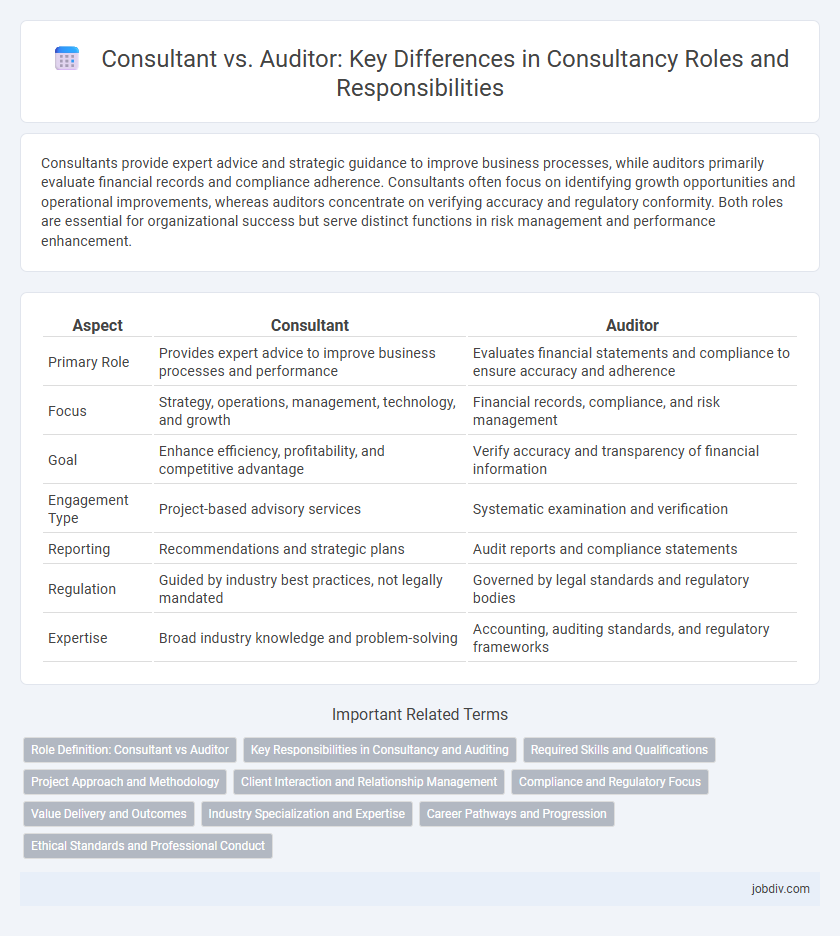

Consultants provide expert advice and strategic guidance to improve business processes, while auditors primarily evaluate financial records and compliance adherence. Consultants often focus on identifying growth opportunities and operational improvements, whereas auditors concentrate on verifying accuracy and regulatory conformity. Both roles are essential for organizational success but serve distinct functions in risk management and performance enhancement.

Table of Comparison

| Aspect | Consultant | Auditor |

|---|---|---|

| Primary Role | Provides expert advice to improve business processes and performance | Evaluates financial statements and compliance to ensure accuracy and adherence |

| Focus | Strategy, operations, management, technology, and growth | Financial records, compliance, and risk management |

| Goal | Enhance efficiency, profitability, and competitive advantage | Verify accuracy and transparency of financial information |

| Engagement Type | Project-based advisory services | Systematic examination and verification |

| Reporting | Recommendations and strategic plans | Audit reports and compliance statements |

| Regulation | Guided by industry best practices, not legally mandated | Governed by legal standards and regulatory bodies |

| Expertise | Broad industry knowledge and problem-solving | Accounting, auditing standards, and regulatory frameworks |

Role Definition: Consultant vs Auditor

Consultants provide expert advice and strategic guidance to improve business operations, focusing on problem-solving and implementing tailored solutions. Auditors assess financial records and compliance with regulations, ensuring accuracy and identifying risks through systematic evaluation. The consultant's role is proactive and advisory, while the auditor's role is primarily evaluative and regulatory.

Key Responsibilities in Consultancy and Auditing

Consultants analyze business challenges and develop strategic solutions to improve organizational performance, focusing on innovation, process optimization, and stakeholder engagement. Auditors evaluate financial records and compliance with regulations to ensure accuracy, transparency, and risk mitigation within organizations. Both roles require strong analytical skills, but consultants prioritize advisory and transformative initiatives, whereas auditors emphasize verification and assurance functions.

Required Skills and Qualifications

Consultants require strong problem-solving abilities, communication skills, and industry-specific knowledge to provide strategic advice and implement solutions that drive business growth. Auditors need proficiency in accounting principles, attention to detail, and expertise in regulatory compliance to effectively evaluate financial records and ensure accuracy. Both roles demand analytical thinking and a solid understanding of relevant laws and standards, but consultants emphasize advisory capabilities while auditors focus on verification and validation.

Project Approach and Methodology

Consultants employ a flexible project approach tailored to client needs, emphasizing strategic analysis, solution development, and continuous collaboration to drive business transformation. Auditors follow a systematic, standardized methodology centered on compliance, risk assessment, and transactional verification to ensure accuracy and regulatory adherence. The consultant's adaptive model promotes innovation and change management, while the auditor's structured process prioritizes objectivity and control validation.

Client Interaction and Relationship Management

Consultants engage proactively with clients to understand their unique challenges, offering tailored solutions that foster long-term partnerships and ongoing collaboration. Auditors primarily maintain a formal, compliance-driven relationship, focusing on objective assessment and verification of financial records with limited advisory interaction. Effective client interaction in consultancy centers on trust-building and continuous dialogue, contrasting with auditors' role in providing independent assurance to stakeholders.

Compliance and Regulatory Focus

Consultants specialize in providing strategic guidance to help organizations navigate complex compliance requirements and implement tailored regulatory frameworks efficiently. Auditors focus on systematically examining and verifying adherence to established compliance standards and regulatory mandates through rigorous assessments and evidence-based evaluations. Both roles are essential for maintaining organizational accountability and minimizing legal and financial risks in regulated industries.

Value Delivery and Outcomes

Consultants specialize in driving strategic value by identifying opportunities for growth, optimizing processes, and implementing solutions tailored to organizational needs, resulting in enhanced business outcomes. Auditors focus on verifying compliance, assessing risk management, and ensuring financial accuracy to provide stakeholders with assurance and transparency. While consultants deliver transformative improvements that propel business performance, auditors deliver confidence through independent evaluation and regulatory adherence.

Industry Specialization and Expertise

Consultants offer tailored industry specialization by providing strategic insights and customized solutions that address specific business challenges within sectors such as finance, healthcare, or technology. Auditors possess expertise in regulatory compliance and financial reporting standards, ensuring accuracy and transparency across various industries, often with a focus on risk management and internal controls. The depth of industry knowledge in consultants drives proactive growth initiatives, while auditors emphasize evaluative expertise to uphold organizational integrity.

Career Pathways and Progression

Consultants typically advance by developing specialized expertise and expanding client portfolios, often transitioning into senior advisory or management roles within firms or industries. Auditors progress through structured paths focused on technical proficiency and compliance mastery, leading to positions such as audit manager, risk consultant, or chief audit executive. Both careers demand continuous professional development, with certifications like CPA for auditors and PMP or Six Sigma valuable for consultants to enhance career prospects.

Ethical Standards and Professional Conduct

Consultants and auditors both adhere to strict ethical standards, but their professional conduct varies based on their roles. Consultants prioritize confidentiality, transparency, and client-aligned advice, maintaining independence while offering strategic solutions. Auditors follow stringent regulatory frameworks, emphasizing objectivity, integrity, and impartiality to ensure accurate financial reporting and compliance.

Consultant vs Auditor Infographic

jobdiv.com

jobdiv.com