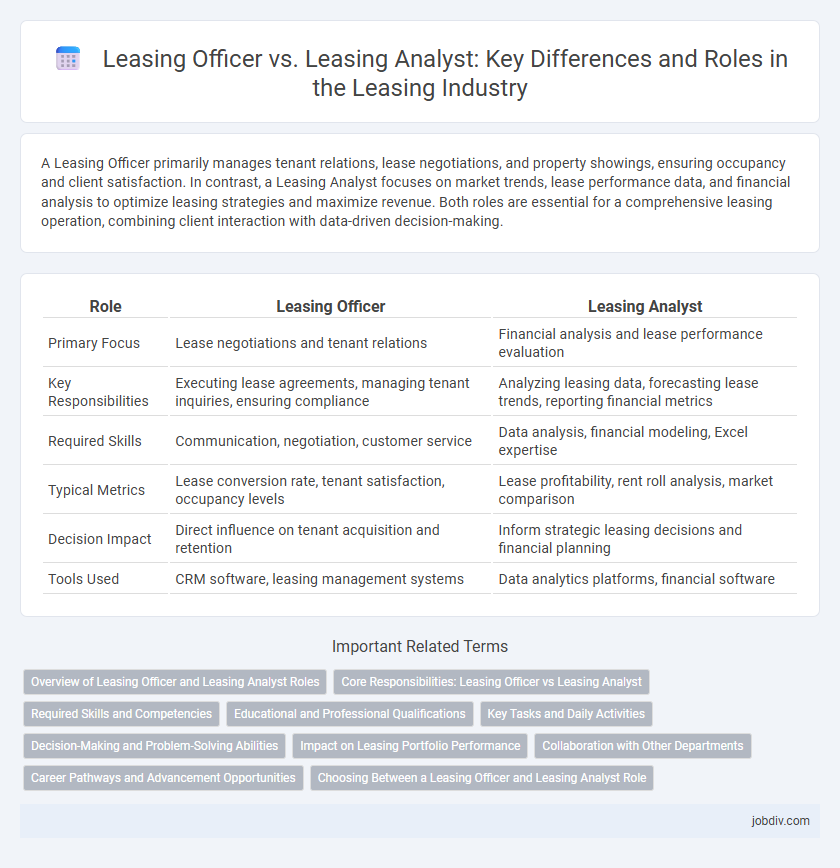

A Leasing Officer primarily manages tenant relations, lease negotiations, and property showings, ensuring occupancy and client satisfaction. In contrast, a Leasing Analyst focuses on market trends, lease performance data, and financial analysis to optimize leasing strategies and maximize revenue. Both roles are essential for a comprehensive leasing operation, combining client interaction with data-driven decision-making.

Table of Comparison

| Role | Leasing Officer | Leasing Analyst |

|---|---|---|

| Primary Focus | Lease negotiations and tenant relations | Financial analysis and lease performance evaluation |

| Key Responsibilities | Executing lease agreements, managing tenant inquiries, ensuring compliance | Analyzing leasing data, forecasting lease trends, reporting financial metrics |

| Required Skills | Communication, negotiation, customer service | Data analysis, financial modeling, Excel expertise |

| Typical Metrics | Lease conversion rate, tenant satisfaction, occupancy levels | Lease profitability, rent roll analysis, market comparison |

| Decision Impact | Direct influence on tenant acquisition and retention | Inform strategic leasing decisions and financial planning |

| Tools Used | CRM software, leasing management systems | Data analytics platforms, financial software |

Overview of Leasing Officer and Leasing Analyst Roles

Leasing Officers primarily manage tenant relations, oversee lease agreement execution, and ensure property occupancy targets are met, focusing on client interaction and contract compliance. Leasing Analysts analyze leasing data, market trends, and financial metrics to optimize leasing strategies and support decision-making processes. Both roles are essential in maximizing property revenue, but Leasing Officers emphasize operational and customer-facing tasks, while Leasing Analysts concentrate on data-driven insights.

Core Responsibilities: Leasing Officer vs Leasing Analyst

A Leasing Officer primarily manages tenant relations, conducts property showings, processes lease applications, and handles contract negotiations to secure tenants efficiently. A Leasing Analyst focuses on financial analysis, market research, and performance reporting to optimize leasing strategies and assess property profitability. Both roles collaborate to enhance occupancy rates but differ in operational execution versus data-driven decision-making.

Required Skills and Competencies

Leasing Officers must excel in interpersonal communication, negotiation, and customer service skills to effectively manage tenant relationships and secure lease agreements. Leasing Analysts require strong analytical abilities, proficiency in financial modeling, and expertise in market research to evaluate leasing trends and optimize property performance. Both roles demand attention to detail and a comprehensive understanding of leasing laws and real estate market dynamics.

Educational and Professional Qualifications

A Leasing Officer typically requires a bachelor's degree in real estate, business administration, or a related field, along with strong interpersonal skills and experience in property management or sales. In contrast, a Leasing Analyst usually holds a degree in finance, economics, or statistics, combined with proficiency in data analysis, market research, and financial modeling. Professional certifications such as Certified Property Manager (CPM) for Leasing Officers and Chartered Financial Analyst (CFA) or real estate finance certificates for Leasing Analysts enhance their qualifications and career prospects.

Key Tasks and Daily Activities

Leasing Officers primarily handle client interactions, property showings, lease negotiations, and tenant screenings, ensuring smooth leasing processes and occupancy rates. Leasing Analysts focus on data evaluation, market trends, rent comparisons, and financial reporting to support strategic leasing decisions and optimize portfolio performance. Both roles contribute to effective property management but differ in emphasis between client-facing activities and analytical support.

Decision-Making and Problem-Solving Abilities

Leasing Officers excel in decision-making by directly managing tenant relations and lease agreements, requiring quick judgment calls to address client needs and property challenges. Leasing Analysts focus on problem-solving through data-driven evaluations of lease terms, market trends, and financial metrics to optimize leasing strategies. Both roles demand strong analytical skills, but Leasing Officers prioritize interpersonal decisions, while Leasing Analysts emphasize detailed quantitative analysis.

Impact on Leasing Portfolio Performance

Leasing Officers directly influence leasing portfolio performance by managing tenant acquisition, lease negotiations, and retention strategies that drive occupancy rates and rental income. Leasing Analysts impact performance through data-driven insights, forecasting market trends, and analyzing lease terms to optimize portfolio risk and returns. Both roles together enhance leasing portfolio outcomes by balancing operational execution and strategic analysis for sustained financial growth.

Collaboration with Other Departments

Leasing Officers collaborate closely with property management and marketing teams to ensure tenant retention and optimize lease agreements. Leasing Analysts work with finance and legal departments to analyze lease data, assess financial risks, and ensure compliance with regulatory standards. Effective collaboration between Leasing Officers and Leasing Analysts enhances decision-making processes and supports seamless lease portfolio management.

Career Pathways and Advancement Opportunities

Leasing Officers typically focus on tenant interactions, lease negotiations, and property marketing, serving as entry points in the leasing career ladder. Leasing Analysts specialize in data analysis, market trends, and financial modeling, positioning themselves for advanced roles in portfolio management or real estate investment. Progression from Leasing Officer to Leasing Analyst involves acquiring analytical skills and industry certifications, opening pathways to senior leasing management or commercial real estate advisory positions.

Choosing Between a Leasing Officer and Leasing Analyst Role

Choosing between a Leasing Officer and Leasing Analyst role depends on career goals and skill sets. Leasing Officers primarily focus on direct client interactions, lease negotiations, and property management, requiring strong interpersonal skills and sales acumen. Leasing Analysts emphasize data analysis, market research, and financial modeling to support leasing strategies, benefiting those with analytical thinking and proficiency in software tools like Excel and SQL.

Leasing Officer vs Leasing Analyst Infographic

jobdiv.com

jobdiv.com