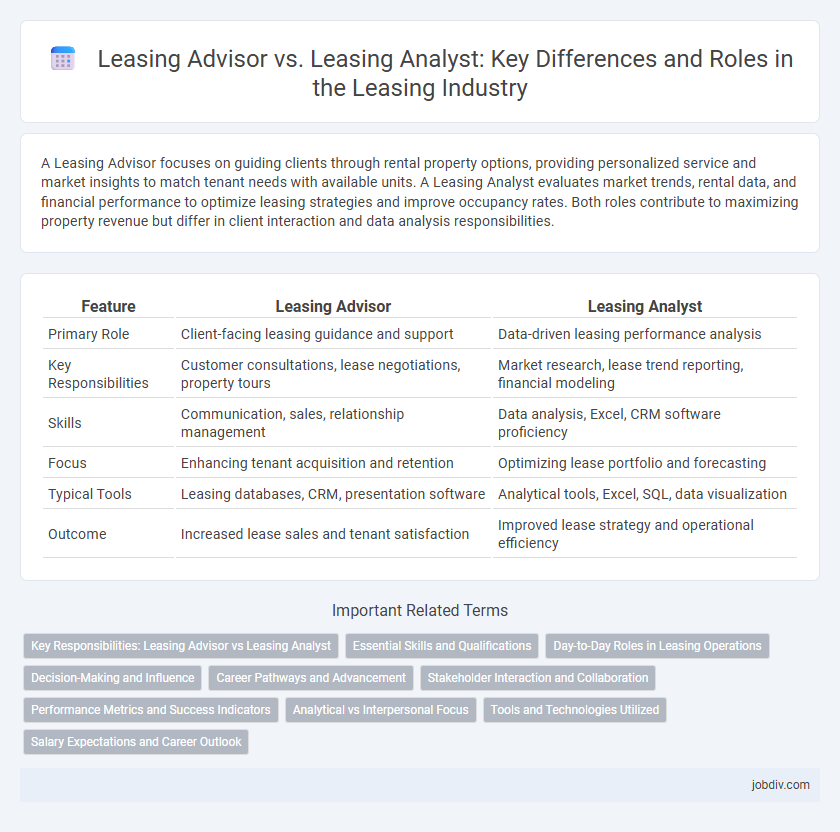

A Leasing Advisor focuses on guiding clients through rental property options, providing personalized service and market insights to match tenant needs with available units. A Leasing Analyst evaluates market trends, rental data, and financial performance to optimize leasing strategies and improve occupancy rates. Both roles contribute to maximizing property revenue but differ in client interaction and data analysis responsibilities.

Table of Comparison

| Feature | Leasing Advisor | Leasing Analyst |

|---|---|---|

| Primary Role | Client-facing leasing guidance and support | Data-driven leasing performance analysis |

| Key Responsibilities | Customer consultations, lease negotiations, property tours | Market research, lease trend reporting, financial modeling |

| Skills | Communication, sales, relationship management | Data analysis, Excel, CRM software proficiency |

| Focus | Enhancing tenant acquisition and retention | Optimizing lease portfolio and forecasting |

| Typical Tools | Leasing databases, CRM, presentation software | Analytical tools, Excel, SQL, data visualization |

| Outcome | Increased lease sales and tenant satisfaction | Improved lease strategy and operational efficiency |

Key Responsibilities: Leasing Advisor vs Leasing Analyst

Leasing Advisors primarily engage with prospective tenants by conducting property tours, explaining lease terms, and negotiating rental agreements to maximize occupancy rates. Leasing Analysts focus on evaluating leasing data, analyzing market trends, and preparing financial reports to support strategic leasing decisions. The Advisor's role centers on client interaction and sales, while the Analyst emphasizes data-driven insights and portfolio performance optimization.

Essential Skills and Qualifications

Leasing Advisors excel in customer service, communication, and negotiation skills essential for guiding prospective tenants and closing leases efficiently. Leasing Analysts require strong analytical abilities, proficiency in data interpretation, and familiarity with real estate market trends to evaluate leasing performance and optimize portfolio management. Both roles demand knowledge of leasing regulations, attention to detail, and proficiency in leasing software and CRM systems.

Day-to-Day Roles in Leasing Operations

Leasing Advisors primarily engage with prospective tenants by showcasing properties, answering inquiries, and facilitating lease agreements, ensuring high occupancy rates through effective customer service. Leasing Analysts focus on data-driven tasks such as analyzing market trends, preparing lease abstracts, and monitoring lease compliance to optimize portfolio performance. Together, they streamline leasing operations by combining client interaction with detailed financial and operational analysis.

Decision-Making and Influence

Leasing Advisors play a crucial role in decision-making by directly influencing tenant acquisition and lease negotiations, leveraging market insights to secure advantageous terms. Leasing Analysts focus on analyzing lease data, financial metrics, and market trends to support strategic decisions without direct negotiation involvement. Advisors drive on-the-ground lease outcomes, while analysts provide the critical data-driven input shaping those decisions.

Career Pathways and Advancement

Leasing Advisors primarily focus on client interaction, property tours, and securing lease agreements, making them ideal for those seeking strong interpersonal and sales skills within real estate. Leasing Analysts concentrate on market research, lease data analysis, and financial reporting, positioning themselves for advanced roles in real estate finance and asset management. Career pathways for Leasing Advisors typically lead toward property management or leasing management, while Leasing Analysts often advance into roles like portfolio management or strategic real estate consulting.

Stakeholder Interaction and Collaboration

Leasing Advisors primarily engage with clients, property owners, and potential tenants to facilitate lease agreements and ensure client satisfaction, emphasizing relationship management and negotiation skills. Leasing Analysts focus on internal collaboration with finance, legal, and operations teams to analyze lease data, assess risks, and support strategic decision-making. Effective stakeholder interaction for Leasing Advisors centers on external negotiation and communication, whereas Leasing Analysts prioritize cross-departmental data sharing and analytical support.

Performance Metrics and Success Indicators

Leasing Advisors excel in client engagement and lease negotiation metrics, often measured by lease conversion rates and tenant satisfaction scores, reflecting their success in securing tenants and maintaining relationships. Leasing Analysts focus on data-driven performance indicators such as lease portfolio profitability, occupancy rates, and market trend analysis to optimize leasing strategies and financial outcomes. Both roles contribute to overall leasing success with Advisors driving front-line leasing activity and Analysts providing actionable insights for strategic decision-making.

Analytical vs Interpersonal Focus

A Leasing Advisor primarily emphasizes interpersonal skills, engaging directly with clients to understand their leasing needs and build strong relationships. In contrast, a Leasing Analyst concentrates on analytical tasks, evaluating market trends, lease agreements, and financial data to inform strategic decisions. The Advisor's role centers on communication and negotiation, while the Analyst focuses on data interpretation and forecasting within the leasing process.

Tools and Technologies Utilized

Leasing Advisors primarily utilize customer relationship management (CRM) software, virtual tour platforms, and digital leasing applications to streamline tenant interactions and lease tracking. Leasing Analysts focus on advanced data analytics tools, financial modeling software, and lease administration systems to evaluate market trends and optimize lease agreements. Both roles leverage cloud-based platforms and automation technologies to increase efficiency and accuracy in leasing processes.

Salary Expectations and Career Outlook

Leasing Advisors typically earn between $40,000 and $60,000 annually, focusing on client interaction and property marketing, while Leasing Analysts command salaries ranging from $55,000 to $75,000, emphasizing data analysis and market trend evaluation. The career outlook for Leasing Advisors centers on advancing to property management or sales roles, whereas Leasing Analysts often progress into real estate finance or investment analysis positions. Both roles benefit from strong negotiation skills and market knowledge, but Leasing Analysts usually require a higher level of analytical expertise and education.

Leasing Advisor vs Leasing Analyst Infographic

jobdiv.com

jobdiv.com