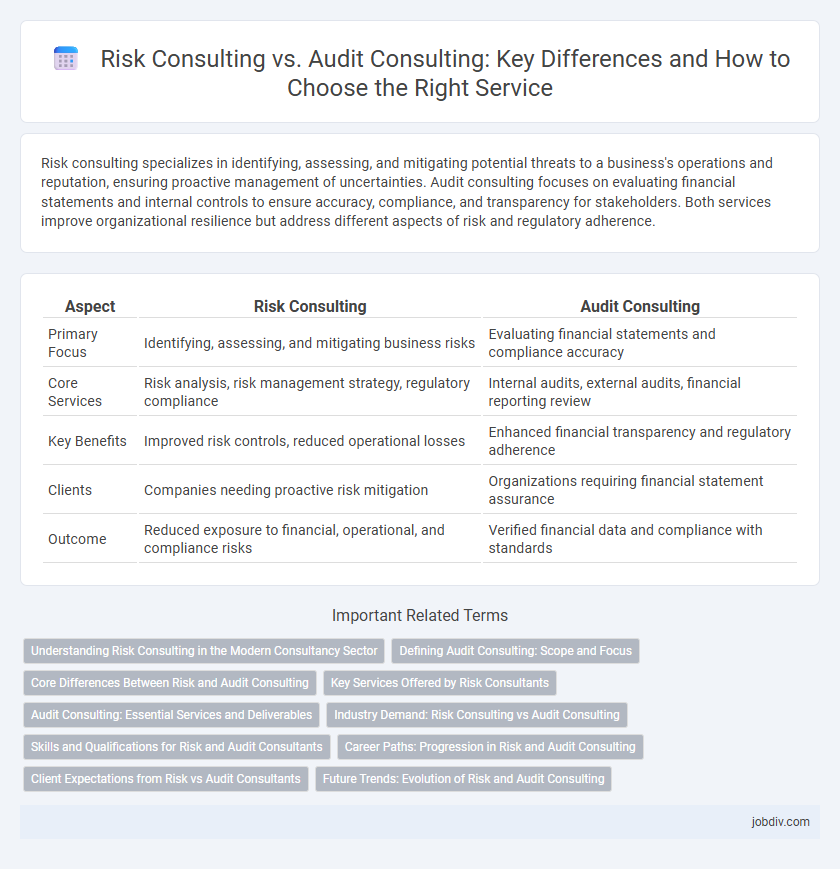

Risk consulting specializes in identifying, assessing, and mitigating potential threats to a business's operations and reputation, ensuring proactive management of uncertainties. Audit consulting focuses on evaluating financial statements and internal controls to ensure accuracy, compliance, and transparency for stakeholders. Both services improve organizational resilience but address different aspects of risk and regulatory adherence.

Table of Comparison

| Aspect | Risk Consulting | Audit Consulting |

|---|---|---|

| Primary Focus | Identifying, assessing, and mitigating business risks | Evaluating financial statements and compliance accuracy |

| Core Services | Risk analysis, risk management strategy, regulatory compliance | Internal audits, external audits, financial reporting review |

| Key Benefits | Improved risk controls, reduced operational losses | Enhanced financial transparency and regulatory adherence |

| Clients | Companies needing proactive risk mitigation | Organizations requiring financial statement assurance |

| Outcome | Reduced exposure to financial, operational, and compliance risks | Verified financial data and compliance with standards |

Understanding Risk Consulting in the Modern Consultancy Sector

Risk consulting in the modern consultancy sector involves identifying, assessing, and mitigating potential threats that could impact an organization's operations, reputation, or financial standing. It emphasizes proactive strategies such as enterprise risk management, regulatory compliance, and cybersecurity risk assessment to help businesses navigate complex uncertainties. Unlike audit consulting, which primarily focuses on verifying financial accuracy and regulatory adherence, risk consulting provides a forward-looking, strategic approach essential for sustainable business resilience.

Defining Audit Consulting: Scope and Focus

Audit consulting primarily concentrates on evaluating financial statements, ensuring compliance with regulatory standards, and enhancing internal controls to provide stakeholders with accurate and reliable financial information. This service encompasses statutory audits, internal audits, and operational audits to identify discrepancies, assess risk exposure, and recommend improvements. The scope of audit consulting aims to safeguard organizational assets while promoting transparency and accountability in financial reporting processes.

Core Differences Between Risk and Audit Consulting

Risk consulting primarily focuses on identifying, assessing, and mitigating potential threats that could impact an organization's objectives, emphasizing proactive risk management strategies. Audit consulting centers on evaluating the accuracy and compliance of financial and operational processes to ensure transparency and adherence to regulatory standards. While risk consultants help prevent issues before they occur, audit consultants verify the integrity of existing controls and processes through systematic examinations.

Key Services Offered by Risk Consultants

Risk consultants specialize in identifying, assessing, and mitigating operational, financial, and compliance risks to safeguard organizational assets and ensure regulatory adherence. Their key services include risk assessments, internal control evaluations, fraud risk management, business continuity planning, and cybersecurity risk analysis. These targeted solutions help organizations proactively manage uncertainty and enhance overall governance frameworks.

Audit Consulting: Essential Services and Deliverables

Audit Consulting delivers critical services including financial statement audits, compliance reviews, and internal control assessments, ensuring organizations meet regulatory requirements and improve transparency. Key deliverables comprise detailed audit reports, risk assessments, and recommendations for enhancing governance and financial processes. These services support informed decision-making and foster stakeholder confidence through accurate and reliable financial information.

Industry Demand: Risk Consulting vs Audit Consulting

Risk consulting experiences rising industry demand driven by increasing regulatory complexity and heightened focus on operational resilience, especially in sectors like finance, healthcare, and technology. Audit consulting maintains steady demand due to mandatory compliance requirements and financial reporting standards critical for public companies and regulated entities. Organizations prioritize risk consulting for proactive identification and mitigation of threats, while audit consulting remains essential for ensuring accuracy and transparency in financial statements.

Skills and Qualifications for Risk and Audit Consultants

Risk consultants require expertise in risk assessment methodologies, regulatory compliance, and strong analytical skills to identify and mitigate potential threats to business operations. Audit consultants must possess in-depth knowledge of accounting principles, auditing standards, and financial reporting, combined with attention to detail and proficiency in data analysis tools. Both roles benefit from certifications such as Certified Risk Manager (CRM) for risk consultants and Certified Public Accountant (CPA) or Certified Internal Auditor (CIA) for audit consultants.

Career Paths: Progression in Risk and Audit Consulting

Career paths in risk consulting typically involve advancing from risk analyst roles to senior risk consultant and ultimately risk management leadership, focusing on identifying and mitigating organizational risks. Audit consulting career progression often starts with junior auditor positions, moving up to audit manager and partner roles, emphasizing regulatory compliance and financial accuracy. Both paths require continuous professional development and certifications such as CRISC for risk consultants and CPA or CIA for audit consultants to enhance career growth.

Client Expectations from Risk vs Audit Consultants

Clients expect Risk Consulting to provide proactive identification and mitigation of potential threats to business continuity, emphasizing strategic risk management and compliance frameworks. In contrast, Audit Consulting clients prioritize objective evaluation of financial statements, internal controls, and regulatory adherence to ensure accuracy and transparency. Both services require deep industry knowledge, but Risk Consultants are sought for forward-looking insights, while Audit Consultants focus on verification and assurance.

Future Trends: Evolution of Risk and Audit Consulting

Risk consulting is rapidly incorporating advanced predictive analytics and AI-driven tools to anticipate emerging threats, while audit consulting is evolving through automation and blockchain technology to enhance transparency and accuracy. Both fields are increasingly emphasizing cybersecurity resilience due to rising digital vulnerabilities. The convergence of risk and audit consulting functions is fostering integrated frameworks for real-time compliance and proactive risk management across industries.

Risk Consulting vs Audit Consulting Infographic

jobdiv.com

jobdiv.com