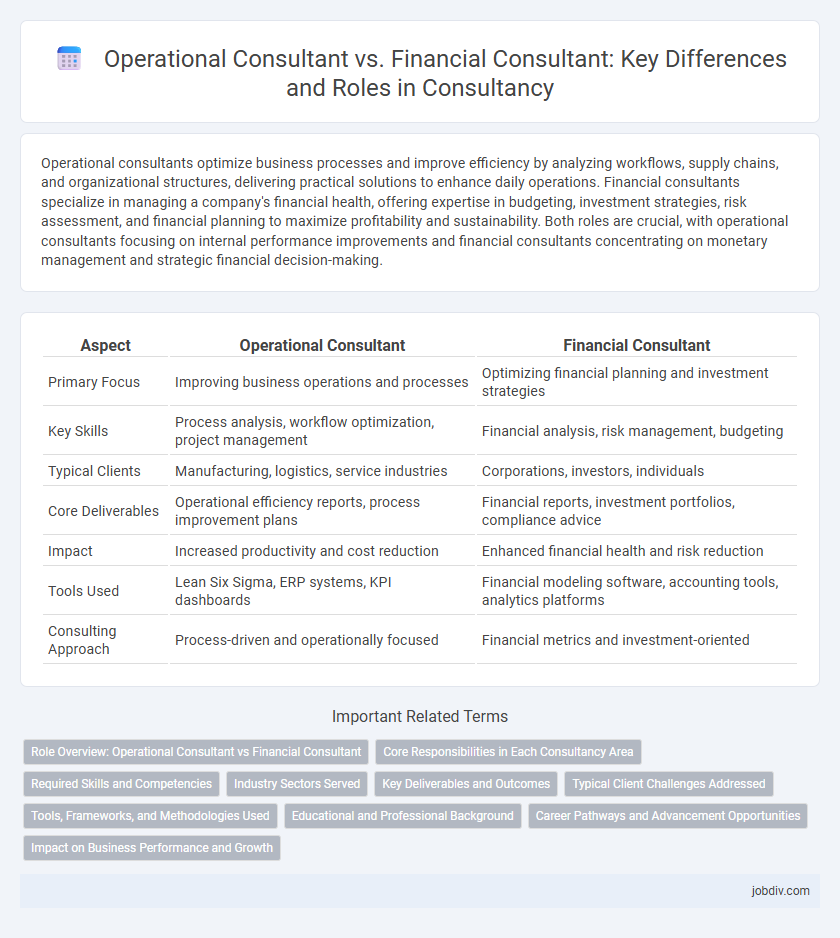

Operational consultants optimize business processes and improve efficiency by analyzing workflows, supply chains, and organizational structures, delivering practical solutions to enhance daily operations. Financial consultants specialize in managing a company's financial health, offering expertise in budgeting, investment strategies, risk assessment, and financial planning to maximize profitability and sustainability. Both roles are crucial, with operational consultants focusing on internal performance improvements and financial consultants concentrating on monetary management and strategic financial decision-making.

Table of Comparison

| Aspect | Operational Consultant | Financial Consultant |

|---|---|---|

| Primary Focus | Improving business operations and processes | Optimizing financial planning and investment strategies |

| Key Skills | Process analysis, workflow optimization, project management | Financial analysis, risk management, budgeting |

| Typical Clients | Manufacturing, logistics, service industries | Corporations, investors, individuals |

| Core Deliverables | Operational efficiency reports, process improvement plans | Financial reports, investment portfolios, compliance advice |

| Impact | Increased productivity and cost reduction | Enhanced financial health and risk reduction |

| Tools Used | Lean Six Sigma, ERP systems, KPI dashboards | Financial modeling software, accounting tools, analytics platforms |

| Consulting Approach | Process-driven and operationally focused | Financial metrics and investment-oriented |

Role Overview: Operational Consultant vs Financial Consultant

Operational consultants specialize in improving business processes, enhancing efficiency, and optimizing supply chain management to drive operational excellence. Financial consultants focus on financial planning, investment strategies, risk management, and ensuring regulatory compliance to maximize financial performance. Both roles require strong analytical skills but differ in their primary objectives, with operational consultants targeting process improvements and financial consultants prioritizing fiscal health.

Core Responsibilities in Each Consultancy Area

Operational consultants specialize in improving internal processes, streamlining workflows, and enhancing supply chain efficiency to boost organizational productivity. Financial consultants focus on financial planning, investment strategies, risk management, and ensuring compliance with regulatory frameworks to optimize fiscal performance. Both consultants leverage data analysis, but operational experts prioritize process optimization while financial consultants concentrate on monetary outcomes.

Required Skills and Competencies

Operational consultants require strong analytical skills, process optimization expertise, and proficiency in project management to improve organizational efficiency. Financial consultants must possess in-depth knowledge of financial analysis, risk assessment, and regulatory compliance to guide investment decisions and budget planning. Both roles demand excellent communication and problem-solving abilities to effectively collaborate with clients and stakeholders.

Industry Sectors Served

Operational consultants primarily serve manufacturing, logistics, and retail sectors by optimizing processes, supply chains, and operational efficiency. Financial consultants focus on banking, investment firms, and corporate finance, delivering strategic financial planning, risk management, and capital optimization. Both roles tailor their expertise to industry-specific challenges, driving growth through specialized sector insights.

Key Deliverables and Outcomes

Operational consultants deliver process optimization, workflow improvements, and efficiency strategies that drive enhanced productivity and reduced operational costs. Financial consultants focus on financial planning, risk assessment, and investment strategies to maximize profitability and ensure regulatory compliance. Both roles provide actionable insights, but operational consultants target internal processes while financial consultants emphasize fiscal health and capital management.

Typical Client Challenges Addressed

Operational consultants address challenges related to improving business processes, enhancing supply chain efficiency, and streamlining daily operations for increased productivity. Financial consultants focus on managing financial risks, optimizing investment strategies, and improving cash flow management to ensure fiscal stability. Both consultants help clients navigate complex organizational issues but specialize in distinct areas vital for overall business success.

Tools, Frameworks, and Methodologies Used

Operational consultants primarily utilize tools such as Lean Six Sigma, Kaizen, and Business Process Modeling to enhance efficiency and streamline workflows. Financial consultants often employ frameworks like discounted cash flow (DCF), financial ratio analysis, and risk assessment models to optimize investment strategies and manage financial performance. Both types of consultants rely on data analytics software, but operational consultants focus on performance metrics while financial consultants emphasize financial forecasting tools.

Educational and Professional Background

Operational consultants typically possess degrees in business administration, industrial engineering, or supply chain management, complemented by certifications such as Lean Six Sigma or PMP. Financial consultants often hold qualifications in finance, accounting, or economics, with professional credentials like CFA, CPA, or ACCA enhancing their expertise. Both roles require strong analytical skills, but operational consultants emphasize process optimization and workflow improvement, while financial consultants focus on investment strategies and financial planning.

Career Pathways and Advancement Opportunities

Operational consultants specialize in improving business processes and efficiency, often progressing toward roles such as Operations Manager or Chief Operating Officer. Financial consultants focus on financial planning, risk management, and investment strategies, with career advancement leading to positions like Finance Director or Chief Financial Officer. Career pathways in both fields emphasize strategic decision-making skills, with operational roles leaning toward organizational optimization and financial roles centering on fiscal stewardship and compliance.

Impact on Business Performance and Growth

Operational Consultants enhance business performance by streamlining processes, improving efficiency, and reducing operational costs, directly boosting productivity and profitability. Financial Consultants focus on optimizing financial strategies, managing risks, and securing funding, which supports sustainable growth and improves cash flow management. Both roles drive business growth, but Operational Consultants influence day-to-day execution while Financial Consultants shape long-term financial health.

Operational Consultant vs Financial Consultant Infographic

jobdiv.com

jobdiv.com