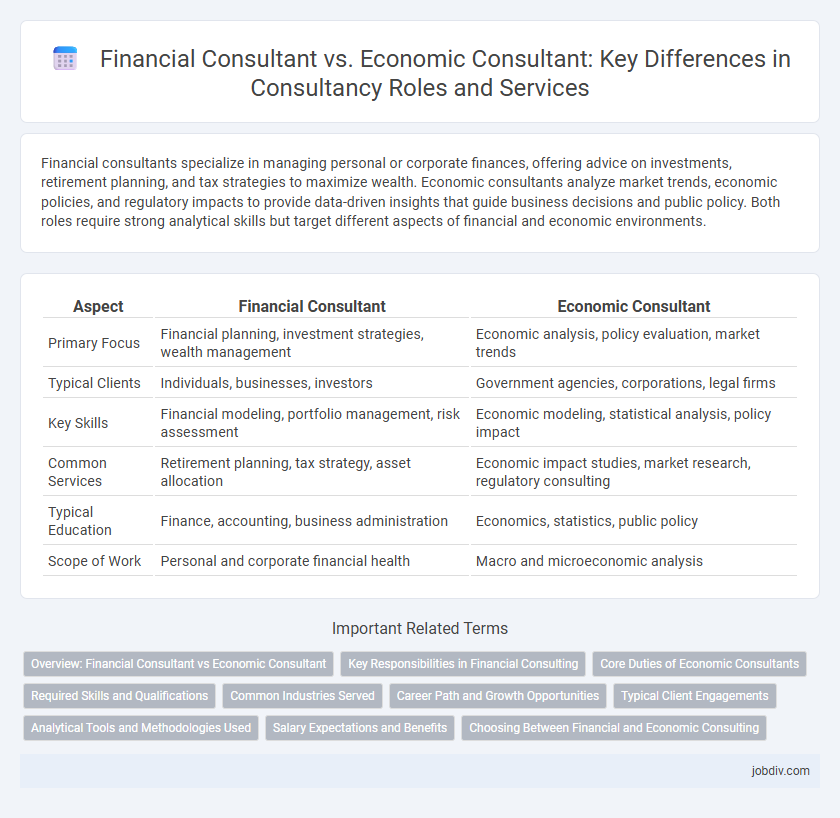

Financial consultants specialize in managing personal or corporate finances, offering advice on investments, retirement planning, and tax strategies to maximize wealth. Economic consultants analyze market trends, economic policies, and regulatory impacts to provide data-driven insights that guide business decisions and public policy. Both roles require strong analytical skills but target different aspects of financial and economic environments.

Table of Comparison

| Aspect | Financial Consultant | Economic Consultant |

|---|---|---|

| Primary Focus | Financial planning, investment strategies, wealth management | Economic analysis, policy evaluation, market trends |

| Typical Clients | Individuals, businesses, investors | Government agencies, corporations, legal firms |

| Key Skills | Financial modeling, portfolio management, risk assessment | Economic modeling, statistical analysis, policy impact |

| Common Services | Retirement planning, tax strategy, asset allocation | Economic impact studies, market research, regulatory consulting |

| Typical Education | Finance, accounting, business administration | Economics, statistics, public policy |

| Scope of Work | Personal and corporate financial health | Macro and microeconomic analysis |

Overview: Financial Consultant vs Economic Consultant

A Financial Consultant specializes in personal or corporate financial planning, including investment management, retirement strategies, and risk assessment to optimize financial health. An Economic Consultant provides expert analysis on economic trends, market dynamics, and policy impacts to support legal cases, government agencies, or business strategies. Both roles require strong analytical skills, but Financial Consultants focus on individual or organizational wealth optimization, while Economic Consultants emphasize broader economic frameworks and policy implications.

Key Responsibilities in Financial Consulting

Financial consultants analyze clients' financial data to develop strategic plans for investment, retirement, and risk management. They provide expert advice on budgeting, tax planning, and portfolio management to optimize financial performance. Emphasis on regulatory compliance and market trend analysis ensures tailored solutions for individual and corporate financial goals.

Core Duties of Economic Consultants

Economic consultants analyze market trends, conduct econometric modeling, and provide expert testimony in legal and regulatory matters. They focus on evaluating economic damages, antitrust issues, and public policy impacts using data-driven insights and advanced statistical techniques. Their core duties involve advising clients on economic strategies, forecasting market behavior, and interpreting complex economic data to support decision-making processes.

Required Skills and Qualifications

Financial consultants require strong expertise in accounting, investment strategies, and financial planning, often holding certifications like CFA or CPA to advise clients on asset management and risk assessment. Economic consultants need advanced knowledge in microeconomics, econometrics, and data analysis, typically possessing degrees in economics or related fields to provide insights on market trends and policy impacts. Both roles demand excellent analytical capabilities, problem-solving skills, and proficiency in financial modeling software to deliver accurate and strategic advice.

Common Industries Served

Financial consultants primarily serve industries such as banking, insurance, investment management, and real estate, offering expertise in financial planning, risk management, and portfolio optimization. Economic consultants focus on sectors like government agencies, litigation firms, energy, healthcare, and telecommunications, providing analysis on market trends, regulatory impacts, and economic forecasting. Both roles support industries requiring data-driven decision-making but differ in the scope of financial versus broader economic advisory services.

Career Path and Growth Opportunities

Financial consultants typically focus on helping clients with investments, retirement planning, and wealth management, offering clear career paths in banking, asset management, and financial advisory firms. Economic consultants analyze market trends, economic policies, and data modeling, providing growth opportunities in government agencies, research institutions, and economic think tanks. Both career paths require strong analytical skills and offer advancement through specialization, certifications, and leadership roles in their respective sectors.

Typical Client Engagements

Financial consultants typically engage with individual clients and businesses to provide advice on investment strategies, retirement planning, and financial risk management. Economic consultants focus on providing expert analysis and testimony for legal cases, policy evaluation, and market research for government agencies, law firms, and corporations. Both consultants tailor their services to address specific client needs but differ in the scope and application of their expertise.

Analytical Tools and Methodologies Used

Financial consultants primarily use analytical tools such as financial modeling, risk assessment, and portfolio analysis to guide investment decisions and optimize financial performance for clients. Economic consultants employ econometric models, statistical analysis, and forecasting techniques to assess market trends, policy impacts, and economic behavior. Both disciplines rely on data-driven methodologies, but financial consultants focus more on individual or corporate financial health, while economic consultants analyze broader economic environments and regulatory effects.

Salary Expectations and Benefits

Financial consultants typically earn salaries ranging from $70,000 to $120,000 annually, with compensation influenced by experience, certifications, and client portfolio size. Economic consultants command higher wages, often between $90,000 and $150,000, due to their expertise in data analysis, econometrics, and policy impact assessments. Benefits for both roles generally include performance bonuses, health insurance, retirement plans, and opportunities for professional development, with economic consultants often receiving additional incentives related to research publications and project complexity.

Choosing Between Financial and Economic Consulting

Choosing between financial and economic consulting depends on the specific needs of your business; financial consultants focus on investment strategies, risk management, and corporate finance, while economic consultants analyze market trends, policy impacts, and economic modeling. Financial consulting is ideal for companies seeking advice on capital structure, mergers, and acquisitions, whereas economic consulting suits firms requiring expertise in antitrust, regulatory issues, or economic forecasting. Understanding the distinctions in skill sets and industry applications helps organizations select the right consultancy to optimize financial performance or address broader economic challenges.

Financial Consultant vs Economic Consultant Infographic

jobdiv.com

jobdiv.com