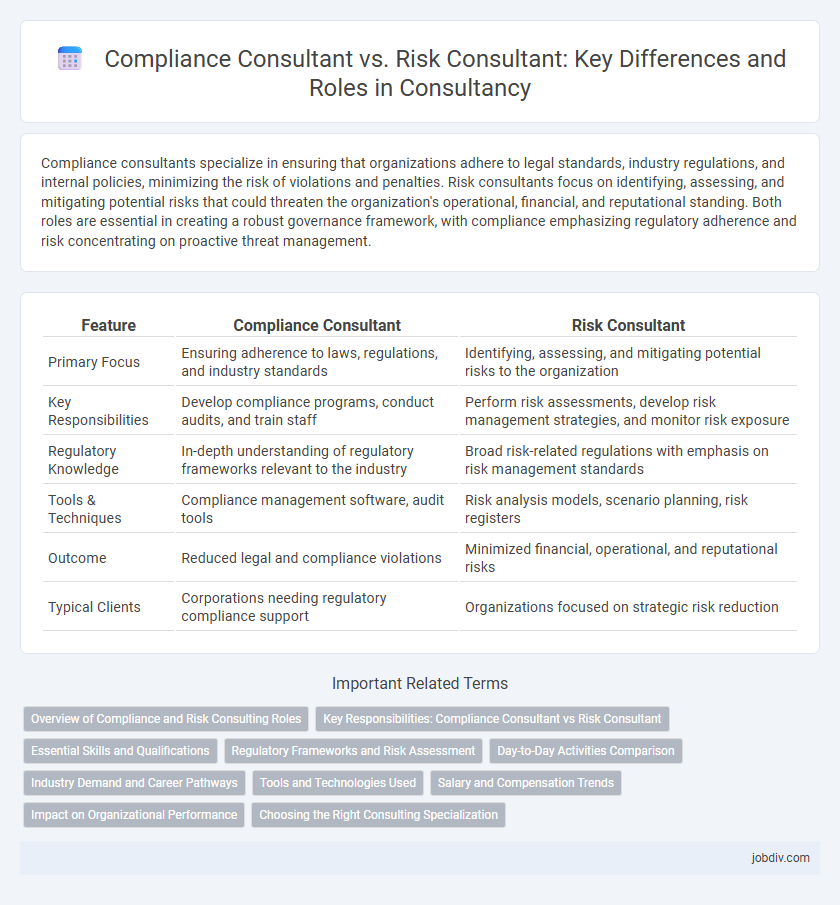

Compliance consultants specialize in ensuring that organizations adhere to legal standards, industry regulations, and internal policies, minimizing the risk of violations and penalties. Risk consultants focus on identifying, assessing, and mitigating potential risks that could threaten the organization's operational, financial, and reputational standing. Both roles are essential in creating a robust governance framework, with compliance emphasizing regulatory adherence and risk concentrating on proactive threat management.

Table of Comparison

| Feature | Compliance Consultant | Risk Consultant |

|---|---|---|

| Primary Focus | Ensuring adherence to laws, regulations, and industry standards | Identifying, assessing, and mitigating potential risks to the organization |

| Key Responsibilities | Develop compliance programs, conduct audits, and train staff | Perform risk assessments, develop risk management strategies, and monitor risk exposure |

| Regulatory Knowledge | In-depth understanding of regulatory frameworks relevant to the industry | Broad risk-related regulations with emphasis on risk management standards |

| Tools & Techniques | Compliance management software, audit tools | Risk analysis models, scenario planning, risk registers |

| Outcome | Reduced legal and compliance violations | Minimized financial, operational, and reputational risks |

| Typical Clients | Corporations needing regulatory compliance support | Organizations focused on strategic risk reduction |

Overview of Compliance and Risk Consulting Roles

Compliance consultants specialize in ensuring organizations adhere to laws, regulations, and internal policies to mitigate legal and regulatory risks. Risk consultants focus on identifying, assessing, and managing potential threats to business objectives, including financial, operational, and strategic risks. Both roles require expertise in risk assessment frameworks and regulatory environments but differ in scope, with compliance emphasizing regulatory adherence and risk consulting addressing broader organizational vulnerabilities.

Key Responsibilities: Compliance Consultant vs Risk Consultant

Compliance consultants ensure organizations adhere to regulatory requirements by developing policies, conducting audits, and providing training on legal standards such as GDPR and HIPAA. Risk consultants focus on identifying, assessing, and mitigating financial, operational, and strategic risks through risk assessments, scenario analysis, and crisis management plans. Both roles collaborate to strengthen governance frameworks but prioritize compliance adherence versus proactive risk management strategies.

Essential Skills and Qualifications

Compliance consultants require expertise in regulatory frameworks, thorough knowledge of industry-specific laws, and strong analytical skills to ensure organizational adherence to legal standards. Risk consultants must excel in risk assessment methodologies, data analysis, and strategic planning to identify, evaluate, and mitigate potential business threats. Both roles benefit from effective communication skills, attention to detail, and proficiency with compliance software and risk management tools.

Regulatory Frameworks and Risk Assessment

Compliance consultants specialize in navigating regulatory frameworks to ensure organizations meet legal and industry standards, minimizing the risk of penalties and reputational damage. Risk consultants focus on identifying, analyzing, and mitigating potential threats through comprehensive risk assessments and management strategies tailored to the specific operational environment. Both roles are essential in creating robust governance structures that align compliance mandates with proactive risk mitigation.

Day-to-Day Activities Comparison

Compliance consultants ensure organizations adhere to legal regulations by conducting audits, developing policies, and training staff on compliance standards. Risk consultants analyze potential threats by identifying vulnerabilities, assessing risk exposure, and recommending mitigation strategies. While compliance consultants focus on regulatory adherence, risk consultants prioritize risk identification and management to safeguard business continuity.

Industry Demand and Career Pathways

Compliance consultants are increasingly sought in heavily regulated industries such as finance, healthcare, and manufacturing due to rising legal and regulatory standards globally. Risk consultants find strong demand in sectors like insurance, banking, and energy, where identifying and mitigating operational and strategic risks is critical. Career pathways for compliance consultants often lead to chief compliance officer roles, while risk consultants typically advance toward risk management director or chief risk officer positions.

Tools and Technologies Used

Compliance consultants utilize regulatory tracking software, policy management systems, and audit tools to ensure organizations adhere to legal standards and industry regulations. Risk consultants rely on advanced risk assessment platforms, predictive analytics, and scenario simulation technologies to identify, evaluate, and mitigate potential threats. Both roles integrate data visualization tools and compliance management systems to enhance decision-making and reporting accuracy.

Salary and Compensation Trends

Compliance consultants typically earn between $70,000 and $120,000 annually, with compensation influenced by industry expertise and regulatory knowledge. Risk consultants command salaries ranging from $80,000 to $130,000, often bolstered by bonuses tied to mitigating financial and operational risks. Both roles see increasing demand, driving competitive compensation packages particularly in finance, healthcare, and technology sectors.

Impact on Organizational Performance

Compliance consultants ensure organizations adhere to legal and regulatory requirements, minimizing penalties and reputational damage. Risk consultants identify, assess, and mitigate potential threats that could disrupt operational efficiency and financial stability. Both roles enhance organizational performance by fostering a proactive culture of accountability and resilience against compliance breaches and risk exposures.

Choosing the Right Consulting Specialization

Selecting between a Compliance Consultant and a Risk Consultant depends on an organization's primary needs: Compliance Consultants specialize in ensuring adherence to regulatory requirements and industry standards, minimizing legal penalties and enhancing corporate governance. Risk Consultants focus on identifying, assessing, and mitigating potential threats that could impact business operations, including financial, strategic, and operational risks. Evaluating specific business challenges and regulatory environments helps in choosing the right consulting specialization that aligns with organizational goals and risk management strategies.

Compliance Consultant vs Risk Consultant Infographic

jobdiv.com

jobdiv.com