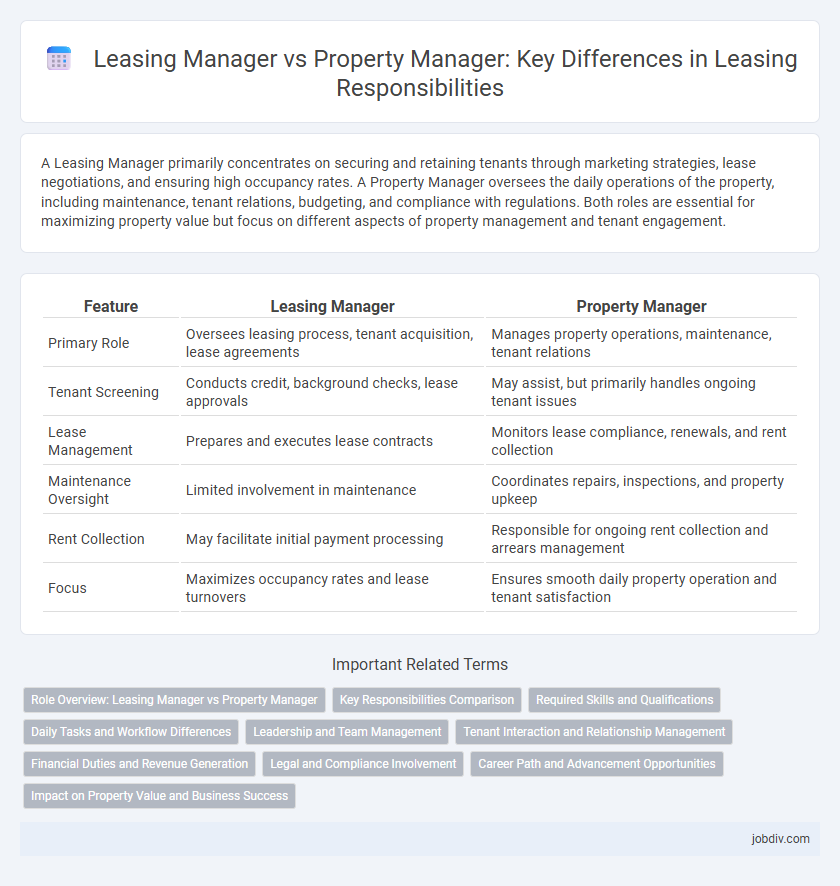

A Leasing Manager primarily concentrates on securing and retaining tenants through marketing strategies, lease negotiations, and ensuring high occupancy rates. A Property Manager oversees the daily operations of the property, including maintenance, tenant relations, budgeting, and compliance with regulations. Both roles are essential for maximizing property value but focus on different aspects of property management and tenant engagement.

Table of Comparison

| Feature | Leasing Manager | Property Manager |

|---|---|---|

| Primary Role | Oversees leasing process, tenant acquisition, lease agreements | Manages property operations, maintenance, tenant relations |

| Tenant Screening | Conducts credit, background checks, lease approvals | May assist, but primarily handles ongoing tenant issues |

| Lease Management | Prepares and executes lease contracts | Monitors lease compliance, renewals, and rent collection |

| Maintenance Oversight | Limited involvement in maintenance | Coordinates repairs, inspections, and property upkeep |

| Rent Collection | May facilitate initial payment processing | Responsible for ongoing rent collection and arrears management |

| Focus | Maximizes occupancy rates and lease turnovers | Ensures smooth daily property operation and tenant satisfaction |

Role Overview: Leasing Manager vs Property Manager

A Leasing Manager primarily focuses on marketing rental properties, screening prospective tenants, and negotiating lease agreements to maximize occupancy and revenue. A Property Manager oversees the overall maintenance, operations, and tenant relations of a property, ensuring compliance with laws and managing budgets for repairs and services. Both roles are critical in real estate management but differ in their core responsibilities, with Leasing Managers driving occupancy and Property Managers ensuring property upkeep and tenant satisfaction.

Key Responsibilities Comparison

Leasing Managers primarily focus on tenant acquisition, lease negotiations, and maintaining occupancy rates, ensuring rental income optimization. Property Managers handle daily operations, including property maintenance, tenant relations, and financial management such as budgeting and expense control. Both roles collaborate to maximize property value but emphasize different aspects of property administration and tenant services.

Required Skills and Qualifications

Leasing Managers require strong sales expertise, negotiation skills, and knowledge of leasing laws and market trends to secure tenants and maximize occupancy rates. Property Managers focus on property maintenance, tenant relations, budgeting, and regulatory compliance, demanding skills in facility management, problem-solving, and financial oversight. Both roles typically require strong communication abilities and relevant certifications such as Certified Property Manager (CPM) or Accredited Residential Manager (ARM).

Daily Tasks and Workflow Differences

Leasing Managers primarily focus on tenant acquisition, handling lease negotiations, and processing applications to maximize property occupancy rates. Property Managers oversee day-to-day property maintenance, coordinate repairs, and manage tenant relations to ensure operational efficiency and tenant satisfaction. The workflow of Leasing Managers centers around marketing and leasing activities, while Property Managers concentrate on property upkeep and administration.

Leadership and Team Management

A Leasing Manager excels in driving leasing strategies, leading sales teams to maximize occupancy rates and tenant retention through targeted marketing and negotiation skills. Property Managers focus on overseeing day-to-day operations and maintenance, managing vendor relationships, and ensuring compliance with property regulations to maintain asset value. Strong leadership in Leasing Managers involves motivating leasing agents and setting performance goals, while Property Managers emphasize coordinating multidisciplinary teams to deliver efficient property management services.

Tenant Interaction and Relationship Management

A Leasing Manager primarily focuses on tenant interaction during the leasing process, handling inquiries, showing properties, and negotiating lease terms to secure new tenants efficiently. In contrast, a Property Manager maintains ongoing tenant relationships by addressing maintenance requests, enforcing lease compliance, and fostering tenant satisfaction to ensure long-term occupancy. Both roles require strong communication skills, but Leasing Managers emphasize conversion and onboarding, while Property Managers prioritize retention and conflict resolution.

Financial Duties and Revenue Generation

A Leasing Manager primarily focuses on revenue generation through tenant acquisition, lease negotiations, and maximizing occupancy rates to boost property income. In contrast, a Property Manager oversees the financial duties of budget preparation, expense management, and rent collection to ensure consistent cash flow and maintain profitability. Both roles collaborate to optimize financial performance, but Leasing Managers drive top-line growth while Property Managers control operational costs.

Legal and Compliance Involvement

A Leasing Manager primarily ensures compliance with leasing laws, fair housing regulations, and contract enforcement during tenant onboarding and renewals. In contrast, a Property Manager handles broader legal responsibilities, including maintenance of property compliance with local building codes, safety regulations, and eviction processes. Both roles require detailed knowledge of legal frameworks to mitigate risks and uphold regulatory standards in property management.

Career Path and Advancement Opportunities

Leasing Managers typically advance by developing expertise in tenant acquisition and lease negotiations, often progressing into senior leasing director roles or portfolio management positions. Property Managers gain comprehensive operational experience overseeing property maintenance, budgeting, and tenant relations, which can lead to senior property management or asset management careers. Both paths offer distinct trajectories within real estate, with Leasing Managers focusing on revenue growth and Property Managers emphasizing property value and tenant satisfaction.

Impact on Property Value and Business Success

Leasing managers directly influence property value by maximizing occupancy rates and securing high-quality tenants, which enhances steady cash flow and market reputation. Property managers maintain and improve physical conditions, ensuring long-term asset preservation and minimizing operational disruptions that could depreciate property value. Collaboration between leasing and property managers drives business success by balancing tenant satisfaction with efficient property upkeep, ultimately boosting overall investment returns.

Leasing Manager vs Property Manager Infographic

jobdiv.com

jobdiv.com