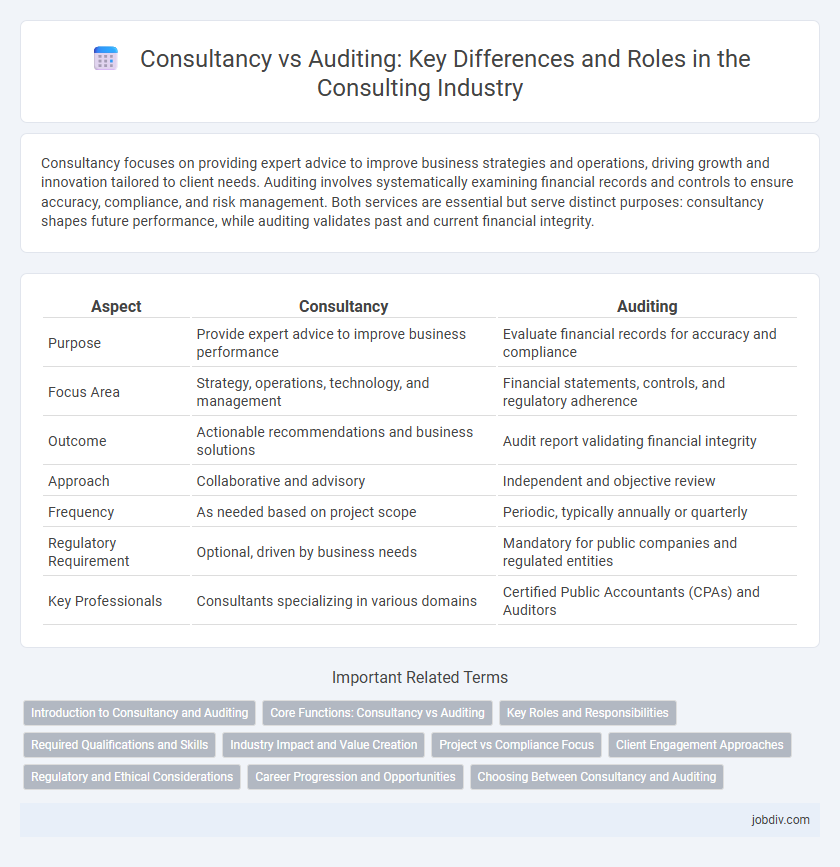

Consultancy focuses on providing expert advice to improve business strategies and operations, driving growth and innovation tailored to client needs. Auditing involves systematically examining financial records and controls to ensure accuracy, compliance, and risk management. Both services are essential but serve distinct purposes: consultancy shapes future performance, while auditing validates past and current financial integrity.

Table of Comparison

| Aspect | Consultancy | Auditing |

|---|---|---|

| Purpose | Provide expert advice to improve business performance | Evaluate financial records for accuracy and compliance |

| Focus Area | Strategy, operations, technology, and management | Financial statements, controls, and regulatory adherence |

| Outcome | Actionable recommendations and business solutions | Audit report validating financial integrity |

| Approach | Collaborative and advisory | Independent and objective review |

| Frequency | As needed based on project scope | Periodic, typically annually or quarterly |

| Regulatory Requirement | Optional, driven by business needs | Mandatory for public companies and regulated entities |

| Key Professionals | Consultants specializing in various domains | Certified Public Accountants (CPAs) and Auditors |

Introduction to Consultancy and Auditing

Consultancy involves providing expert advice to improve business performance, focusing on strategy, management, and operational efficiency. Auditing centers on systematically examining financial records to ensure accuracy, compliance, and transparency. Both play critical roles in organizational governance, with consultancy driving growth and auditing safeguarding integrity.

Core Functions: Consultancy vs Auditing

Consultancy focuses on providing strategic advice, process improvements, and problem-solving solutions to enhance business performance and support decision-making. Auditing concentrates on the systematic examination and verification of financial records, compliance, and internal controls to ensure accuracy and regulatory adherence. Both functions contribute to organizational governance but serve distinct purposes: consultancy drives growth and innovation, while auditing safeguards integrity and accountability.

Key Roles and Responsibilities

Consultancy focuses on providing expert advice to improve business performance, strategic planning, and problem-solving across various functions. Auditing involves systematically reviewing financial statements and compliance with regulations to ensure accuracy and transparency. Consultants drive innovation and change management, while auditors safeguard financial integrity and risk management.

Required Qualifications and Skills

Consultancy requires strong problem-solving skills, industry-specific knowledge, and expertise in strategic planning to guide business improvements and innovation. Auditing demands proficiency in accounting principles, regulatory compliance, and attention to detail for accurate financial analysis and risk assessment. Both fields typically require certifications such as CPA for auditing and PMP or CMC for consultancy, reflecting their distinct professional standards.

Industry Impact and Value Creation

Consultancy drives industry transformation by delivering tailored strategies that enhance operational efficiency and foster innovation across sectors. Auditing ensures financial accuracy and regulatory compliance, safeguarding stakeholder trust and mitigating risks within industries. The combined impact of consultancy and auditing creates a robust framework where value creation is optimized through strategic insights and verified accountability.

Project vs Compliance Focus

Consultancy primarily concentrates on driving project success through tailored strategies, innovative solutions, and proactive problem-solving to enhance business performance. Auditing focuses on compliance by systematically evaluating financial statements, internal controls, and regulatory adherence to ensure accuracy and accountability. Project-oriented consultancy fosters growth opportunities, whereas auditing ensures organizational integrity and risk management.

Client Engagement Approaches

Consultancy emphasizes collaborative problem-solving and tailored strategies, leveraging deep client insights to drive business transformation and innovation. Auditing focuses on objective evaluation and compliance verification, ensuring financial accuracy and regulatory adherence through systematic examination. Effective client engagement in consultancy involves continuous dialogue and adaptive solutions, while auditing prioritizes structured communication and transparency to maintain trust and accountability.

Regulatory and Ethical Considerations

Consultancy services prioritize providing strategic guidance while adhering to regulatory frameworks such as GDPR and SOX, ensuring clients maintain compliance and ethical standards. Auditing focuses on independently verifying financial records and internal controls to detect fraud and confirm adherence to accounting principles like GAAP or IFRS. Both fields require strict adherence to professional codes of ethics from bodies such as the ICMAP and AICPA to uphold transparency and accountability.

Career Progression and Opportunities

Consultancy offers diverse career progression through roles in strategy, management, and technology, often leading to leadership positions across various industries. Auditing provides a more structured career path centered on financial compliance, risk assessment, and regulatory expertise, with opportunities to advance into senior auditor, audit manager, or chief audit executive roles. Both fields value analytical skills, but consultancy generally offers broader exposure to business operations and innovation, while auditing emphasizes regulatory knowledge and financial accuracy.

Choosing Between Consultancy and Auditing

Choosing between consultancy and auditing depends on the organization's goals; consultancy provides strategic advice and solutions to improve business performance, while auditing offers an independent evaluation of financial statements and compliance. Businesses seeking growth opportunities, operational improvements, and risk management often prioritize consultancy services, whereas those requiring regulatory compliance and financial transparency focus on auditing. Understanding the distinct roles, outcomes, and regulatory requirements of each ensures informed decisions tailored to organizational needs.

Consultancy vs Auditing Infographic

jobdiv.com

jobdiv.com