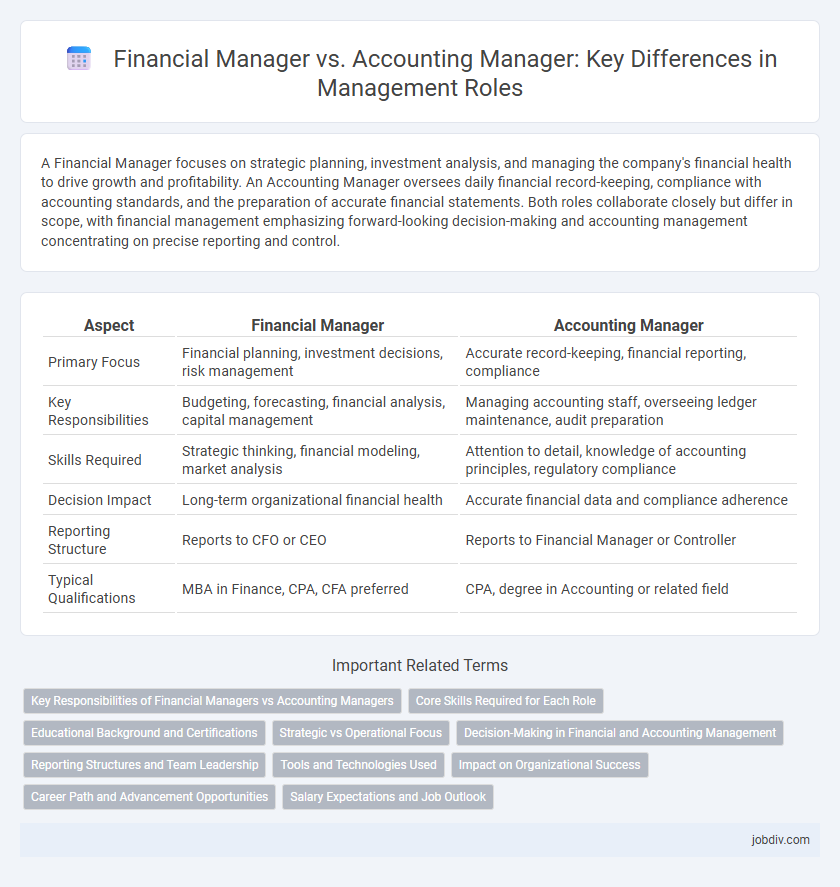

A Financial Manager focuses on strategic planning, investment analysis, and managing the company's financial health to drive growth and profitability. An Accounting Manager oversees daily financial record-keeping, compliance with accounting standards, and the preparation of accurate financial statements. Both roles collaborate closely but differ in scope, with financial management emphasizing forward-looking decision-making and accounting management concentrating on precise reporting and control.

Table of Comparison

| Aspect | Financial Manager | Accounting Manager |

|---|---|---|

| Primary Focus | Financial planning, investment decisions, risk management | Accurate record-keeping, financial reporting, compliance |

| Key Responsibilities | Budgeting, forecasting, financial analysis, capital management | Managing accounting staff, overseeing ledger maintenance, audit preparation |

| Skills Required | Strategic thinking, financial modeling, market analysis | Attention to detail, knowledge of accounting principles, regulatory compliance |

| Decision Impact | Long-term organizational financial health | Accurate financial data and compliance adherence |

| Reporting Structure | Reports to CFO or CEO | Reports to Financial Manager or Controller |

| Typical Qualifications | MBA in Finance, CPA, CFA preferred | CPA, degree in Accounting or related field |

Key Responsibilities of Financial Managers vs Accounting Managers

Financial Managers oversee budgeting, financial planning, and investment strategies to optimize company profitability and support long-term growth objectives. Accounting Managers focus on maintaining accurate financial records, managing ledger entries, ensuring compliance with accounting standards, and preparing financial statements. Both roles require collaboration to align financial reporting with strategic financial management goals, but Financial Managers emphasize analysis and strategy while Accounting Managers prioritize transaction accuracy and regulatory adherence.

Core Skills Required for Each Role

Financial Managers require strong analytical skills, expertise in financial planning, investment management, and risk assessment to guide organizational financial strategy. Accounting Managers excel in detailed knowledge of accounting principles, regulatory compliance, ledger management, and accuracy in financial reporting to ensure proper record-keeping. Both roles demand proficiency in financial software, leadership capabilities, and the ability to interpret complex financial data for informed decision-making.

Educational Background and Certifications

A Financial Manager typically holds a degree in finance, economics, or business administration, often supplemented with certifications such as CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) highlighting expertise in investment analysis and strategic financial planning. In contrast, an Accounting Manager usually possesses a degree in accounting or finance, paired with professional certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant), emphasizing proficiency in financial reporting, compliance, and auditing standards. The divergence in educational background and certifications reflects distinct skill sets essential for managing financial performance versus ensuring accurate record-keeping and regulatory adherence.

Strategic vs Operational Focus

Financial managers prioritize strategic planning by analyzing market trends, managing investments, and forecasting long-term financial goals to drive business growth. Accounting managers focus on operational tasks such as maintaining accurate financial records, ensuring compliance with regulations, and overseeing daily bookkeeping activities to support organizational efficiency. Both roles are essential, yet the financial manager's role centers on forward-looking strategies while the accounting manager emphasizes day-to-day financial management.

Decision-Making in Financial and Accounting Management

Financial managers prioritize strategic decision-making to optimize investment portfolios, manage capital structure, and assess financial risks, ensuring long-term organizational growth. Accounting managers focus on accurate financial reporting, compliance with regulatory standards, and cost control to provide reliable data for operational decisions. Both roles require collaboration to align financial strategies with precise accounting records for effective overall management.

Reporting Structures and Team Leadership

Financial Managers oversee the strategic financial planning and reporting structures, ensuring alignment with organizational goals while leading cross-functional teams. Accounting Managers concentrate on managing daily accounting operations, maintaining accurate financial records, and supervising accounting staff to uphold compliance and internal controls. Both roles require strong leadership skills but differ in scope, with Financial Managers focusing on broader financial analysis and Accounting Managers on detailed transactional accuracy.

Tools and Technologies Used

Financial managers utilize advanced financial modeling software, enterprise resource planning (ERP) systems like SAP and Oracle, and data analytics tools such as Tableau and Power BI to forecast budgets, manage investment portfolios, and assess financial risks. Accounting managers rely heavily on accounting software including QuickBooks, Xero, and Microsoft Dynamics GP for tasks like ledger maintenance, payroll processing, and compliance reporting. Both roles increasingly leverage cloud-based platforms to enhance real-time data accessibility, streamline collaboration, and ensure accuracy in financial operations.

Impact on Organizational Success

Financial Managers drive organizational success by strategically managing investments, budgeting, and financial forecasting to optimize resource allocation and maximize profitability. Accounting Managers ensure accuracy in financial reporting, compliance with regulations, and effective internal controls, which uphold the organization's financial integrity and support informed decision-making. Together, their coordinated efforts enhance operational efficiency, risk management, and sustainable growth.

Career Path and Advancement Opportunities

Financial Managers typically advance by gaining expertise in financial analysis, investment strategies, and risk management, often moving into roles such as Chief Financial Officer (CFO) or Finance Director. Accounting Managers usually progress through mastering compliance, auditing, and tax regulations, with career paths leading to positions like Controller or Chief Accounting Officer. Both roles require strong leadership skills, but Financial Managers often have broader strategic responsibilities, while Accounting Managers focus on accuracy and regulatory adherence.

Salary Expectations and Job Outlook

Financial Managers typically earn higher salaries, with median annual wages around $131,710, reflecting their strategic role in budgeting and investment decisions. Accounting Managers, earning a median salary near $99,000, focus more on overseeing daily accounting operations and ensuring regulatory compliance. The job outlook for Financial Managers is projected to grow 17% from 2022 to 2032, faster than average, while Accounting Managers can expect steady demand due to ongoing needs for financial reporting and audit functions.

Financial Manager vs Accounting Manager Infographic

jobdiv.com

jobdiv.com