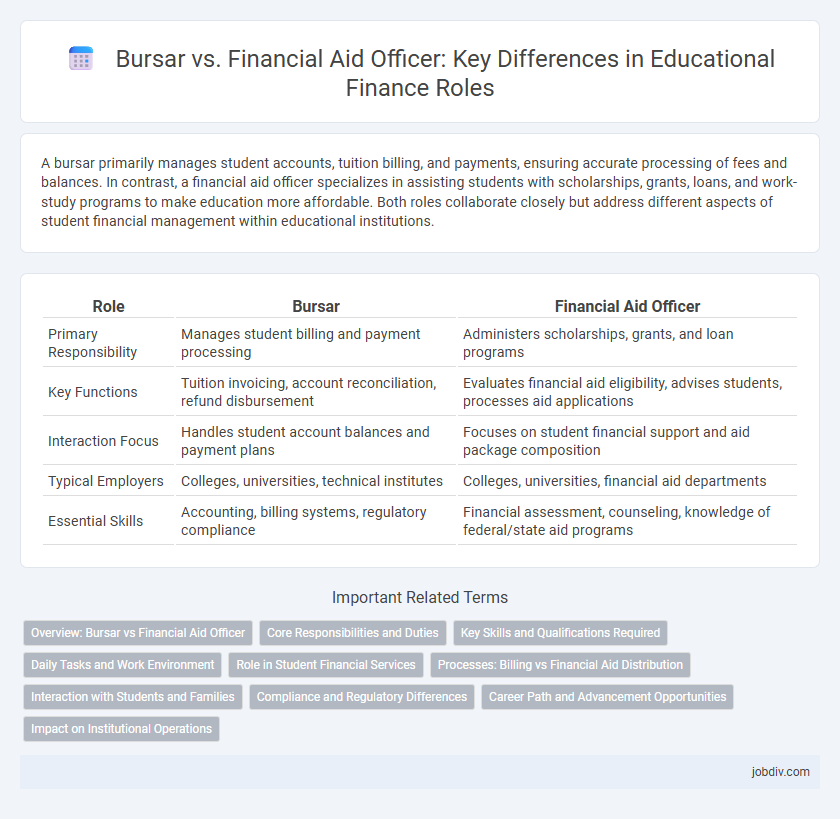

A bursar primarily manages student accounts, tuition billing, and payments, ensuring accurate processing of fees and balances. In contrast, a financial aid officer specializes in assisting students with scholarships, grants, loans, and work-study programs to make education more affordable. Both roles collaborate closely but address different aspects of student financial management within educational institutions.

Table of Comparison

| Role | Bursar | Financial Aid Officer |

|---|---|---|

| Primary Responsibility | Manages student billing and payment processing | Administers scholarships, grants, and loan programs |

| Key Functions | Tuition invoicing, account reconciliation, refund disbursement | Evaluates financial aid eligibility, advises students, processes aid applications |

| Interaction Focus | Handles student account balances and payment plans | Focuses on student financial support and aid package composition |

| Typical Employers | Colleges, universities, technical institutes | Colleges, universities, financial aid departments |

| Essential Skills | Accounting, billing systems, regulatory compliance | Financial assessment, counseling, knowledge of federal/state aid programs |

Overview: Bursar vs Financial Aid Officer

Bursars manage student billing, tuition payments, and account balances, ensuring accurate financial records and timely fee collection at educational institutions. Financial Aid Officers assess student eligibility for scholarships, grants, and loans, guiding applicants through the financial aid process to maximize funding opportunities. Both roles are essential for maintaining the financial stability of students and institutions, with bursars focusing on account management and financial aid officers specializing in funding acquisition.

Core Responsibilities and Duties

A Bursar manages student accounts, oversees tuition billing, processes payments, and handles financial records to ensure accurate account reconciliations. Financial Aid Officers evaluate students' financial need, administer scholarships, grants, and loan programs, and guide applicants through the financial aid process. Both roles are essential in managing educational finances but focus on distinct areas: the Bursar on payment administration and the Financial Aid Officer on funding allocation.

Key Skills and Qualifications Required

Bursars require strong financial management skills, attention to detail, and proficiency in accounting software to manage tuition payments, billing, and budgeting effectively. Financial Aid Officers must possess expertise in federal and state financial aid regulations, counseling abilities to guide students through funding options, and strong communication skills for liaising between students and financial institutions. Both roles demand a solid understanding of educational finance, confidentiality, and organizational skills to support student financial needs efficiently.

Daily Tasks and Work Environment

Bursars manage student tuition payments, maintain financial records, and coordinate billing processes within a university's finance office, typically working in structured office environments with frequent interactions with students and other departments. Financial Aid Officers assess and process student financial aid applications, counsel students on funding options, and ensure compliance with federal and institutional regulations, often collaborating with academic advisors and attending outreach events. Both roles require strong attention to detail and knowledge of educational finance but differ in their primary focus on payment collection versus aid distribution.

Role in Student Financial Services

The bursar manages student accounts, including tuition billing, payment processing, and maintaining accurate financial records. Financial aid officers evaluate and administer scholarships, grants, loans, and work-study programs, ensuring students receive optimal funding based on eligibility. Both roles collaborate to streamline student financial services, balancing account management with financial aid distribution.

Processes: Billing vs Financial Aid Distribution

A Bursar primarily manages billing processes, including tuition invoicing, payment collection, and account reconciliation for students. A Financial Aid Officer focuses on distributing financial aid funds, processing scholarships, grants, and loan disbursements to support students' educational expenses. Both roles ensure accurate financial transactions but differ in handling institutional income versus student financial assistance.

Interaction with Students and Families

Bursars primarily manage student tuition payments, billing, and account balances, ensuring clear communication about financial deadlines and payment options. Financial Aid Officers focus on guiding students and families through scholarship, grant, and loan applications, offering personalized support to optimize financial aid packages. Both roles collaborate to provide comprehensive financial information, but their interactions differ in scope and purpose, with bursars addressing transactional concerns and financial aid officers handling eligibility and funding opportunities.

Compliance and Regulatory Differences

Bursars primarily ensure compliance with institutional billing policies and federal regulations related to tuition collection and refund processes, managing student account accuracy and reporting requirements. Financial Aid Officers focus on adherence to federal and state financial aid regulations, including the verification of eligibility, disbursement rules, and audit standards set by the Department of Education. Both roles require detailed knowledge of Title IV compliance but apply distinct regulatory frameworks pertinent to either funds management or aid administration.

Career Path and Advancement Opportunities

Bursars typically manage student accounts, billing, and payments, often progressing to roles like Director of Student Financial Services with experience in finance and administration. Financial Aid Officers specialize in assessing and distributing scholarships, grants, and loans, advancing to positions such as Financial Aid Director or Compliance Manager by developing expertise in federal aid regulations and counseling. Both career paths offer opportunities in higher education finance, with advancement dependent on proficiency in financial management, regulatory knowledge, and institutional leadership.

Impact on Institutional Operations

Bursars manage student accounts and billing processes, ensuring accurate tuition collection and financial record maintenance, which directly impacts the institution's cash flow and budget planning. Financial Aid Officers administer scholarships, grants, and loan programs, influencing student enrollment and retention by making education more accessible and affordable. Collaboration between bursars and financial aid officers is essential for seamless coordination of payments and aid disbursements, optimizing financial operations within educational institutions.

Bursar vs Financial Aid Officer Infographic

jobdiv.com

jobdiv.com