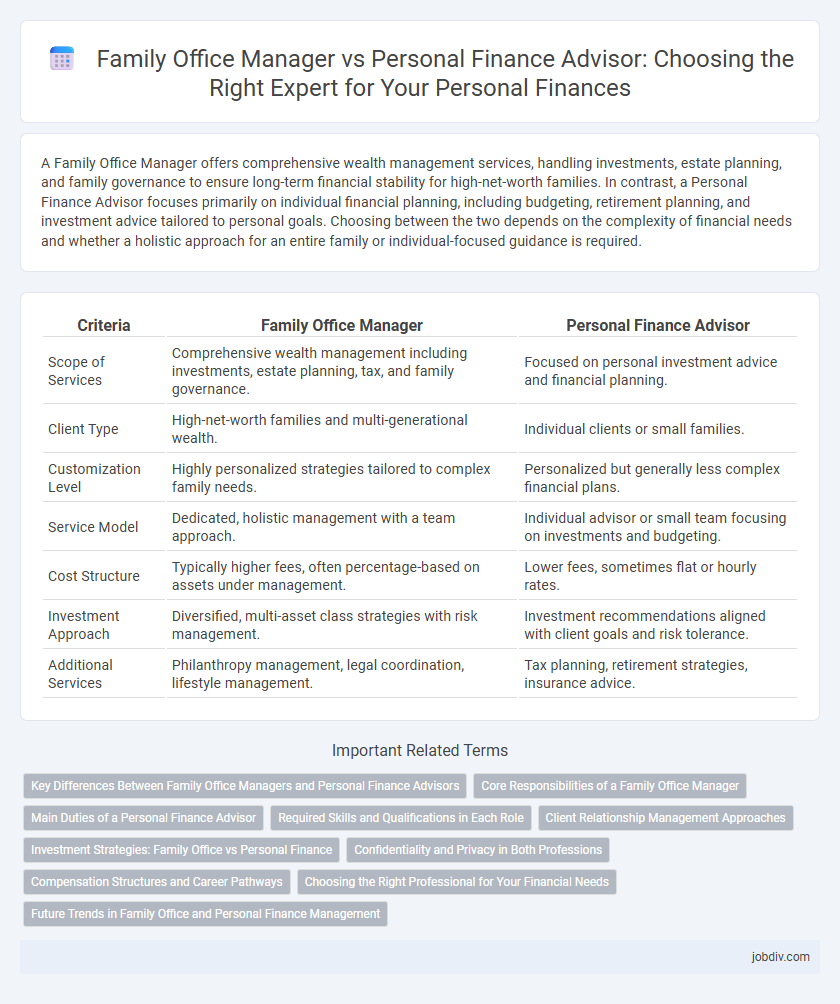

A Family Office Manager offers comprehensive wealth management services, handling investments, estate planning, and family governance to ensure long-term financial stability for high-net-worth families. In contrast, a Personal Finance Advisor focuses primarily on individual financial planning, including budgeting, retirement planning, and investment advice tailored to personal goals. Choosing between the two depends on the complexity of financial needs and whether a holistic approach for an entire family or individual-focused guidance is required.

Table of Comparison

| Criteria | Family Office Manager | Personal Finance Advisor |

|---|---|---|

| Scope of Services | Comprehensive wealth management including investments, estate planning, tax, and family governance. | Focused on personal investment advice and financial planning. |

| Client Type | High-net-worth families and multi-generational wealth. | Individual clients or small families. |

| Customization Level | Highly personalized strategies tailored to complex family needs. | Personalized but generally less complex financial plans. |

| Service Model | Dedicated, holistic management with a team approach. | Individual advisor or small team focusing on investments and budgeting. |

| Cost Structure | Typically higher fees, often percentage-based on assets under management. | Lower fees, sometimes flat or hourly rates. |

| Investment Approach | Diversified, multi-asset class strategies with risk management. | Investment recommendations aligned with client goals and risk tolerance. |

| Additional Services | Philanthropy management, legal coordination, lifestyle management. | Tax planning, retirement strategies, insurance advice. |

Key Differences Between Family Office Managers and Personal Finance Advisors

Family Office Managers oversee comprehensive wealth management for ultra-high-net-worth families, including investment strategy, estate planning, tax services, and philanthropic activities, ensuring a holistic approach tailored to multigenerational needs. Personal Finance Advisors primarily focus on individual clients' financial planning, investment management, retirement preparation, and budgeting, emphasizing goal-specific solutions. Unlike Personal Finance Advisors, Family Office Managers coordinate multiple specialized services under one umbrella to maintain and grow extensive family wealth across generations.

Core Responsibilities of a Family Office Manager

A Family Office Manager oversees comprehensive wealth management, coordinating investment strategies, tax planning, estate planning, and philanthropic activities for ultra-high-net-worth families. They manage multi-generational financial affairs, liaise with legal, tax, and investment professionals, and ensure seamless execution of family governance and reporting. Unlike Personal Finance Advisors who typically focus on individual financial planning, Family Office Managers deliver holistic, bespoke solutions tailored to the complex needs of family enterprises.

Main Duties of a Personal Finance Advisor

A Personal Finance Advisor primarily focuses on creating tailored financial plans, managing investments, and offering retirement and tax strategies to individuals. Unlike a Family Office Manager who oversees the comprehensive wealth and administrative needs of ultra-high-net-worth families, advisors concentrate on personalized goals such as budgeting, debt management, and risk assessment. Their expertise ensures clients optimize asset growth and achieve long-term financial security.

Required Skills and Qualifications in Each Role

A Family Office Manager requires expertise in wealth management, estate planning, tax optimization, and investment strategy, often backed by certifications such as CFA or CFP alongside extensive experience in managing high-net-worth family assets. Personal Finance Advisors need strong skills in financial planning, risk assessment, retirement strategies, and client relationship management, typically holding credentials like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Both roles demand excellent analytical abilities, communication skills, and a deep understanding of financial markets, but the Family Office Manager often requires more comprehensive knowledge of multi-generational wealth preservation and complex legal frameworks.

Client Relationship Management Approaches

Family Office Managers maintain deeply personalized and comprehensive client relationship management by overseeing multi-generational wealth, coordinating with various specialists to tailor holistic financial strategies. Personal Finance Advisors focus more on individual or nuclear family needs, emphasizing goal-oriented financial planning and regular progress reviews to adapt strategies dynamically. Both roles prioritize trust and confidentiality but differ in the complexity and scope of their client engagement models.

Investment Strategies: Family Office vs Personal Finance

Family Office Managers implement highly customized investment strategies tailored to ultra-high-net-worth families, incorporating diverse asset classes, direct investments, and generational wealth planning. Personal Finance Advisors primarily focus on individual or household portfolios, optimizing retirement accounts, mutual funds, and standard investment vehicles for wealth growth and risk management. The Family Office approach emphasizes long-term legacy preservation and multi-entity coordination, while Personal Finance strategies target achievable financial goals within shorter timespans.

Confidentiality and Privacy in Both Professions

Family Office Managers prioritize strict confidentiality and privacy, managing sensitive wealth information and personal matters for ultra-high-net-worth families with robust security protocols. Personal Finance Advisors maintain client privacy by adhering to fiduciary duties and regulatory standards, though their scope often involves less comprehensive data management. Both professions emphasize trust, but Family Office Managers typically handle more detailed, intimate financial and personal information, necessitating higher confidentiality measures.

Compensation Structures and Career Pathways

Family office managers typically receive a salary combined with performance bonuses aligned with managing high-net-worth family assets, while personal finance advisors often earn commissions and fees based on client portfolios and financial products. Career progression for family office managers often involves deepening expertise in wealth preservation, estate planning, and bespoke investment strategies, whereas personal finance advisors may advance by acquiring certifications such as CFP and expanding client bases. Both roles demand strong financial acumen, but family office managers tend to operate within a single family's wealth ecosystem, whereas personal finance advisors serve a broader range of clients.

Choosing the Right Professional for Your Financial Needs

Selecting between a Family Office Manager and a Personal Finance Advisor depends on the complexity and scope of your financial needs, as Family Office Managers offer comprehensive wealth management including estate planning, tax strategy, and philanthropy coordination. Personal Finance Advisors typically focus on investment advice, budgeting, and retirement planning for individuals or small families. Assessing your long-term goals, asset complexity, and desired level of personalized service helps determine the most suitable professional to optimize your financial well-being.

Future Trends in Family Office and Personal Finance Management

Family office managers are increasingly integrating advanced data analytics and AI-driven tools to offer personalized wealth strategies, distinguishing their services from traditional personal finance advisors. The trend toward holistic financial planning emphasizes multi-generational wealth preservation and impact investing within family offices, while personal finance advisors focus more on individual retirement planning and budgeting solutions. Technological advancements and evolving regulatory landscapes are driving both roles to adopt more proactive, customized approaches to financial management.

Family Office Manager vs Personal Finance Advisor Infographic

jobdiv.com

jobdiv.com