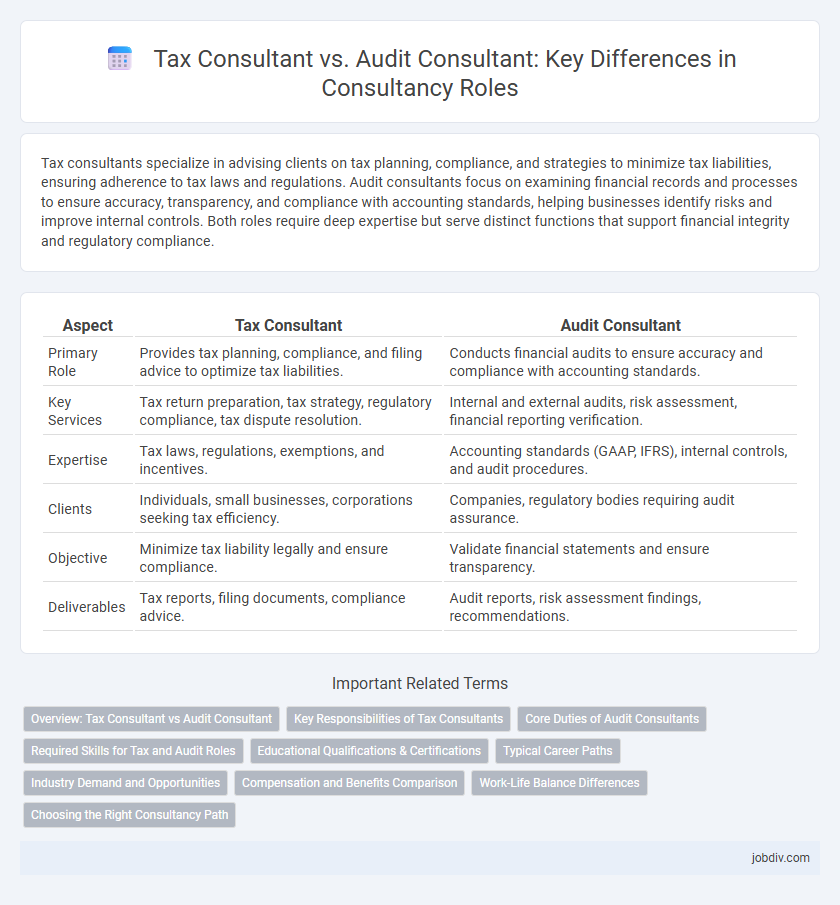

Tax consultants specialize in advising clients on tax planning, compliance, and strategies to minimize tax liabilities, ensuring adherence to tax laws and regulations. Audit consultants focus on examining financial records and processes to ensure accuracy, transparency, and compliance with accounting standards, helping businesses identify risks and improve internal controls. Both roles require deep expertise but serve distinct functions that support financial integrity and regulatory compliance.

Table of Comparison

| Aspect | Tax Consultant | Audit Consultant |

|---|---|---|

| Primary Role | Provides tax planning, compliance, and filing advice to optimize tax liabilities. | Conducts financial audits to ensure accuracy and compliance with accounting standards. |

| Key Services | Tax return preparation, tax strategy, regulatory compliance, tax dispute resolution. | Internal and external audits, risk assessment, financial reporting verification. |

| Expertise | Tax laws, regulations, exemptions, and incentives. | Accounting standards (GAAP, IFRS), internal controls, and audit procedures. |

| Clients | Individuals, small businesses, corporations seeking tax efficiency. | Companies, regulatory bodies requiring audit assurance. |

| Objective | Minimize tax liability legally and ensure compliance. | Validate financial statements and ensure transparency. |

| Deliverables | Tax reports, filing documents, compliance advice. | Audit reports, risk assessment findings, recommendations. |

Overview: Tax Consultant vs Audit Consultant

Tax consultants specialize in advising individuals and businesses on tax planning, compliance, and minimizing tax liabilities through strategic use of tax laws and regulations. Audit consultants focus on evaluating financial statements, internal controls, and compliance to ensure accuracy and adherence to accounting standards for risk mitigation. Both roles demand expertise in regulatory frameworks but target distinct aspects of financial consulting, with tax consultants concentrating on tax efficiency and audit consultants emphasizing financial integrity and assurance.

Key Responsibilities of Tax Consultants

Tax consultants specialize in advising clients on tax planning, compliance, and regulatory matters, ensuring accurate tax filings and optimizing tax liabilities. They interpret complex tax laws to provide strategies that minimize risks and leverage deductions or credits for businesses and individuals. Unlike audit consultants who focus on financial statement verification, tax consultants concentrate on meeting tax obligations and improving fiscal efficiency.

Core Duties of Audit Consultants

Audit consultants specialize in examining financial statements, ensuring compliance with accounting standards, and identifying risks related to internal controls. Their core duties include conducting audits, assessing financial accuracy, and providing recommendations to improve organizational governance and financial processes. This contrasts with tax consultants who focus primarily on tax planning, compliance, and optimizing tax liabilities.

Required Skills for Tax and Audit Roles

Tax consultants require in-depth knowledge of tax laws, regulations, and compliance, along with strong analytical skills to interpret complex financial data for accurate tax planning and reporting. Audit consultants must possess expertise in risk assessment, internal controls, and financial statement analysis, combined with meticulous attention to detail to identify discrepancies and ensure regulatory compliance. Both roles demand proficiency in accounting software, critical thinking, and excellent communication skills to effectively advise clients and stakeholders.

Educational Qualifications & Certifications

Tax consultants typically hold degrees in accounting, finance, or law and pursue certifications such as Certified Public Accountant (CPA) or Chartered Tax Advisor (CTA) to specialize in tax legislation and compliance. Audit consultants often possess similar educational backgrounds with an emphasis on accounting or finance and frequently obtain Certified Internal Auditor (CIA) or CPA credentials to qualify for roles focused on financial auditing and risk assessment. Both roles require continuous professional education to stay updated with regulatory changes and industry standards.

Typical Career Paths

Tax consultants often begin their careers with a focus on tax preparation, compliance, and planning, progressing to specialized roles in corporate tax strategy or international taxation. Audit consultants typically start in financial auditing roles, gaining expertise in internal controls, risk assessment, and regulatory compliance, which can lead to positions in forensic auditing or advisory services. Both paths offer advancement opportunities into senior consultancy roles, management, or advisory positions within accounting firms or corporate finance departments.

Industry Demand and Opportunities

Tax consultants are increasingly sought after in industries facing complex regulatory environments, such as finance, technology, and manufacturing, due to evolving tax laws and compliance requirements. Audit consultants experience strong demand in sectors like banking, healthcare, and public companies where rigorous financial reporting and internal control assessments are critical. Both roles offer diverse opportunities, but tax consultants often benefit from advisory positions related to tax planning and optimization, while audit consultants excel in risk assessment and assurance services.

Compensation and Benefits Comparison

Tax consultants typically earn salaries ranging from $60,000 to $120,000 annually, with benefits often including performance bonuses, health insurance, and retirement plans, reflecting their expertise in tax planning and compliance. Audit consultants usually command compensation between $55,000 and $110,000, accompanied by benefits such as paid time off, professional development allowances, and health coverage, driven by their role in financial statement verification and regulatory adherence. Variations in pay depend on factors like location, experience, certification, and firm size, with both roles offering potential for upward mobility and enhanced benefits packages over time.

Work-Life Balance Differences

Tax consultants often experience peak workloads during tax season, leading to long hours and increased stress, while audit consultants face cyclical demands aligned with financial reporting periods but generally maintain more predictable schedules. The audit consultant's work typically involves extensive fieldwork and client interaction, which can require travel, whereas tax consultants primarily concentrate on detailed regulatory analysis and compliance tasks often performed in-office. Work-life balance for tax consultants may be more challenging during filing deadlines, whereas audit consultants benefit from clearer project timelines, facilitating more consistent personal time management.

Choosing the Right Consultancy Path

Choosing the right consultancy path depends on your expertise and business needs, as tax consultants specialize in tax laws, compliance, and strategic tax planning, ensuring optimal financial outcomes and legal adherence. Audit consultants focus on evaluating financial statements, internal controls, and risk management to enhance transparency and regulatory compliance. Understanding these core differences allows organizations to select consultants who align with their specific financial goals and regulatory requirements.

Tax Consultant vs Audit Consultant Infographic

jobdiv.com

jobdiv.com