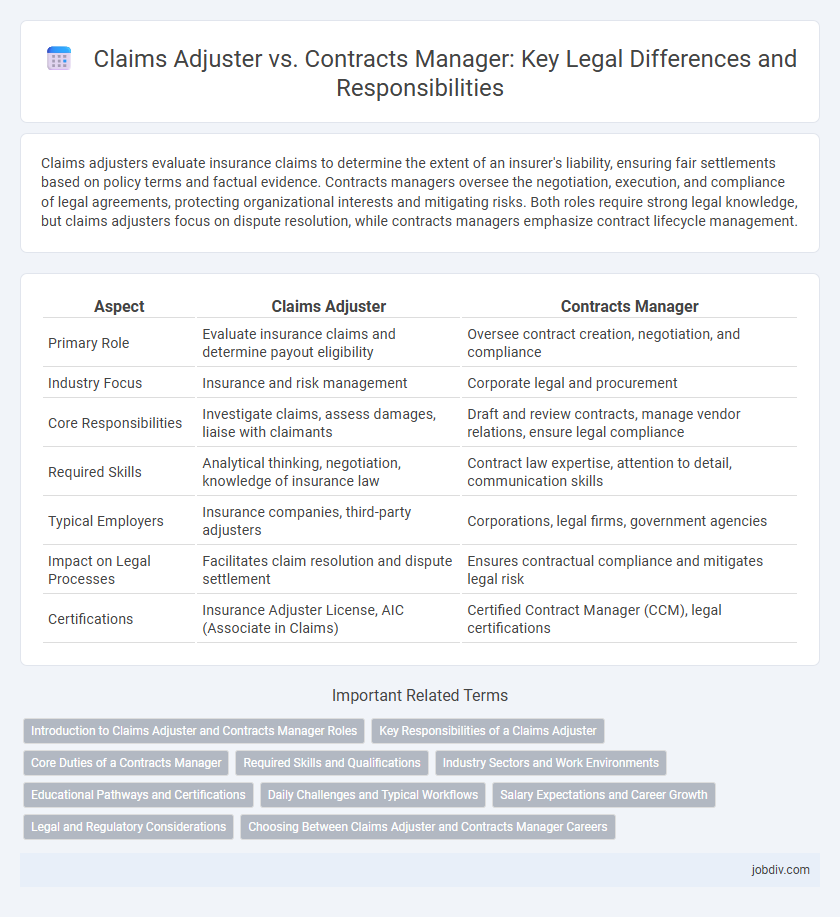

Claims adjusters evaluate insurance claims to determine the extent of an insurer's liability, ensuring fair settlements based on policy terms and factual evidence. Contracts managers oversee the negotiation, execution, and compliance of legal agreements, protecting organizational interests and mitigating risks. Both roles require strong legal knowledge, but claims adjusters focus on dispute resolution, while contracts managers emphasize contract lifecycle management.

Table of Comparison

| Aspect | Claims Adjuster | Contracts Manager |

|---|---|---|

| Primary Role | Evaluate insurance claims and determine payout eligibility | Oversee contract creation, negotiation, and compliance |

| Industry Focus | Insurance and risk management | Corporate legal and procurement |

| Core Responsibilities | Investigate claims, assess damages, liaise with claimants | Draft and review contracts, manage vendor relations, ensure legal compliance |

| Required Skills | Analytical thinking, negotiation, knowledge of insurance law | Contract law expertise, attention to detail, communication skills |

| Typical Employers | Insurance companies, third-party adjusters | Corporations, legal firms, government agencies |

| Impact on Legal Processes | Facilitates claim resolution and dispute settlement | Ensures contractual compliance and mitigates legal risk |

| Certifications | Insurance Adjuster License, AIC (Associate in Claims) | Certified Contract Manager (CCM), legal certifications |

Introduction to Claims Adjuster and Contracts Manager Roles

Claims adjusters investigate insurance claims by evaluating damages, interviewing claimants, and determining the validity of claims to ensure accurate settlement amounts. Contracts managers oversee the creation, negotiation, execution, and compliance of contracts to protect organizational interests and mitigate legal risks. Both roles require attention to detail, strong analytical skills, and a comprehensive understanding of legal documentation and industry regulations.

Key Responsibilities of a Claims Adjuster

Claims adjusters investigate, evaluate, and settle insurance claims by analyzing reports, interviewing claimants, and consulting with legal experts to determine liability and claim validity. They collaborate with insurance companies to negotiate settlements and ensure compliance with policy terms and relevant laws. Detailed documentation and accurate record-keeping of claim files are essential responsibilities to support dispute resolution and legal proceedings.

Core Duties of a Contracts Manager

A Contracts Manager is responsible for negotiating, drafting, and managing contracts to ensure compliance with legal and regulatory requirements while minimizing risk for the organization. They coordinate with legal, finance, and project teams to oversee contract execution, amendments, and renewals throughout the contract lifecycle. Expertise in contract law, risk assessment, and vendor management is essential for maintaining contractual obligations and resolving disputes effectively.

Required Skills and Qualifications

Claims adjusters require strong analytical skills, attention to detail, and knowledge of insurance policies, legal regulations, and claims processing software. Contracts managers must possess expertise in contract law, negotiation skills, and the ability to interpret complex legal documents while ensuring compliance with regulatory standards. Both roles demand excellent communication abilities, problem-solving skills, and proficiency with industry-specific technology platforms to effectively manage risk and contractual obligations.

Industry Sectors and Work Environments

Claims adjusters primarily operate within insurance, healthcare, and legal sectors, handling investigations and settlements related to insurance claims in dynamic, field-based environments. Contracts managers often work in construction, manufacturing, and corporate sectors, managing contract negotiations and compliance in office or corporate settings. The work environment for claims adjusters involves frequent travel and on-site assessments, while contracts managers typically engage in strategic planning and stakeholder coordination within structured office environments.

Educational Pathways and Certifications

Claims Adjusters typically pursue a certificate in claims adjusting or an associate degree in insurance, often obtaining licenses such as the State Adjuster License or Chartered Property Casualty Underwriter (CPCU) designation. Contracts Managers usually hold a bachelor's degree in business, law, or contract management, with certifications like Certified Professional Contracts Manager (CPCM) or Certified Federal Contracts Manager (CFCM) enhancing their credentials. Both careers benefit from specialized training in regulatory compliance, negotiation skills, and risk management to excel in their legal and administrative responsibilities.

Daily Challenges and Typical Workflows

Claims adjusters handle complex investigations and detailed documentation to assess insurance claims accurately, often managing multiple deadlines while ensuring compliance with regulatory standards. Contracts managers oversee contract negotiation, execution, and compliance monitoring, balancing risk mitigation with business objectives and maintaining clear communication between stakeholders. Daily workflows for claims adjusters revolve around claim evaluation and interaction with clients and insurers, whereas contracts managers prioritize drafting, reviewing, and managing contract lifecycle processes.

Salary Expectations and Career Growth

Claims adjusters typically earn an average salary ranging from $50,000 to $70,000 annually, with opportunities for bonuses based on performance and experience, while contracts managers can expect salaries between $70,000 and $100,000, reflecting their specialized expertise in contract negotiation and compliance. Career growth for claims adjusters often involves moving into senior adjusting roles or transitioning into risk management, whereas contracts managers may advance to senior legal positions, procurement leadership, or corporate compliance roles. Both careers offer strong upward mobility, but contracts managers generally benefit from higher salary ceilings due to the complexity and legal implications of their work.

Legal and Regulatory Considerations

Claims adjusters must ensure compliance with insurance laws, state regulations, and claims handling standards while investigating and settling claims to avoid legal disputes. Contracts managers oversee contract creation, negotiation, and enforcement, ensuring adherence to regulatory requirements such as federal acquisition regulations, industry-specific laws, and corporate governance policies. Both roles require thorough understanding of tort law, liability issues, and risk management to mitigate potential legal exposures effectively.

Choosing Between Claims Adjuster and Contracts Manager Careers

Claims adjusters specialize in investigating, evaluating, and negotiating insurance claims to determine liability and settlement amounts, requiring strong analytical and negotiation skills. Contracts managers focus on drafting, reviewing, and managing legal contracts to ensure compliance and mitigate risks, necessitating expertise in contract law and regulatory standards. Opting between careers depends on preferences for claims investigation and dispute resolution or contract administration and legal compliance within the legal and insurance industries.

Claims Adjuster vs Contracts Manager Infographic

jobdiv.com

jobdiv.com