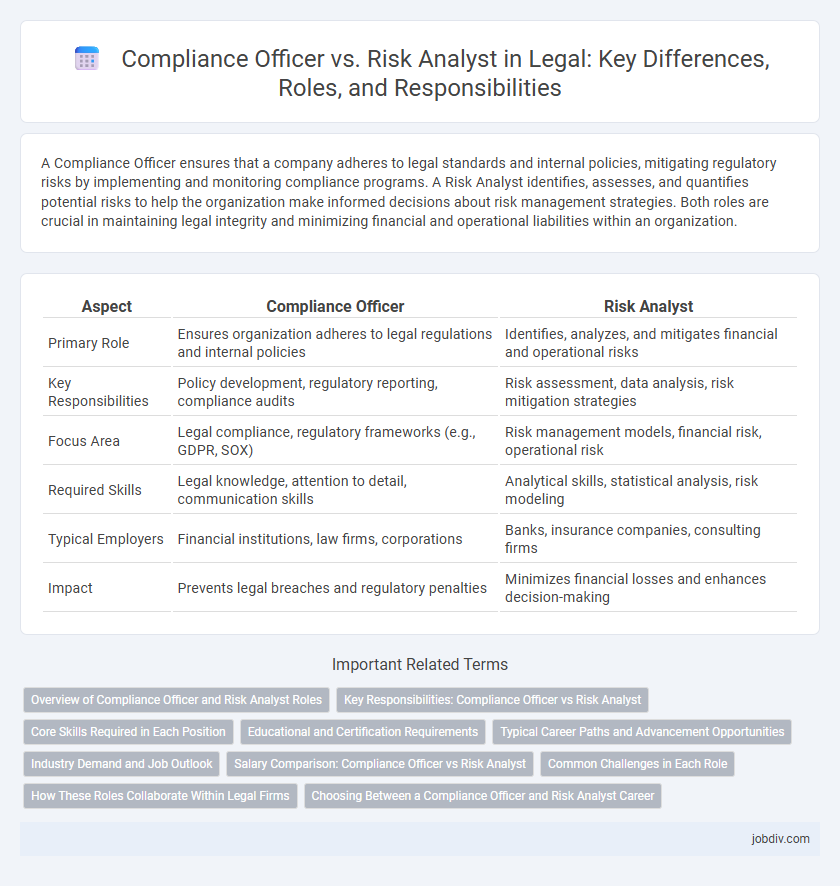

A Compliance Officer ensures that a company adheres to legal standards and internal policies, mitigating regulatory risks by implementing and monitoring compliance programs. A Risk Analyst identifies, assesses, and quantifies potential risks to help the organization make informed decisions about risk management strategies. Both roles are crucial in maintaining legal integrity and minimizing financial and operational liabilities within an organization.

Table of Comparison

| Aspect | Compliance Officer | Risk Analyst |

|---|---|---|

| Primary Role | Ensures organization adheres to legal regulations and internal policies | Identifies, analyzes, and mitigates financial and operational risks |

| Key Responsibilities | Policy development, regulatory reporting, compliance audits | Risk assessment, data analysis, risk mitigation strategies |

| Focus Area | Legal compliance, regulatory frameworks (e.g., GDPR, SOX) | Risk management models, financial risk, operational risk |

| Required Skills | Legal knowledge, attention to detail, communication skills | Analytical skills, statistical analysis, risk modeling |

| Typical Employers | Financial institutions, law firms, corporations | Banks, insurance companies, consulting firms |

| Impact | Prevents legal breaches and regulatory penalties | Minimizes financial losses and enhances decision-making |

Overview of Compliance Officer and Risk Analyst Roles

Compliance Officers ensure organizations adhere to legal standards and internal policies, managing regulatory requirements and mitigating compliance risks. Risk Analysts evaluate potential financial, operational, and strategic risks, using data analysis to inform risk management strategies and decision-making. Both roles are critical in maintaining organizational integrity and minimizing exposure to legal and financial liabilities.

Key Responsibilities: Compliance Officer vs Risk Analyst

Compliance Officers ensure adherence to regulatory requirements by developing internal policies, conducting audits, and providing employee training to mitigate legal risks. Risk Analysts identify, evaluate, and quantify potential threats to the organization by analyzing financial, operational, and strategic data to inform risk mitigation strategies. Both roles collaborate to maintain organizational integrity, but Compliance Officers focus on regulatory compliance while Risk Analysts concentrate on risk assessment and management.

Core Skills Required in Each Position

A Compliance Officer must possess strong knowledge of regulatory frameworks, exceptional attention to detail, and proficiency in auditing and reporting to ensure organizational adherence to laws and policies. A Risk Analyst requires expertise in data analysis, risk assessment methodologies, and financial modeling to identify and mitigate potential business threats. Both roles demand critical thinking and effective communication skills, but the Compliance Officer emphasizes legal compliance, while the Risk Analyst focuses on quantifying and managing risks.

Educational and Certification Requirements

Compliance Officers typically hold degrees in law, finance, or business administration, often complemented by certifications such as Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM). Risk Analysts usually possess backgrounds in finance, economics, or statistics, with certifications like Financial Risk Manager (FRM) or Professional Risk Manager (PRM) enhancing their expertise. Both roles demand strong analytical skills, but their educational focus and professional certifications diverge to align with their specific regulatory and risk assessment responsibilities.

Typical Career Paths and Advancement Opportunities

Compliance Officers often begin their careers in legal or regulatory roles, advancing to senior compliance manager or chief compliance officer positions by deepening expertise in industry regulations and corporate governance. Risk Analysts typically start in entry-level risk assessment or financial analysis roles, progressing to senior risk manager or chief risk officer roles through specialization in risk modeling and strategic risk mitigation. Both career paths offer opportunities to move into executive roles focusing on organizational risk and compliance strategy, with certifications like Certified Compliance & Ethics Professional (CCEP) or Financial Risk Manager (FRM) enhancing advancement prospects.

Industry Demand and Job Outlook

Compliance officers are essential in regulated industries like finance, healthcare, and pharmaceuticals, where legal adherence and ethical standards drive high demand for their expertise. Risk analysts are increasingly sought after in sectors such as insurance, banking, and cybersecurity due to growing emphasis on identifying and mitigating financial and operational risks. Job outlook projections indicate steady growth for both roles, with compliance officers benefiting from expanding regulatory frameworks and risk analysts gaining importance from evolving market complexities.

Salary Comparison: Compliance Officer vs Risk Analyst

Compliance Officers earn an average annual salary of $72,000, with variations depending on industry and experience, while Risk Analysts typically command a slightly higher average salary of $78,000 due to their specialized focus on identifying and mitigating financial risks. In sectors like finance and healthcare, Compliance Officers may see salaries rise to $90,000 or more, whereas Risk Analysts in investment banking or insurance often exceed $85,000. Salary growth for both roles is influenced by certifications such as Certified Compliance and Ethics Professional (CCEP) for Compliance Officers and Financial Risk Manager (FRM) for Risk Analysts.

Common Challenges in Each Role

Compliance Officers often navigate complex regulatory landscapes, ensuring company adherence to laws such as GDPR and SOX, which requires constant update on evolving legislation and meticulous documentation. Risk Analysts face challenges in accurately quantifying potential threats by leveraging data analytics and predictive modeling to prevent financial losses and operational disruptions. Both roles demand a deep understanding of legal frameworks, effective communication with stakeholders, and the ability to implement proactive measures to mitigate compliance breaches and risk exposures.

How These Roles Collaborate Within Legal Firms

Compliance officers and risk analysts collaborate within legal firms by integrating regulatory adherence with effective risk management strategies to safeguard the firm's operations and reputation. Compliance officers ensure that all legal practices comply with relevant laws and internal policies, while risk analysts identify potential legal and financial risks, providing data-driven insights to mitigate those threats. Their combined efforts promote a proactive approach to legal risk, enhancing the firm's ability to navigate complex regulatory environments and avoid costly violations.

Choosing Between a Compliance Officer and Risk Analyst Career

Choosing between a Compliance Officer and Risk Analyst career depends on your interest in regulatory frameworks versus risk assessment methodologies. Compliance Officers focus on ensuring organizational adherence to laws and policies, which requires expertise in legal standards and corporate governance. Risk Analysts prioritize identifying and mitigating potential threats using data analysis, financial modeling, and risk management tools.

Compliance Officer vs Risk Analyst Infographic

jobdiv.com

jobdiv.com