Short-term leasing offers flexibility with shorter commitment periods, ideal for businesses or individuals needing temporary vehicle use or equipment. Long-term leasing typically provides lower monthly payments and better rates, making it cost-effective for ongoing needs and stable budgets. Choosing between short-term and long-term leasing depends on the duration of use, budget constraints, and specific requirements for flexibility or cost savings.

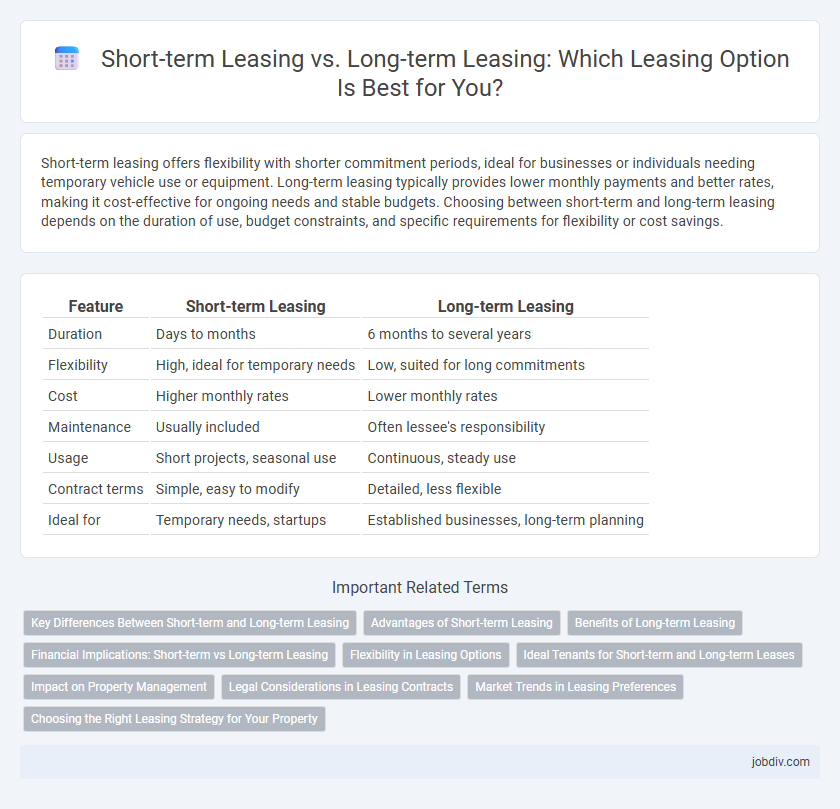

Table of Comparison

| Feature | Short-term Leasing | Long-term Leasing |

|---|---|---|

| Duration | Days to months | 6 months to several years |

| Flexibility | High, ideal for temporary needs | Low, suited for long commitments |

| Cost | Higher monthly rates | Lower monthly rates |

| Maintenance | Usually included | Often lessee's responsibility |

| Usage | Short projects, seasonal use | Continuous, steady use |

| Contract terms | Simple, easy to modify | Detailed, less flexible |

| Ideal for | Temporary needs, startups | Established businesses, long-term planning |

Key Differences Between Short-term and Long-term Leasing

Short-term leasing offers flexibility with lease terms typically ranging from one month to a year, making it ideal for temporary needs or transitional use. Long-term leasing spans multiple years and often includes lower monthly payments, providing cost-effectiveness and stability for businesses or individuals seeking extended use. Key differences include commitment duration, overall cost structure, and the level of maintenance responsibility, with short-term leases usually requiring less commitment but costing more per month.

Advantages of Short-term Leasing

Short-term leasing offers greater flexibility by allowing businesses to adjust equipment or vehicle usage according to fluctuating demand without long-term commitments. It reduces upfront costs and minimizes financial risk, making it ideal for startups or projects with uncertain durations. This leasing option also enables quick access to the latest technology or models, enhancing operational efficiency and competitiveness.

Benefits of Long-term Leasing

Long-term leasing offers significant cost savings through lower monthly payments and reduced depreciation expenses compared to short-term leasing. It provides stability and predictability in budgeting by locking in fixed rates over an extended period, minimizing concerns about fluctuating market prices. Additionally, long-term leases often include maintenance packages, reducing unexpected repair costs and enhancing overall convenience for lessees.

Financial Implications: Short-term vs Long-term Leasing

Short-term leasing often results in higher monthly payments but offers greater flexibility and lower commitment, making it suitable for fluctuating business needs or temporary vehicle use. Long-term leasing typically provides lower monthly costs and potential tax benefits through depreciation, making it financially advantageous for stable, predictable asset requirements. Evaluating total lease expenses, including maintenance and potential penalties, is crucial to optimize cash flow and overall budget impact.

Flexibility in Leasing Options

Short-term leasing offers greater flexibility by allowing lessees to adapt quickly to changing needs without long-term commitments, ideal for businesses or individuals seeking temporary solutions. Long-term leasing provides stability and often lower monthly costs but lacks the agility to accommodate sudden shifts in usage or financial situations. Choosing between these options depends on balancing the need for flexible terms against cost efficiency and duration of use.

Ideal Tenants for Short-term and Long-term Leases

Ideal tenants for short-term leasing typically include transient professionals, travelers, and startups needing flexible arrangements without long commitment. Long-term leasing appeals to tenants seeking stability, such as established businesses, families, and individuals desiring consistent accommodation or workspace. Understanding tenant needs helps landlords tailor lease terms, optimizing occupancy and cash flow.

Impact on Property Management

Short-term leasing demands frequent tenant turnover management, increasing operational complexity and maintenance costs for property managers. Long-term leasing provides stable occupancy, reducing vacancy rates and streamlining maintenance scheduling. Effective property management strategies prioritize leasing terms based on market demand, balancing cash flow stability with tenant satisfaction.

Legal Considerations in Leasing Contracts

Short-term leasing contracts typically involve simplified legal terms with fewer obligations, focusing on flexibility and quick termination clauses, which benefit tenants needing temporary use. Long-term leasing agreements require comprehensive legal scrutiny, including detailed covenants, maintenance obligations, and renewal options to protect both parties over extended periods. Understanding jurisdiction-specific regulations and ensuring clear dispute resolution mechanisms are critical to minimizing legal risks in both leasing scenarios.

Market Trends in Leasing Preferences

Market trends indicate a growing preference for short-term leasing due to increased flexibility and shifting consumer behavior favoring agile asset usage. Data from industry reports reveal a 25% annual growth in short-term leasing sectors such as automotive and equipment rental, driven by urbanization and remote work trends. Long-term leasing remains dominant in corporate fleets and real estate, but its growth rate has slowed to under 5% annually, reflecting changing market dynamics.

Choosing the Right Leasing Strategy for Your Property

Short-term leasing offers greater flexibility and higher rental yields ideal for properties in high-demand urban areas or tourist destinations, while long-term leasing provides stable, predictable income preferred for suburban residential or commercial properties. Evaluating tenant turnover rates, maintenance costs, and local market demand helps determine the optimal leasing strategy tailored to property type and investment goals. Leveraging data on rental vacancy trends and seasonal occupancy further refines the decision, maximizing profitability and minimizing vacancy risk.

Short-term Leasing vs Long-term Leasing Infographic

jobdiv.com

jobdiv.com