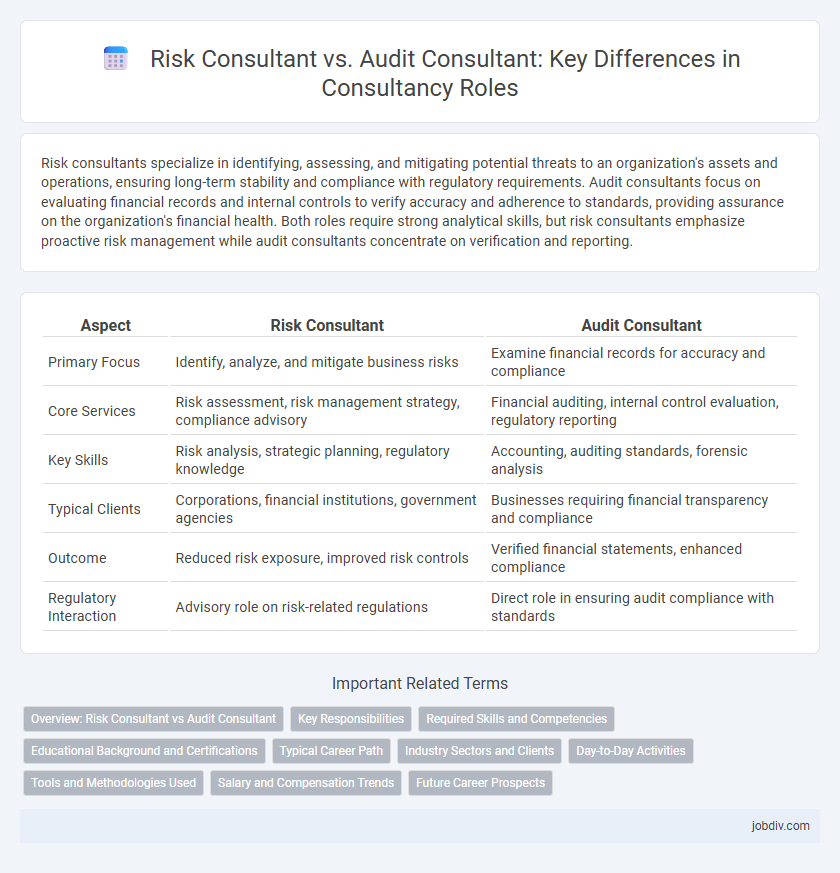

Risk consultants specialize in identifying, assessing, and mitigating potential threats to an organization's assets and operations, ensuring long-term stability and compliance with regulatory requirements. Audit consultants focus on evaluating financial records and internal controls to verify accuracy and adherence to standards, providing assurance on the organization's financial health. Both roles require strong analytical skills, but risk consultants emphasize proactive risk management while audit consultants concentrate on verification and reporting.

Table of Comparison

| Aspect | Risk Consultant | Audit Consultant |

|---|---|---|

| Primary Focus | Identify, analyze, and mitigate business risks | Examine financial records for accuracy and compliance |

| Core Services | Risk assessment, risk management strategy, compliance advisory | Financial auditing, internal control evaluation, regulatory reporting |

| Key Skills | Risk analysis, strategic planning, regulatory knowledge | Accounting, auditing standards, forensic analysis |

| Typical Clients | Corporations, financial institutions, government agencies | Businesses requiring financial transparency and compliance |

| Outcome | Reduced risk exposure, improved risk controls | Verified financial statements, enhanced compliance |

| Regulatory Interaction | Advisory role on risk-related regulations | Direct role in ensuring audit compliance with standards |

Overview: Risk Consultant vs Audit Consultant

Risk consultants specialize in identifying, assessing, and mitigating potential threats to an organization's assets and operations, using frameworks like ISO 31000 to enhance risk management strategies. Audit consultants focus on evaluating financial records, internal controls, and compliance with regulations to ensure accuracy and transparency in reporting, leveraging standards such as GAAP and IFRS. Both roles require strong analytical skills, but risk consultants emphasize proactive risk prevention while audit consultants concentrate on retrospective validation and verification.

Key Responsibilities

Risk Consultants identify, assess, and mitigate potential threats to an organization's financial and operational stability by developing comprehensive risk management strategies. Audit Consultants focus on examining financial statements and internal controls to ensure compliance with regulatory standards and identify discrepancies or inefficiencies. Both roles require strong analytical skills but differ in their approach, with Risk Consultants proactively managing uncertainty and Audit Consultants providing assurance through detailed evaluation.

Required Skills and Competencies

Risk Consultants require strong analytical skills, proficiency in risk assessment methodologies, and expertise in regulatory compliance to identify and mitigate potential threats. Audit Consultants must possess detailed knowledge of accounting principles, exceptional attention to detail, and the ability to evaluate financial records and internal controls effectively. Both roles demand excellent communication skills and the capacity to interpret complex data to provide actionable insights for organizational improvement.

Educational Background and Certifications

Risk Consultants typically hold degrees in finance, economics, or risk management and often pursue certifications such as FRM (Financial Risk Manager) or CRM (Certified Risk Manager) to validate their expertise. Audit Consultants usually have accounting or finance degrees and achieve certifications like CPA (Certified Public Accountant) or CIA (Certified Internal Auditor) that emphasize compliance, controls, and financial reporting. Both roles require strong analytical skills, but their educational focus and certifications align distinctly with risk assessment versus audit and assurance services.

Typical Career Path

Risk Consultants typically begin their careers with a focus on identifying, assessing, and mitigating potential risks within organizations, often progressing to senior risk management or compliance roles. Audit Consultants usually start by evaluating financial statements, internal controls, and regulatory compliance, advancing toward senior audit management or advisory positions. Both paths demand strong analytical skills, with Risk Consultants leaning more towards risk assessment frameworks and Audit Consultants excelling in auditing standards and financial regulations.

Industry Sectors and Clients

Risk Consultants specialize in identifying, assessing, and mitigating risks across diverse industry sectors such as finance, healthcare, and manufacturing, tailoring their strategies to client-specific operational vulnerabilities. Audit Consultants focus on examining financial statements and internal controls within regulated industries like banking, insurance, and public companies to ensure compliance, accuracy, and transparency for stakeholders. Clients seeking Risk Consultants often prioritize proactive risk management and resilience, while those engaging Audit Consultants require thorough financial oversight and regulatory adherence.

Day-to-Day Activities

Risk Consultants primarily analyze and mitigate potential financial, operational, and compliance risks by conducting risk assessments, developing risk management strategies, and monitoring control frameworks. Audit Consultants focus on evaluating financial statements, ensuring regulatory compliance, and verifying the accuracy of accounting records through detailed internal and external audits. Both roles require collaboration with stakeholders to improve organizational governance, but Risk Consultants emphasize proactive risk identification while Audit Consultants specialize in retrospective examination and assurance.

Tools and Methodologies Used

Risk Consultants utilize advanced risk assessment software such as @Risk and Palisade's DecisionTools Suite to model uncertainties and quantify potential impacts. Audit Consultants rely heavily on data analytics platforms like ACL and IDEA for transactional testing and control evaluations, combined with standardized frameworks such as COSO and ISO 19011 for audit planning and execution. Both consultants integrate statistical analysis and ERP system audits but differentiate through their focus on risk quantification versus compliance verification methodologies.

Salary and Compensation Trends

Risk consultants typically command higher salaries than audit consultants due to the specialized expertise required in identifying and mitigating complex business risks. According to industry salary surveys, risk consultants earn an average annual compensation ranging from $85,000 to $130,000, while audit consultants' salaries generally range between $60,000 and $95,000. Compensation trends suggest that demand for risk management skills is driving salary growth, with bonuses and performance incentives more prevalent in risk consultancy roles compared to audit positions.

Future Career Prospects

Risk Consultants specialize in identifying and mitigating potential threats to business continuity, making their expertise increasingly valuable as companies prioritize cybersecurity and regulatory compliance. Audit Consultants focus on evaluating financial statements and internal controls, ensuring transparency and adherence to accounting standards, which remains essential for corporate governance. Both career paths offer robust growth opportunities, with demand for risk consultants rising sharply due to digital transformation and increasing global uncertainties.

Risk Consultant vs Audit Consultant Infographic

jobdiv.com

jobdiv.com