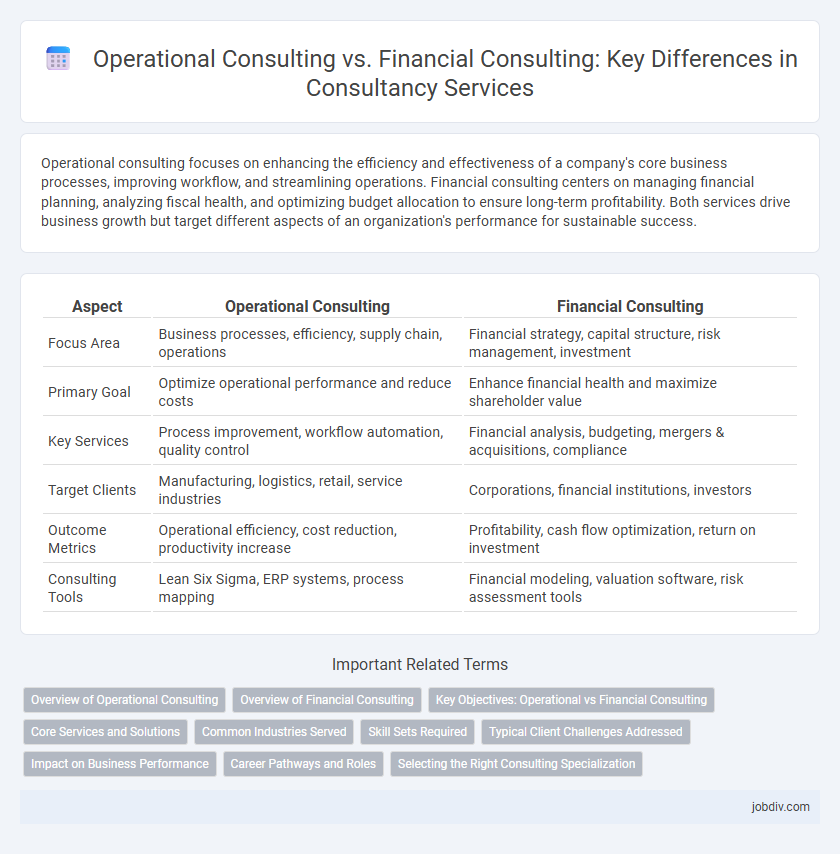

Operational consulting focuses on enhancing the efficiency and effectiveness of a company's core business processes, improving workflow, and streamlining operations. Financial consulting centers on managing financial planning, analyzing fiscal health, and optimizing budget allocation to ensure long-term profitability. Both services drive business growth but target different aspects of an organization's performance for sustainable success.

Table of Comparison

| Aspect | Operational Consulting | Financial Consulting |

|---|---|---|

| Focus Area | Business processes, efficiency, supply chain, operations | Financial strategy, capital structure, risk management, investment |

| Primary Goal | Optimize operational performance and reduce costs | Enhance financial health and maximize shareholder value |

| Key Services | Process improvement, workflow automation, quality control | Financial analysis, budgeting, mergers & acquisitions, compliance |

| Target Clients | Manufacturing, logistics, retail, service industries | Corporations, financial institutions, investors |

| Outcome Metrics | Operational efficiency, cost reduction, productivity increase | Profitability, cash flow optimization, return on investment |

| Consulting Tools | Lean Six Sigma, ERP systems, process mapping | Financial modeling, valuation software, risk assessment tools |

Overview of Operational Consulting

Operational consulting focuses on improving business processes, enhancing efficiency, and optimizing resource allocation within organizations. It involves strategies such as workflow analysis, supply chain management, and process reengineering to drive performance gains and cost reductions. Consultants in this field leverage data analytics and industry best practices to streamline operations and support sustainable growth.

Overview of Financial Consulting

Financial consulting specializes in advising businesses on managing assets, optimizing cash flow, and navigating investment strategies to enhance profitability and ensure regulatory compliance. This field covers budgeting, financial planning, risk management, mergers and acquisitions, and tax optimization, leveraging data analysis and market expertise. Financial consultants provide critical insights to support strategic decision-making and improve overall financial health.

Key Objectives: Operational vs Financial Consulting

Operational consulting focuses on improving internal processes, enhancing efficiency, and optimizing resource allocation to drive business performance. Financial consulting centers on financial planning, risk management, and capital structure to ensure fiscal stability and growth. Both aim to increase organizational value but prioritize distinct strategic objectives.

Core Services and Solutions

Operational consulting focuses on enhancing business processes, supply chain management, and workforce optimization to improve overall efficiency and productivity. Financial consulting provides expertise in financial planning, risk management, mergers and acquisitions, and capital structuring to ensure sustainable fiscal health and strategic growth. Both core services are designed to drive organizational performance but address different operational and financial challenges.

Common Industries Served

Operational consulting and financial consulting both serve diverse industries such as manufacturing, healthcare, retail, and technology, addressing different aspects of organizational performance. Operational consulting focuses on improving efficiency, supply chain management, and process optimization, while financial consulting concentrates on capital management, investment strategies, and risk analysis. Key sectors like banking, energy, and telecommunications benefit from operational strategies to streamline workflows, whereas financial consulting supports these industries in financial planning and compliance.

Skill Sets Required

Operational consulting requires expertise in process improvement, supply chain management, and change management, emphasizing analytical and problem-solving skills to optimize business operations. Financial consulting demands proficiency in financial analysis, risk assessment, and regulatory compliance, with a strong foundation in accounting principles and data interpretation. Both fields benefit from strategic thinking and client communication abilities but differ in their core technical knowledge and industry focus.

Typical Client Challenges Addressed

Operational consulting typically addresses client challenges related to process inefficiencies, supply chain optimization, and workforce productivity improvements. Financial consulting focuses on issues such as cash flow management, financial reporting accuracy, and strategic investment planning. Both services aim to enhance overall business performance but target distinct areas of client needs.

Impact on Business Performance

Operational consulting enhances business performance by streamlining processes, improving supply chain efficiency, and optimizing resource allocation to boost productivity and reduce costs. Financial consulting drives performance through strategic financial planning, risk management, and capital structure optimization, ensuring sustainable growth and profitability. Both consulting types directly influence key performance indicators by aligning operational execution with financial objectives for comprehensive business success.

Career Pathways and Roles

Operational consulting focuses on improving business processes, supply chain efficiency, and organizational performance, with career pathways leading to roles such as operations manager, process improvement specialist, or supply chain analyst. Financial consulting centers on financial planning, risk management, and investment strategies, offering career opportunities like financial analyst, risk consultant, or corporate finance advisor. Both paths demand strong analytical skills, but operational consulting emphasizes process optimization, while financial consulting prioritizes fiscal expertise and regulatory compliance.

Selecting the Right Consulting Specialization

Operational consulting enhances business processes by optimizing workflows, supply chains, and organizational structures to boost efficiency and productivity. Financial consulting focuses on managing financial strategies, investment planning, risk assessment, and regulatory compliance to improve fiscal performance and capital allocation. Selecting the right consulting specialization depends on a company's immediate needs, whether improving operational effectiveness or strengthening financial health.

Operational Consulting vs Financial Consulting Infographic

jobdiv.com

jobdiv.com