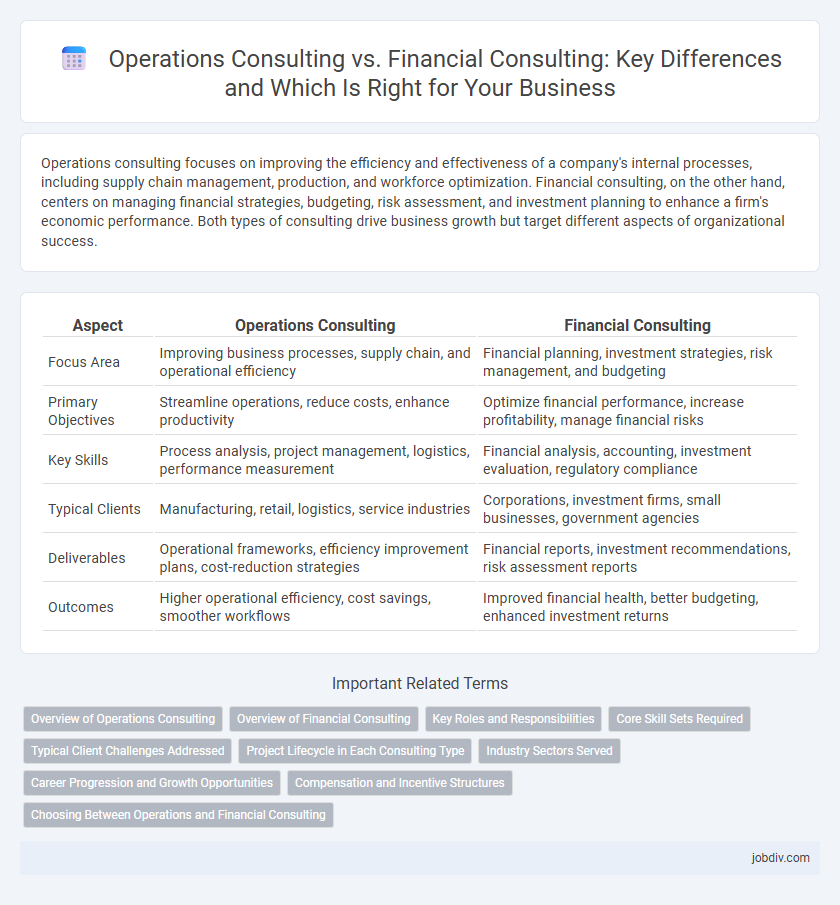

Operations consulting focuses on improving the efficiency and effectiveness of a company's internal processes, including supply chain management, production, and workforce optimization. Financial consulting, on the other hand, centers on managing financial strategies, budgeting, risk assessment, and investment planning to enhance a firm's economic performance. Both types of consulting drive business growth but target different aspects of organizational success.

Table of Comparison

| Aspect | Operations Consulting | Financial Consulting |

|---|---|---|

| Focus Area | Improving business processes, supply chain, and operational efficiency | Financial planning, investment strategies, risk management, and budgeting |

| Primary Objectives | Streamline operations, reduce costs, enhance productivity | Optimize financial performance, increase profitability, manage financial risks |

| Key Skills | Process analysis, project management, logistics, performance measurement | Financial analysis, accounting, investment evaluation, regulatory compliance |

| Typical Clients | Manufacturing, retail, logistics, service industries | Corporations, investment firms, small businesses, government agencies |

| Deliverables | Operational frameworks, efficiency improvement plans, cost-reduction strategies | Financial reports, investment recommendations, risk assessment reports |

| Outcomes | Higher operational efficiency, cost savings, smoother workflows | Improved financial health, better budgeting, enhanced investment returns |

Overview of Operations Consulting

Operations consulting specializes in improving a company's internal processes, supply chain efficiency, and production management to enhance overall performance and cost-effectiveness. It involves analyzing workflow, optimizing resource allocation, and implementing technology solutions tailored to operational challenges across manufacturing, logistics, and service industries. Firms leveraging operations consulting often achieve significant gains in productivity, quality control, and customer satisfaction through data-driven methodologies and process reengineering.

Overview of Financial Consulting

Financial consulting centers on advising businesses regarding investment strategies, risk management, and capital allocation to enhance financial performance and ensure regulatory compliance. Specialists analyze financial statements, develop forecasting models, and optimize budgeting processes to drive sustainable growth and improve profitability. This consulting branch often works closely with CFOs and finance departments to implement effective financial controls and strategic planning.

Key Roles and Responsibilities

Operations consulting centers on enhancing business processes, supply chain management, and organizational efficiency to drive operational excellence. Financial consulting emphasizes budgeting, financial planning, risk management, and investment strategies to improve fiscal performance and compliance. Both roles require data analysis, strategic advisory, and stakeholder collaboration to deliver tailored solutions for sustainable growth.

Core Skill Sets Required

Operations consulting requires expertise in process optimization, supply chain management, and performance improvement methodologies such as Lean and Six Sigma. Financial consulting demands strong analytical abilities, proficiency in financial modeling, budgeting, forecasting, and knowledge of regulatory compliance and risk management. Both fields benefit from problem-solving skills and data-driven decision-making but focus on distinct technical competencies aligned with operational efficiency or financial strategy.

Typical Client Challenges Addressed

Operations consulting primarily addresses challenges such as inefficient processes, supply chain disruptions, and cost reduction strategies, helping clients optimize workflow and enhance productivity. Financial consulting focuses on issues including budgeting accuracy, risk management, and regulatory compliance, enabling organizations to improve financial planning and ensure fiscal stability. Both consulting types tailor solutions to client-specific needs, driving improved performance and sustainable growth.

Project Lifecycle in Each Consulting Type

Operations consulting emphasizes optimizing the project lifecycle through process analysis, workflow redesign, and continuous improvement initiatives aimed at enhancing efficiency and operational performance. Financial consulting focuses on project lifecycle stages that include financial planning, risk assessment, budgeting, and compliance to ensure projects align with fiscal goals and regulatory requirements. Both consulting types use tailored methodologies, but operations consulting prioritizes process execution while financial consulting centers on financial control and strategic investment decisions.

Industry Sectors Served

Operations consulting primarily serves manufacturing, logistics, and retail industries by enhancing supply chain efficiency, production processes, and operational workflows. Financial consulting targets banking, investment, and insurance sectors, delivering expertise in risk management, regulatory compliance, and financial strategy optimization. Both sectors benefit from tailored approaches that align consulting services with industry-specific challenges and opportunities.

Career Progression and Growth Opportunities

Operations consulting offers professionals the chance to develop expertise in process improvement, supply chain management, and organizational efficiency, often leading to leadership roles in project management or corporate strategy. Financial consulting focuses on skills like financial analysis, risk management, and regulatory compliance, paving the way for careers in investment banking, financial planning, or CFO positions. Both paths provide robust career progression, yet operations consulting tends to emphasize cross-functional growth while financial consulting centers on specialized financial expertise and industry influence.

Compensation and Incentive Structures

Operations consulting focuses on optimizing compensation and incentive structures to enhance workforce productivity and align employee performance with organizational goals through performance-based pay and bonus schemes. Financial consulting emphasizes designing incentive structures that promote fiscal responsibility, risk management, and profitability, often integrating stock options, profit-sharing plans, and long-term financial rewards. Both consulting types tailor compensation frameworks to drive desired behaviors and improve overall business outcomes.

Choosing Between Operations and Financial Consulting

Choosing between operations and financial consulting depends on a company's primary challenges and strategic goals. Operations consulting focuses on optimizing internal processes, supply chain management, and productivity enhancements, making it ideal for businesses seeking efficiency improvements. Financial consulting emphasizes cash flow management, investment analysis, and risk mitigation, suited for organizations aiming to strengthen financial performance and capital structure.

Operations Consulting vs Financial Consulting Infographic

jobdiv.com

jobdiv.com