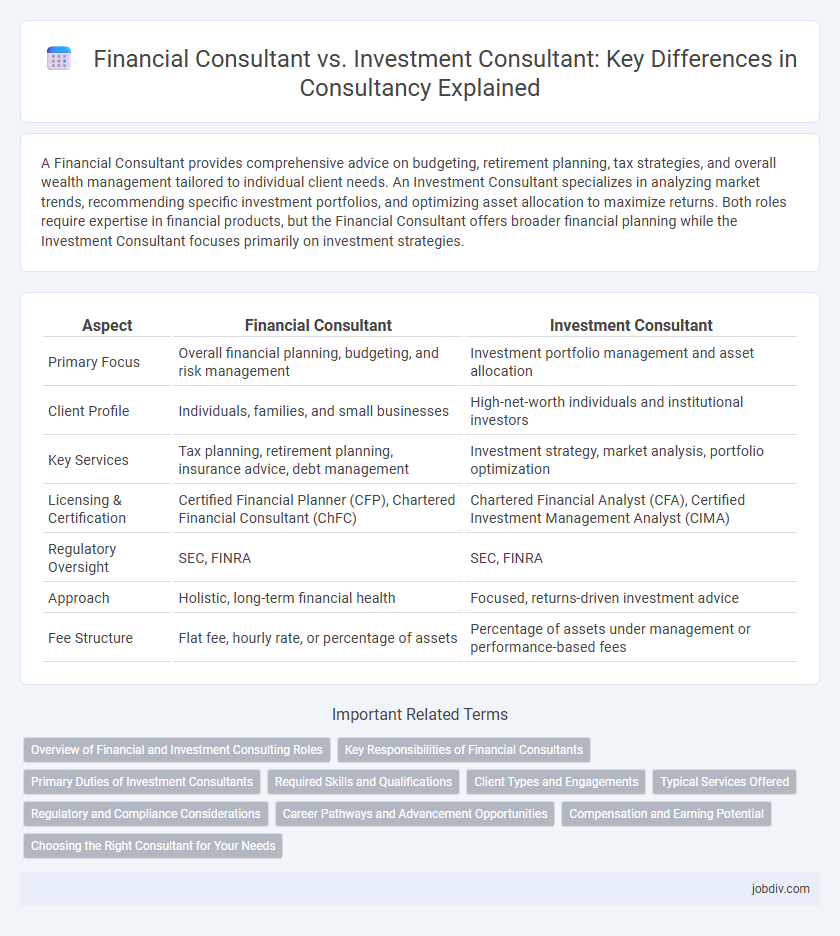

A Financial Consultant provides comprehensive advice on budgeting, retirement planning, tax strategies, and overall wealth management tailored to individual client needs. An Investment Consultant specializes in analyzing market trends, recommending specific investment portfolios, and optimizing asset allocation to maximize returns. Both roles require expertise in financial products, but the Financial Consultant offers broader financial planning while the Investment Consultant focuses primarily on investment strategies.

Table of Comparison

| Aspect | Financial Consultant | Investment Consultant |

|---|---|---|

| Primary Focus | Overall financial planning, budgeting, and risk management | Investment portfolio management and asset allocation |

| Client Profile | Individuals, families, and small businesses | High-net-worth individuals and institutional investors |

| Key Services | Tax planning, retirement planning, insurance advice, debt management | Investment strategy, market analysis, portfolio optimization |

| Licensing & Certification | Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC) | Chartered Financial Analyst (CFA), Certified Investment Management Analyst (CIMA) |

| Regulatory Oversight | SEC, FINRA | SEC, FINRA |

| Approach | Holistic, long-term financial health | Focused, returns-driven investment advice |

| Fee Structure | Flat fee, hourly rate, or percentage of assets | Percentage of assets under management or performance-based fees |

Overview of Financial and Investment Consulting Roles

Financial consultants provide comprehensive planning, including budgeting, retirement, tax strategies, and risk management, tailored to clients' overall financial health. Investment consultants specialize in advising on asset allocation, portfolio management, and market analysis to optimize investment performance and achieve specific financial goals. Both roles require expertise in financial markets, but financial consultants address broader financial planning needs while investment consultants focus primarily on investment decisions and strategies.

Key Responsibilities of Financial Consultants

Financial consultants primarily focus on comprehensive financial planning, including budgeting, retirement strategies, tax planning, and risk management to help clients achieve long-term financial stability. They assess clients' overall financial health and recommend tailored solutions for debt management, insurance needs, and savings goals. Investment consultants, by contrast, specialize in advising clients on portfolio construction, asset allocation, and market trends to optimize investment returns and manage market risks.

Primary Duties of Investment Consultants

Investment consultants primarily analyze market trends, evaluate investment opportunities, and develop tailored portfolio strategies to optimize client returns. They provide expert advice on asset allocation, risk management, and fund selection to align investments with clients' financial goals. Their role involves continuous monitoring of investment performance and adjusting recommendations based on changing market conditions and client needs.

Required Skills and Qualifications

Financial consultants require strong analytical skills, knowledge of financial planning, risk management, and regulatory compliance certifications such as CFP or CPA. Investment consultants need expertise in portfolio management, securities analysis, and understanding of market trends, often holding designations like CFA. Both roles demand excellent communication and client relationship skills, but their qualifications differ based on the focus of financial strategy versus investment advice.

Client Types and Engagements

Financial consultants primarily engage with individual clients seeking comprehensive financial planning, retirement strategies, and risk management solutions, tailoring their services to personal financial goals. Investment consultants typically serve institutional clients such as pension funds, endowments, and corporations, focusing on portfolio management, asset allocation, and investment policy development. The distinction in client types directly influences the depth and scope of engagements, with financial consultants offering broad, personalized advice and investment consultants delivering specialized, portfolio-centric recommendations.

Typical Services Offered

Financial consultants provide comprehensive services including budgeting, tax planning, retirement strategy, and debt management to optimize overall financial health. Investment consultants specialize in portfolio analysis, asset allocation, risk assessment, and investment strategy development tailored to client goals. Both roles offer personalized advice but differ primarily in the scope of financial planning versus investment-specific guidance.

Regulatory and Compliance Considerations

Financial consultants advise clients on comprehensive financial planning while adhering to broad regulatory frameworks such as the SEC and FINRA guidelines. Investment consultants specialize in portfolio management and must comply with specific regulations including the Investment Advisers Act of 1940, ensuring fiduciary responsibility and transparency in investment strategies. Both roles require ongoing compliance with anti-money laundering (AML) laws and know-your-customer (KYC) regulations to mitigate legal risks.

Career Pathways and Advancement Opportunities

Financial consultants specialize in creating comprehensive financial plans, including budgeting, tax optimization, and retirement strategies, while investment consultants focus on managing and advising on asset portfolios and market investments. Career pathways for financial consultants often lead to roles such as financial planning manager or chief financial officer, whereas investment consultants may advance to portfolio manager or chief investment officer positions. Both careers offer opportunities for certification, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), which significantly enhance advancement prospects and client trust.

Compensation and Earning Potential

Financial consultants typically earn a base salary ranging from $60,000 to $120,000 annually, with bonuses tied to client acquisition and portfolio performance, while investment consultants often receive higher compensation due to managing larger assets, with average salaries between $80,000 and $150,000 plus performance-based incentives. Compensation structures for investment consultants frequently include commissions and profit-sharing, significantly boosting earning potential in bullish markets. Both roles benefit from experience and credentials like CFA or CFP, which can exponentially increase income through higher fees and premium client engagements.

Choosing the Right Consultant for Your Needs

Financial consultants provide comprehensive planning and advice on budgeting, tax strategies, retirement plans, and risk management, tailoring solutions to overall financial health. Investment consultants specialize in portfolio management, asset allocation, and investment strategies aimed at maximizing returns based on market analysis and risk tolerance. Selecting the right consultant depends on whether your primary goal is holistic financial management or focused investment guidance, ensuring alignment with your specific financial objectives.

Financial Consultant vs Investment Consultant Infographic

jobdiv.com

jobdiv.com