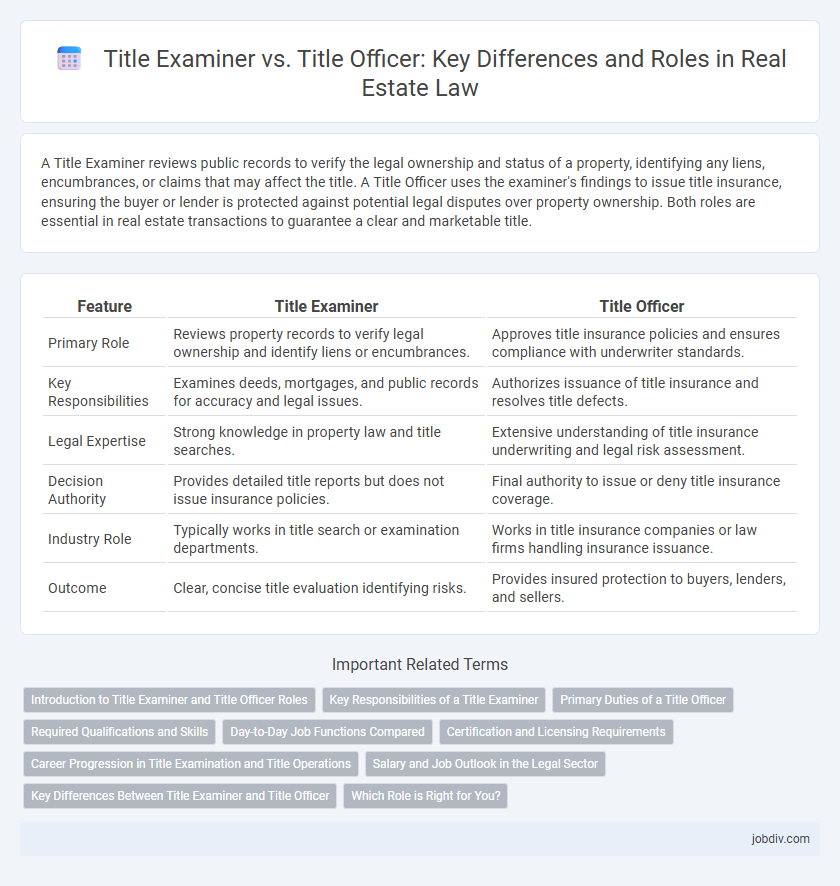

A Title Examiner reviews public records to verify the legal ownership and status of a property, identifying any liens, encumbrances, or claims that may affect the title. A Title Officer uses the examiner's findings to issue title insurance, ensuring the buyer or lender is protected against potential legal disputes over property ownership. Both roles are essential in real estate transactions to guarantee a clear and marketable title.

Table of Comparison

| Feature | Title Examiner | Title Officer |

|---|---|---|

| Primary Role | Reviews property records to verify legal ownership and identify liens or encumbrances. | Approves title insurance policies and ensures compliance with underwriter standards. |

| Key Responsibilities | Examines deeds, mortgages, and public records for accuracy and legal issues. | Authorizes issuance of title insurance and resolves title defects. |

| Legal Expertise | Strong knowledge in property law and title searches. | Extensive understanding of title insurance underwriting and legal risk assessment. |

| Decision Authority | Provides detailed title reports but does not issue insurance policies. | Final authority to issue or deny title insurance coverage. |

| Industry Role | Typically works in title search or examination departments. | Works in title insurance companies or law firms handling insurance issuance. |

| Outcome | Clear, concise title evaluation identifying risks. | Provides insured protection to buyers, lenders, and sellers. |

Introduction to Title Examiner and Title Officer Roles

Title Examiners analyze property titles to identify liens, encumbrances, or discrepancies affecting ownership and ensure legal compliance. Title Officers oversee the title process, approve insurance commitments, and coordinate with lenders, agents, and attorneys to secure clear title transfers. Both roles collaborate to minimize risks in real estate transactions and uphold title insurance standards.

Key Responsibilities of a Title Examiner

Title Examiners conduct thorough research on property titles, analyzing public records to identify liens, encumbrances, or errors that could affect ownership. They prepare detailed reports that summarize their findings, ensuring titles meet legal standards before properties are transferred or financed. Their expertise is crucial in preventing legal disputes and securing clear ownership in real estate transactions.

Primary Duties of a Title Officer

A Title Officer primarily conducts thorough title searches to verify the legal ownership and identify any liens or encumbrances on a property, ensuring a clear title for real estate transactions. They prepare and issue title insurance policies, mitigating risks associated with property ownership disputes. Their role often involves collaborating with underwriters, lenders, and legal professionals to facilitate seamless closings.

Required Qualifications and Skills

Title Examiners must possess strong analytical skills and an in-depth understanding of property laws to accurately review land titles and identify potential legal issues. Title Officers require comprehensive knowledge of real estate transactions, exceptional judgment, and the ability to communicate effectively with clients, lenders, and attorneys. Both roles demand attention to detail, familiarity with state and federal regulations, and proficiency in title search software and documentation processes.

Day-to-Day Job Functions Compared

Title examiners analyze property titles and public records to verify ownership and identify liens, encumbrances, or defects that could affect transferability. Title officers oversee the issuance of title insurance policies, ensuring compliance with underwriting standards and resolving issues uncovered during the examination. Both roles require detailed knowledge of real estate law, but examiners focus more on research and documentation, while officers manage risk assessment and communication with clients.

Certification and Licensing Requirements

Title examiners typically require certification such as the Certified Title Examiner (CTE) credential, which validates expertise in property records and title searches; however, formal licensing is generally not mandatory. Title officers often must hold state-specific licenses or certifications, reflecting their broader responsibilities in managing title insurance policies and legal compliance. Both roles demand thorough knowledge of real estate laws, but title officers face stricter regulatory requirements due to their involvement in underwriting and insurance issuance.

Career Progression in Title Examination and Title Operations

Title examiners often begin their careers by reviewing property records and identifying any issues affecting ownership, gaining expertise in legal descriptions and documentation. With experience, they can advance to title officer roles, taking on responsibilities such as managing title searches, resolving complex claims, and overseeing the issuance of title insurance policies. Career progression in title examination and title operations emphasizes a deep understanding of real estate law, attention to detail, and strong analytical skills, allowing professionals to move from technical review positions to more supervisory and decision-making roles.

Salary and Job Outlook in the Legal Sector

Title Examiners typically earn an average salary range of $40,000 to $60,000 annually, with a moderate job outlook influenced by fluctuations in the real estate market. Title Officers, often earning between $55,000 and $75,000 per year, play a critical role in legal reviews and approvals, which sustains steady demand in the legal and real estate sectors. Both roles require thorough knowledge of property law, but Title Officers generally have greater responsibility and higher compensation reflecting their position in the legal hierarchy.

Key Differences Between Title Examiner and Title Officer

Title Examiners primarily analyze public records to verify property ownership and identify potential legal issues, ensuring the title is clear for transfer. Title Officers, on the other hand, oversee the title insurance process, authorize policy issuance, and resolve title defects to protect against future claims. The key difference lies in the Title Examiner's focus on research and discovery, while the Title Officer handles risk assessment and final approval in real estate transactions.

Which Role is Right for You?

A Title Examiner conducts in-depth research to identify any legal issues or claims affecting property titles, ensuring clear ownership status before transactions. A Title Officer oversees the entire title process, including risk assessment, issuing title insurance, and managing closing documentation for smooth property transfers. Choosing between these roles depends on whether you prefer detailed investigative work as a Title Examiner or a broader managerial and client-facing position as a Title Officer.

Title Examiner vs Title Officer Infographic

jobdiv.com

jobdiv.com