provide advancement opportunities through specialization and leadership roles, but actuarial consulting emphasizes quantitative skills, while insurance consulting leans more on client relations and industry regulations.

Challenges and Opportunities in Each Role

Actuarial consulting faces challenges in predicting long-term financial risks due to complex data modeling and regulatory changes, yet offers opportunities in leveraging advanced analytics and machine learning for precise risk assessment. Insurance consulting grapples with market volatility and evolving client expectations but benefits from expanding digital transformation initiatives and customized insurance product development. Both roles demand adaptability to shifting regulations and innovation in risk management strategies to drive value for clients.

Choosing Between Actuarial and Insurance Consulting

Choosing between actuarial consulting and insurance consulting depends on the desired focus area; actuarial consulting centers on risk assessment, statistical analysis, and financial modeling to predict future events, while insurance consulting emphasizes policy design, regulatory compliance, and claims management. Actuarial consultants utilize advanced mathematics and probability theories to develop pricing strategies and reserve calculations, whereas insurance consultants provide strategic advice on product development, underwriting guidelines, and market trends. Understanding these distinctions helps organizations select experts who align with specific business objectives related to risk quantification or insurance operations.

Actuarial Consulting vs Insurance Consulting Infographic

jobdiv.com

jobdiv.com