Risk consultants assess potential threats to a business and develop strategies to minimize financial, operational, and reputational risks. Compliance consultants ensure that organizations adhere to laws, regulations, and internal policies to avoid legal penalties and maintain ethical standards. Both roles are essential for safeguarding a company's integrity, but risk consultants focus on proactive risk management while compliance consultants concentrate on regulatory adherence.

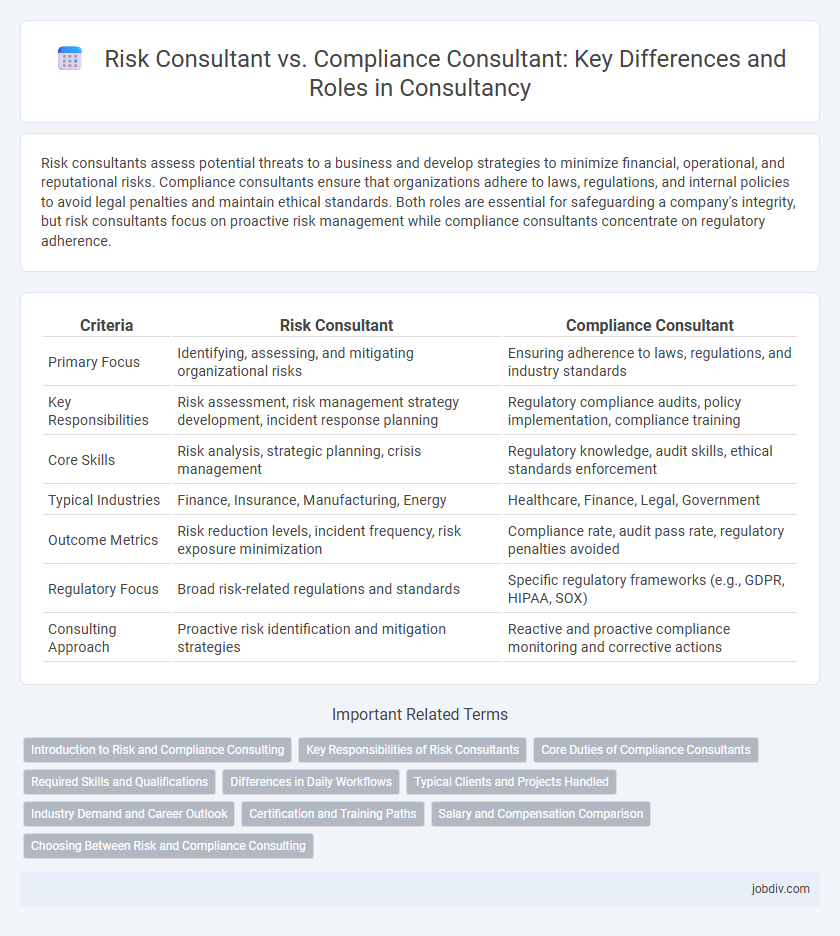

Table of Comparison

| Criteria | Risk Consultant | Compliance Consultant |

|---|---|---|

| Primary Focus | Identifying, assessing, and mitigating organizational risks | Ensuring adherence to laws, regulations, and industry standards |

| Key Responsibilities | Risk assessment, risk management strategy development, incident response planning | Regulatory compliance audits, policy implementation, compliance training |

| Core Skills | Risk analysis, strategic planning, crisis management | Regulatory knowledge, audit skills, ethical standards enforcement |

| Typical Industries | Finance, Insurance, Manufacturing, Energy | Healthcare, Finance, Legal, Government |

| Outcome Metrics | Risk reduction levels, incident frequency, risk exposure minimization | Compliance rate, audit pass rate, regulatory penalties avoided |

| Regulatory Focus | Broad risk-related regulations and standards | Specific regulatory frameworks (e.g., GDPR, HIPAA, SOX) |

| Consulting Approach | Proactive risk identification and mitigation strategies | Reactive and proactive compliance monitoring and corrective actions |

Introduction to Risk and Compliance Consulting

Risk consultants specialize in identifying, assessing, and mitigating potential threats that could impact an organization's operations, financial stability, and reputation. Compliance consultants focus on ensuring that businesses adhere to relevant laws, regulations, and industry standards to avoid legal penalties and maintain ethical practices. Both roles are crucial in helping companies develop robust frameworks to manage uncertainties and regulatory demands effectively.

Key Responsibilities of Risk Consultants

Risk Consultants specialize in identifying, assessing, and mitigating potential threats that could adversely impact an organization's operations, financial health, and reputation. They develop risk management frameworks, conduct risk assessments, and recommend strategies to minimize exposure to operational, financial, and strategic risks. Their key responsibilities include monitoring regulatory changes, implementing risk controls, and advising senior management on risk-related decision-making processes.

Core Duties of Compliance Consultants

Compliance consultants specialize in ensuring organizations adhere to regulatory requirements by developing and implementing comprehensive compliance programs, conducting audits, and providing training on legal standards. They analyze internal policies, monitor regulatory changes, and recommend corrective actions to mitigate risks of non-compliance. Their core duties include maintaining documentation, performing risk assessments specifically related to compliance, and advising management on best practices to align with industry regulations.

Required Skills and Qualifications

Risk Consultants require expertise in risk assessment methodologies, quantitative analysis, and knowledge of industry-specific regulations to identify and mitigate potential threats. Compliance Consultants must possess a deep understanding of regulatory frameworks, strong analytical skills, and experience in policy development to ensure organizational adherence to legal standards. Both roles demand excellent communication abilities and proficiency in risk management software, but Risk Consultants emphasize strategic risk mitigation while Compliance Consultants focus on regulatory enforcement and internal controls.

Differences in Daily Workflows

Risk consultants primarily analyze potential threats to business operations by assessing financial, operational, and strategic risks using quantitative risk models and scenario analyses. Compliance consultants focus on ensuring organizations adhere to regulatory requirements and internal policies, conducting audits and training sessions to maintain legal and ethical standards. While risk consultants develop mitigation strategies, compliance consultants monitor ongoing adherence to regulatory frameworks, emphasizing enforcement and reporting workflows.

Typical Clients and Projects Handled

Risk consultants typically work with financial institutions, manufacturing firms, and energy companies to identify, assess, and mitigate operational, financial, and strategic risks, often handling projects involving risk assessments, crisis management, and business continuity planning. Compliance consultants primarily serve healthcare organizations, pharmaceutical companies, and government agencies, focusing on regulatory adherence, internal audits, and the implementation of compliance programs to prevent legal and regulatory violations. Both roles collaborate with senior management but differ in project scope, with risk consultants addressing uncertainty and threat management while compliance consultants ensure conformity with laws and standards.

Industry Demand and Career Outlook

Risk Consultants and Compliance Consultants both experience strong industry demand, with Risk Consultants increasingly sought after in sectors such as finance, insurance, and energy due to rising regulatory scrutiny and cyber threats. Compliance Consultants remain essential in heavily regulated industries like healthcare, pharmaceuticals, and banking, where adherence to evolving laws and standards is critical. Career outlook for Risk Consultants forecasts steady growth driven by global risk management needs, while Compliance Consultants benefit from ongoing regulatory changes and organizational emphasis on corporate governance.

Certification and Training Paths

Risk Consultants typically pursue certifications such as Certified Risk Manager (CRM) and Project Management Professional (PMP) to enhance their expertise in identifying and mitigating organizational risks. Compliance Consultants often obtain certifications like Certified Compliance & Ethics Professional (CCEP) and Certified Regulatory Compliance Manager (CRCM) to ensure adherence to regulatory standards and policies. Both roles benefit from continuous training in industry-specific regulations, risk assessment methodologies, and governance frameworks to maintain up-to-date knowledge and effective consultancy practices.

Salary and Compensation Comparison

Risk consultants typically earn higher average salaries than compliance consultants due to the specialized nature of risk assessment and management expertise, with median annual earnings around $90,000 compared to $75,000 for compliance consultants. Compensation packages for risk consultants often include performance bonuses and profit-sharing, reflecting the direct impact of their work on organizational risk mitigation. Compliance consultants, while generally commanding lower base salaries, benefit from steady demand in regulated industries, offering job stability and consistent compensation growth over time.

Choosing Between Risk and Compliance Consulting

Choosing between risk and compliance consulting depends on the organization's strategic priorities and regulatory environment. Risk consultants specialize in identifying, assessing, and mitigating potential threats to business continuity, leveraging frameworks such as ISO 31000 and COSO ERM. Compliance consultants focus on ensuring adherence to legal requirements, industry standards, and internal policies, often working with regulations like GDPR, SOX, and HIPAA to minimize regulatory penalties and safeguard corporate reputation.

Risk Consultant vs Compliance Consultant Infographic

jobdiv.com

jobdiv.com