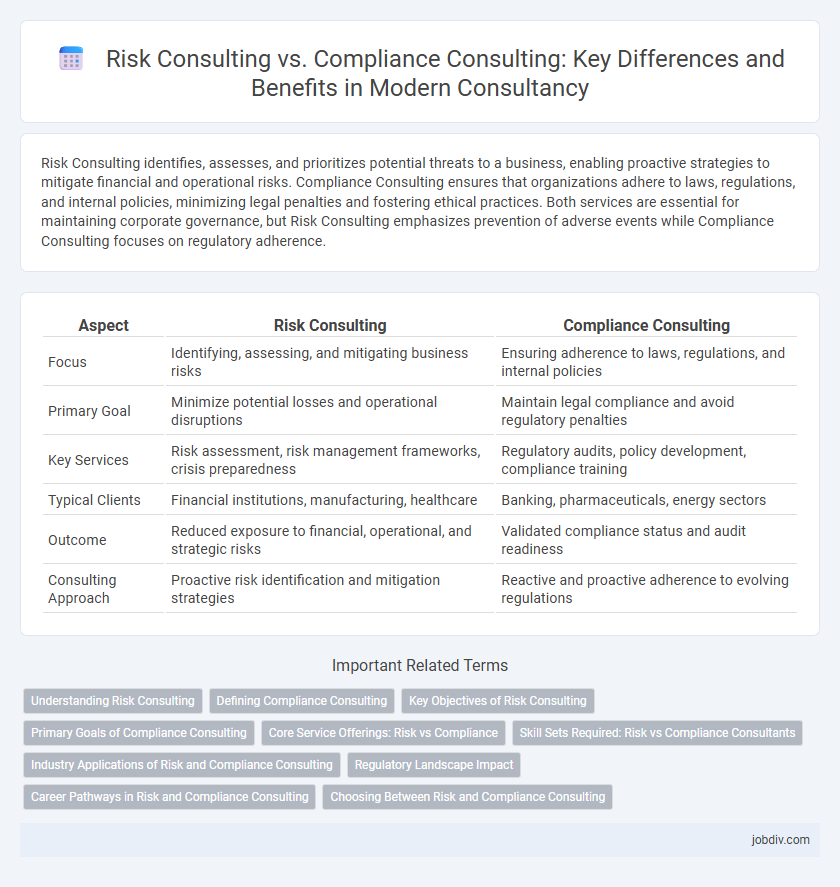

Risk Consulting identifies, assesses, and prioritizes potential threats to a business, enabling proactive strategies to mitigate financial and operational risks. Compliance Consulting ensures that organizations adhere to laws, regulations, and internal policies, minimizing legal penalties and fostering ethical practices. Both services are essential for maintaining corporate governance, but Risk Consulting emphasizes prevention of adverse events while Compliance Consulting focuses on regulatory adherence.

Table of Comparison

| Aspect | Risk Consulting | Compliance Consulting |

|---|---|---|

| Focus | Identifying, assessing, and mitigating business risks | Ensuring adherence to laws, regulations, and internal policies |

| Primary Goal | Minimize potential losses and operational disruptions | Maintain legal compliance and avoid regulatory penalties |

| Key Services | Risk assessment, risk management frameworks, crisis preparedness | Regulatory audits, policy development, compliance training |

| Typical Clients | Financial institutions, manufacturing, healthcare | Banking, pharmaceuticals, energy sectors |

| Outcome | Reduced exposure to financial, operational, and strategic risks | Validated compliance status and audit readiness |

| Consulting Approach | Proactive risk identification and mitigation strategies | Reactive and proactive adherence to evolving regulations |

Understanding Risk Consulting

Risk consulting involves identifying, assessing, and mitigating potential threats to an organization's assets, operations, and reputation by using advanced risk management frameworks and data analytics. It focuses on proactive strategies to minimize financial losses, cyber threats, regulatory penalties, and business disruptions. This approach helps businesses make informed decisions by quantifying risks, prioritizing based on impact and likelihood, and implementing tailored risk controls.

Defining Compliance Consulting

Compliance consulting involves guiding organizations to adhere strictly to regulatory requirements, industry standards, and internal policies, minimizing legal and financial risks. This includes conducting compliance audits, developing internal controls, and ensuring ongoing adherence to laws such as GDPR, HIPAA, or SOX. Expert compliance consultants help companies implement frameworks that foster ethical conduct and maintain operational integrity.

Key Objectives of Risk Consulting

Risk consulting primarily focuses on identifying, assessing, and mitigating potential threats that could impact an organization's financial health, operational efficiency, and reputation. It aims to implement dynamic risk management frameworks that enable proactive decision-making and resilience against uncertainties. Key objectives include minimizing exposure to risk, ensuring business continuity, and enhancing strategic planning through comprehensive risk analysis.

Primary Goals of Compliance Consulting

Compliance consulting primarily focuses on ensuring organizations adhere to regulatory requirements and industry standards to avoid legal penalties and reputational damage. It involves establishing robust policies, monitoring adherence, and designing training programs that embed a culture of compliance within the organization. The goal is to create a systematic framework that supports transparency, accountability, and sustainable business practices aligned with external legal obligations.

Core Service Offerings: Risk vs Compliance

Risk Consulting focuses on identifying, assessing, and mitigating potential threats that could impact business operations, including financial risks, operational risks, and strategic risks. Compliance Consulting ensures organizations adhere to regulatory requirements, industry standards, and internal policies to avoid legal penalties and reputational damage. Core service offerings in Risk Consulting include risk assessments, risk management frameworks, and crisis response planning, while Compliance Consulting specializes in regulatory audits, policy development, and compliance training programs.

Skill Sets Required: Risk vs Compliance Consultants

Risk consultants require strong analytical skills, expertise in risk assessment methodologies, and proficiency in data interpretation to identify potential threats and develop mitigation strategies. Compliance consultants need in-depth knowledge of regulatory frameworks, excellent attention to detail, and the ability to design and implement policies ensuring organizational adherence to laws and standards. Both roles demand effective communication skills, but risk consultants focus more on predictive analysis while compliance consultants specialize in regulatory compliance and audit processes.

Industry Applications of Risk and Compliance Consulting

Risk consulting primarily focuses on identifying, assessing, and mitigating operational, financial, and strategic risks across industries such as banking, healthcare, and manufacturing, enhancing organizational resilience. Compliance consulting ensures adherence to industry-specific regulations and standards like GDPR in technology, HIPAA in healthcare, and SOX in finance, reducing legal and regulatory penalties. Both consulting types play crucial roles in sectors like energy and retail, where dynamic regulatory environments and complex supply chains demand integrated risk and compliance strategies.

Regulatory Landscape Impact

Risk consulting focuses on identifying, assessing, and mitigating potential threats to an organization's assets and operations, emphasizing the dynamic regulatory landscape that shapes risk exposure. Compliance consulting centers on ensuring that business processes and policies adhere strictly to evolving laws, standards, and regulations to prevent legal penalties and reputational damage. Both disciplines require deep expertise in regulatory frameworks but differ in their approach: risk consulting proactively manages uncertainty, while compliance consulting enforces conformity within regulatory boundaries.

Career Pathways in Risk and Compliance Consulting

Career pathways in risk consulting emphasize developing expertise in risk assessment, mitigation strategies, and regulatory requirements across various industries, often leading to roles such as risk analyst, risk manager, or chief risk officer. Compliance consulting careers focus on ensuring organizations adhere to legal standards and internal policies, with progression typically moving through compliance analyst, compliance officer, and compliance director positions. Both fields demand strong analytical skills and industry-specific knowledge, offering opportunities for specialization in areas like cybersecurity risk, financial compliance, or environmental regulations.

Choosing Between Risk and Compliance Consulting

Choosing between risk consulting and compliance consulting depends on your organization's strategic priorities and regulatory environment. Risk consulting focuses on identifying, assessing, and mitigating potential threats to business objectives, enhancing resilience and decision-making through risk management frameworks. Compliance consulting ensures adherence to laws, regulations, and industry standards, minimizing legal penalties and fostering ethical corporate governance.

Risk Consulting vs Compliance Consulting Infographic

jobdiv.com

jobdiv.com