A Risk Manager identifies, assesses, and mitigates potential threats that could disrupt business operations, ensuring organizational resilience. A Compliance Manager ensures that the company adheres to legal regulations, industry standards, and internal policies to avoid penalties and maintain ethical conduct. Both roles collaborate closely to safeguard the business, but Risk Managers focus on proactive hazard management while Compliance Managers emphasize regulatory adherence.

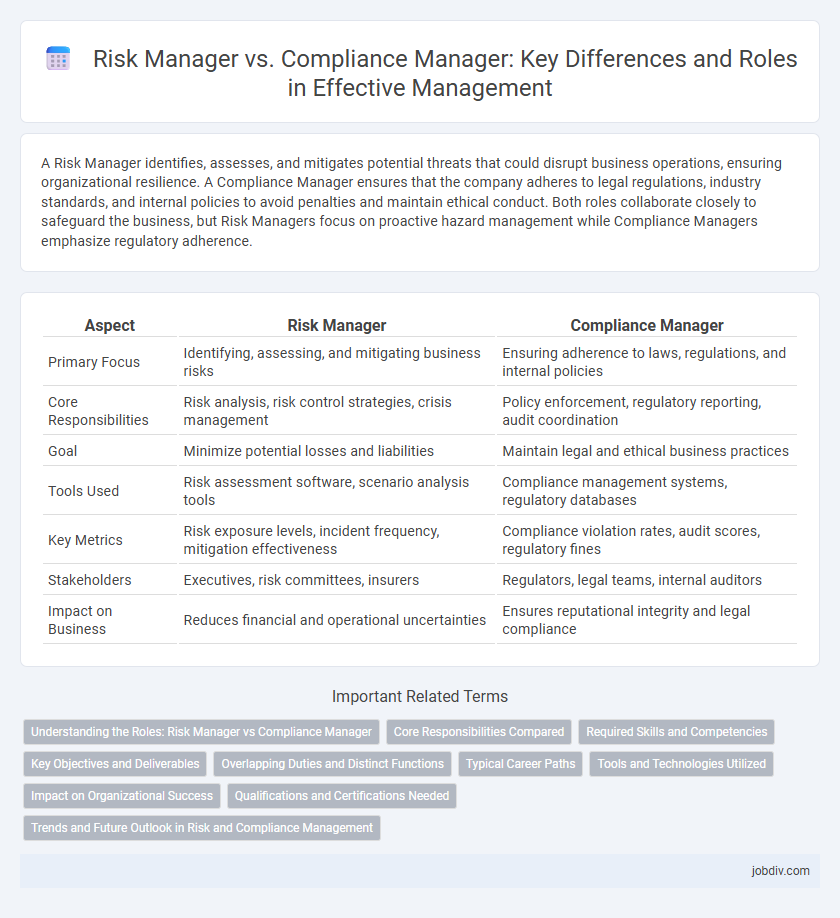

Table of Comparison

| Aspect | Risk Manager | Compliance Manager |

|---|---|---|

| Primary Focus | Identifying, assessing, and mitigating business risks | Ensuring adherence to laws, regulations, and internal policies |

| Core Responsibilities | Risk analysis, risk control strategies, crisis management | Policy enforcement, regulatory reporting, audit coordination |

| Goal | Minimize potential losses and liabilities | Maintain legal and ethical business practices |

| Tools Used | Risk assessment software, scenario analysis tools | Compliance management systems, regulatory databases |

| Key Metrics | Risk exposure levels, incident frequency, mitigation effectiveness | Compliance violation rates, audit scores, regulatory fines |

| Stakeholders | Executives, risk committees, insurers | Regulators, legal teams, internal auditors |

| Impact on Business | Reduces financial and operational uncertainties | Ensures reputational integrity and legal compliance |

Understanding the Roles: Risk Manager vs Compliance Manager

Risk Managers identify, assess, and mitigate potential threats to an organization's assets, focusing on financial, operational, and strategic risks to ensure business continuity. Compliance Managers develop, implement, and monitor policies that ensure adherence to legal regulations and internal standards, reducing the risk of regulatory penalties and reputational damage. Both roles collaborate closely to establish a robust governance framework, but Risk Managers emphasize proactive risk prevention, while Compliance Managers focus on regulatory conformity.

Core Responsibilities Compared

Risk Managers primarily identify, assess, and mitigate organizational risks to protect assets and ensure business continuity. Compliance Managers focus on ensuring adherence to laws, regulations, and internal policies to prevent legal issues and maintain corporate integrity. Both roles collaborate closely, with Risk Managers addressing potential threats and Compliance Managers enforcing regulatory standards.

Required Skills and Competencies

Risk Managers require strong analytical skills, proficiency in risk assessment tools, and expertise in financial modeling to identify, evaluate, and mitigate potential threats to an organization's assets. Compliance Managers excel in regulatory knowledge, attention to detail, and effective communication to ensure that company policies adhere to legal standards and industry regulations. Both roles demand problem-solving abilities and a solid understanding of business processes, but Risk Managers prioritize predictive analysis while Compliance Managers focus on adherence and monitoring.

Key Objectives and Deliverables

Risk Managers focus on identifying, assessing, and mitigating potential risks to protect organizational assets, with key deliverables including comprehensive risk assessments, mitigation strategies, and risk registers. Compliance Managers ensure adherence to regulatory requirements, internal policies, and industry standards, delivering compliance audits, regulatory reports, and policy updates. Both roles collaborate to create a secure and compliant operational environment but differ in scope: Risk Managers prioritize risk reduction and prevention, while Compliance Managers emphasize regulatory conformity and control implementation.

Overlapping Duties and Distinct Functions

Risk Managers and Compliance Managers both play critical roles in safeguarding an organization, with overlapping duties that include identifying potential risks, developing mitigation strategies, and ensuring adherence to internal policies and external regulations. Risk Managers focus primarily on assessing and managing financial, operational, and strategic risks to minimize losses, while Compliance Managers concentrate on regulatory compliance, implementing control frameworks, and monitoring adherence to laws such as GDPR, SOX, and HIPAA. Their distinct functions complement each other by integrating risk management with regulatory compliance to create a comprehensive governance structure.

Typical Career Paths

Risk Managers often begin their careers in risk analysis, auditing, or finance roles, gradually advancing to positions such as Risk Analyst, Risk Consultant, and ultimately Risk Manager or Chief Risk Officer. Compliance Managers typically start in legal, regulatory affairs, or internal audit departments, moving through roles like Compliance Specialist and Compliance Officer before reaching senior positions such as Compliance Manager or Chief Compliance Officer. Both career paths require strong analytical skills, industry-specific knowledge, and experience in regulatory frameworks, but Risk Managers focus more on identifying and mitigating financial and operational risks, while Compliance Managers concentrate on ensuring adherence to laws and policies.

Tools and Technologies Utilized

Risk Managers utilize advanced risk assessment software, predictive analytics, and real-time monitoring tools to identify and mitigate potential threats to organizational assets. Compliance Managers rely on regulatory compliance management systems, audit management platforms, and automated reporting tools to ensure adherence to industry standards and legal requirements. Both roles leverage data visualization technologies and integrated dashboards to enhance decision-making and streamline risk and compliance workflows effectively.

Impact on Organizational Success

Risk Managers identify, assess, and mitigate potential threats that could disrupt business operations, enhancing organizational resilience and stability. Compliance Managers ensure adherence to laws, regulations, and internal policies, reducing legal risks and safeguarding corporate reputation. Both roles drive organizational success by fostering a secure, accountable, and sustainable operational environment.

Qualifications and Certifications Needed

Risk Managers typically require strong backgrounds in finance, business administration, or risk management, often supported by certifications such as Certified Risk Manager (CRM) or Financial Risk Manager (FRM). Compliance Managers usually hold degrees in law, business, or regulatory affairs, with key certifications including Certified Compliance & Ethics Professional (CCEP) and Certified Regulatory Compliance Manager (CRCM). Both roles benefit from project management skills and knowledge of industry-specific regulations to effectively mitigate organizational risks and ensure adherence to legal standards.

Trends and Future Outlook in Risk and Compliance Management

Risk Managers will increasingly leverage artificial intelligence and predictive analytics to identify and mitigate potential threats proactively, enhancing organizational resilience. Compliance Managers are expected to prioritize automation and real-time monitoring tools to ensure adherence to evolving regulatory frameworks across diverse jurisdictions. The convergence of risk and compliance functions driven by integrated technology platforms will create more cohesive strategies for enterprise governance and decision-making.

Risk Manager vs Compliance Manager Infographic

jobdiv.com

jobdiv.com