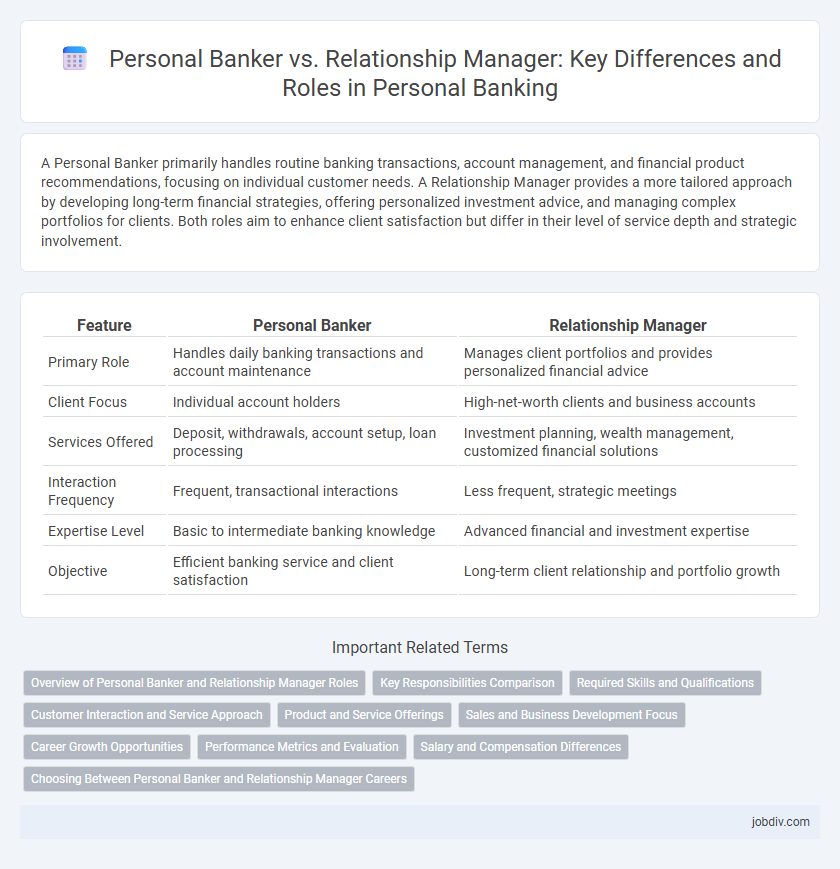

A Personal Banker primarily handles routine banking transactions, account management, and financial product recommendations, focusing on individual customer needs. A Relationship Manager provides a more tailored approach by developing long-term financial strategies, offering personalized investment advice, and managing complex portfolios for clients. Both roles aim to enhance client satisfaction but differ in their level of service depth and strategic involvement.

Table of Comparison

| Feature | Personal Banker | Relationship Manager |

|---|---|---|

| Primary Role | Handles daily banking transactions and account maintenance | Manages client portfolios and provides personalized financial advice |

| Client Focus | Individual account holders | High-net-worth clients and business accounts |

| Services Offered | Deposit, withdrawals, account setup, loan processing | Investment planning, wealth management, customized financial solutions |

| Interaction Frequency | Frequent, transactional interactions | Less frequent, strategic meetings |

| Expertise Level | Basic to intermediate banking knowledge | Advanced financial and investment expertise |

| Objective | Efficient banking service and client satisfaction | Long-term client relationship and portfolio growth |

Overview of Personal Banker and Relationship Manager Roles

Personal Bankers primarily focus on transactional services, assisting clients with account management, loans, and basic financial products to address everyday banking needs. Relationship Managers engage in a more consultative role, offering tailored financial advice, wealth management, and long-term planning to foster deeper client relationships. Both roles aim to enhance customer satisfaction, but Relationship Managers typically handle high-net-worth individuals requiring customized solutions.

Key Responsibilities Comparison

A Personal Banker primarily handles day-to-day banking needs such as account management, processing deposits and withdrawals, and providing financial product advice for retail clients. A Relationship Manager focuses on building long-term client relationships by offering tailored financial solutions, managing investment portfolios, and identifying opportunities for cross-selling complex banking services. While Personal Bankers emphasize transactional support, Relationship Managers prioritize strategic financial planning and client retention in high-net-worth segments.

Required Skills and Qualifications

Personal Bankers require strong customer service skills, knowledge of banking products, and proficiency in sales to effectively assist clients with personal accounts and transactions. Relationship Managers demand advanced communication abilities, financial analysis expertise, and a deep understanding of client portfolio management to cultivate long-term client relationships and provide tailored financial solutions. Both roles typically require a bachelor's degree in finance, business, or a related field, with Relationship Managers often needing more extensive experience and certifications such as CFA or CFP.

Customer Interaction and Service Approach

Personal bankers deliver tailored financial advice through proactive daily interactions, focusing on transactional efficiency and immediate customer needs. Relationship managers emphasize long-term client partnerships by offering holistic wealth management and personalized financial planning. Both roles prioritize customer satisfaction but differ in service scope and interaction depth.

Product and Service Offerings

Personal Bankers specialize in transactional products such as checking accounts, credit cards, and personal loans, offering tailored solutions for everyday banking needs. Relationship Managers focus on comprehensive financial planning and investment products like wealth management, estate planning, and business financing, catering to high-net-worth clients. Both roles prioritize personalized service, but Relationship Managers provide a broader range of advisory services beyond standard retail banking products.

Sales and Business Development Focus

Personal Bankers primarily focus on transactional sales, offering tailored financial products such as loans, credit cards, and savings accounts to meet individual client needs while driving branch revenue. Relationship Managers adopt a broader business development role, cultivating long-term partnerships through in-depth financial planning, cross-selling diverse investment products, and managing high-net-worth portfolios to enhance client loyalty and institutional growth. Effective sales strategies for Personal Bankers center on immediate product acquisition, whereas Relationship Managers prioritize strategic client engagement and portfolio expansion for sustainable revenue.

Career Growth Opportunities

Personal bankers often start with transactional roles, gaining foundational financial knowledge and customer service skills that pave the way for advancement into senior banking positions. Relationship managers focus on building long-term client portfolios, which can lead to higher earning potential and leadership roles in wealth management or corporate banking. Career growth opportunities in both roles depend on developing expertise in financial products, client acquisition, and risk management.

Performance Metrics and Evaluation

Personal bankers are evaluated primarily on transaction volumes, loan approvals, and customer account growth, emphasizing daily operational efficiency and sales targets. Relationship managers focus on client retention rates, portfolio growth, and the depth of client relationships, reflecting long-term value creation and strategic account management. Performance metrics for relationship managers include net promoter scores and cross-selling ratios, highlighting their role in fostering trust and expanding service adoption.

Salary and Compensation Differences

Personal bankers typically earn a base salary ranging from $40,000 to $65,000 annually, with additional bonuses tied to sales performance and customer acquisition. Relationship managers often command higher total compensation, averaging between $60,000 and $100,000 per year, due to broader client portfolio responsibilities and incentive-based commissions. The salary gap reflects the difference in scope, with relationship managers managing long-term client relationships and larger accounts, resulting in greater earning potential through performance bonuses and profit-sharing plans.

Choosing Between Personal Banker and Relationship Manager Careers

Choosing between a Personal Banker and a Relationship Manager career depends on your skills and interest in client interaction. Personal Bankers focus on transactional services, such as account management and financial product sales, while Relationship Managers prioritize long-term client relationships and personalized financial planning. Career growth in relationship management often involves deeper client trust and higher-value portfolios, whereas personal banking offers foundational banking experience and broader customer service.

Personal Banker vs Relationship Manager Infographic

jobdiv.com

jobdiv.com