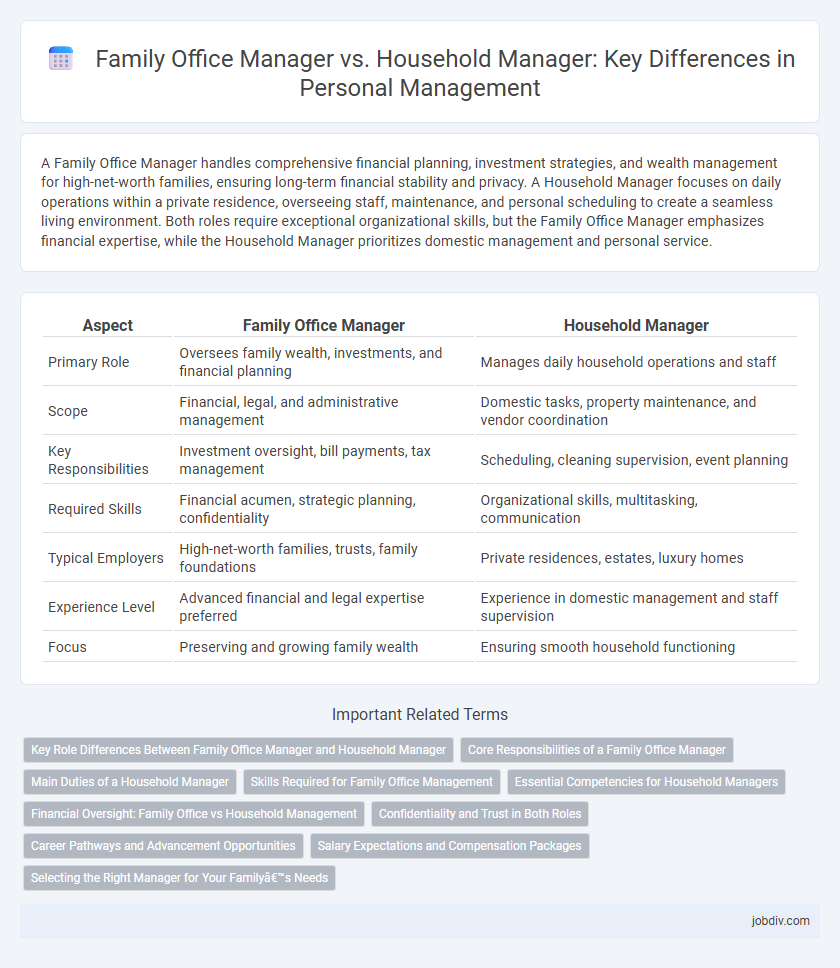

A Family Office Manager handles comprehensive financial planning, investment strategies, and wealth management for high-net-worth families, ensuring long-term financial stability and privacy. A Household Manager focuses on daily operations within a private residence, overseeing staff, maintenance, and personal scheduling to create a seamless living environment. Both roles require exceptional organizational skills, but the Family Office Manager emphasizes financial expertise, while the Household Manager prioritizes domestic management and personal service.

Table of Comparison

| Aspect | Family Office Manager | Household Manager |

|---|---|---|

| Primary Role | Oversees family wealth, investments, and financial planning | Manages daily household operations and staff |

| Scope | Financial, legal, and administrative management | Domestic tasks, property maintenance, and vendor coordination |

| Key Responsibilities | Investment oversight, bill payments, tax management | Scheduling, cleaning supervision, event planning |

| Required Skills | Financial acumen, strategic planning, confidentiality | Organizational skills, multitasking, communication |

| Typical Employers | High-net-worth families, trusts, family foundations | Private residences, estates, luxury homes |

| Experience Level | Advanced financial and legal expertise preferred | Experience in domestic management and staff supervision |

| Focus | Preserving and growing family wealth | Ensuring smooth household functioning |

Key Role Differences Between Family Office Manager and Household Manager

Family Office Managers oversee comprehensive financial planning, investment management, and estate coordination for high-net-worth families, ensuring long-term wealth preservation and growth. Household Managers focus on managing daily domestic operations, including staff supervision, property maintenance, and event planning to maintain household efficiency and comfort. The key role difference lies in the strategic financial oversight by Family Office Managers versus the operational and hospitality responsibilities handled by Household Managers.

Core Responsibilities of a Family Office Manager

A Family Office Manager oversees comprehensive financial planning, investment strategies, and wealth preservation tailored to high-net-worth families, ensuring intergenerational asset growth and compliance with tax regulations. This role involves managing multiple service providers, coordinating legal, accounting, and philanthropic activities, and aligning financial goals with family values. Unlike a Household Manager, who focuses on daily domestic operations, the Family Office Manager ensures long-term financial governance and strategic wealth management.

Main Duties of a Household Manager

A Household Manager is responsible for overseeing daily household operations, including managing staff, coordinating schedules, and ensuring maintenance of the property. They handle budgeting for household expenses, procurement of supplies, and organizing events or family activities. Unlike a Family Office Manager who focuses on financial and investment management, the Household Manager ensures smooth running of the home environment and personal services.

Skills Required for Family Office Management

Family office managers require expertise in financial planning, investment management, and legal compliance to oversee complex family wealth and assets effectively. Household managers focus on organizational skills, staff coordination, and vendor relations to maintain smooth daily operations within a private residence. Strong communication, discretion, and strategic thinking are essential skills bridging both roles, ensuring personalized service and long-term family goals alignment.

Essential Competencies for Household Managers

Household Managers must demonstrate exceptional organizational skills, including scheduling, staff coordination, and budget management, to ensure seamless household operations. Proficiency in vendor relations and contract negotiation is essential for maintaining quality services and cost efficiency. Strong interpersonal communication and discretion are critical in managing family privacy while fostering trust and effective collaboration among household staff.

Financial Oversight: Family Office vs Household Management

A Family Office Manager oversees comprehensive financial strategies, including investment portfolios, tax planning, and wealth preservation for ultra-high-net-worth families. In contrast, a Household Manager focuses primarily on managing household budgets, vendor payments, and day-to-day expense tracking. The Family Office Manager requires expertise in financial markets and fiduciary responsibilities, while the Household Manager emphasizes operational financial oversight within a private residence.

Confidentiality and Trust in Both Roles

Family Office Managers and Household Managers both require a high level of confidentiality and trust, but the scope differs significantly. Family Office Managers handle sensitive financial information, investment strategies, and legal matters, demanding rigorous discretion and fiduciary responsibility. Household Managers focus on personal and domestic privacy, ensuring that intimate family details and daily routines remain secure and confidential.

Career Pathways and Advancement Opportunities

Family Office Managers often advance through finance, wealth management, or legal backgrounds, gaining expertise in investment strategies and estate planning, which opens pathways to executive roles within ultra-high-net-worth households or private wealth firms. Household Managers typically rise through hospitality or property management experience, developing skills in staff coordination, event planning, and home maintenance, leading to opportunities in luxury estate administration or senior domestic management. Both career paths offer specialization prospects, but Family Office Managers generally pursue broader financial oversight roles, while Household Managers focus on operational leadership within private residences.

Salary Expectations and Compensation Packages

Family office managers typically command higher salaries, often ranging from $100,000 to $250,000 annually, reflecting their extensive responsibilities in managing complex financial portfolios, investments, and multi-generational wealth. Household managers usually earn between $60,000 and $120,000 per year, with compensation packages that may include housing, bonuses, and benefits tied to overseeing domestic staff and daily operations of luxury estates. Both roles offer performance-based incentives, but family office managers are more likely to receive equity stakes or profit-sharing arrangements due to their involvement in strategic wealth management.

Selecting the Right Manager for Your Family’s Needs

Selecting the right manager for your family depends on the scope of responsibilities and expertise required. A Family Office Manager handles comprehensive financial planning, investment management, tax strategy, and legal affairs, essential for high-net-worth families with complex asset portfolios. In contrast, a Household Manager focuses on daily domestic operations, staff coordination, and property management, ideal for families prioritizing seamless household efficiency and lifestyle management.

Family Office Manager vs Household Manager Infographic

jobdiv.com

jobdiv.com