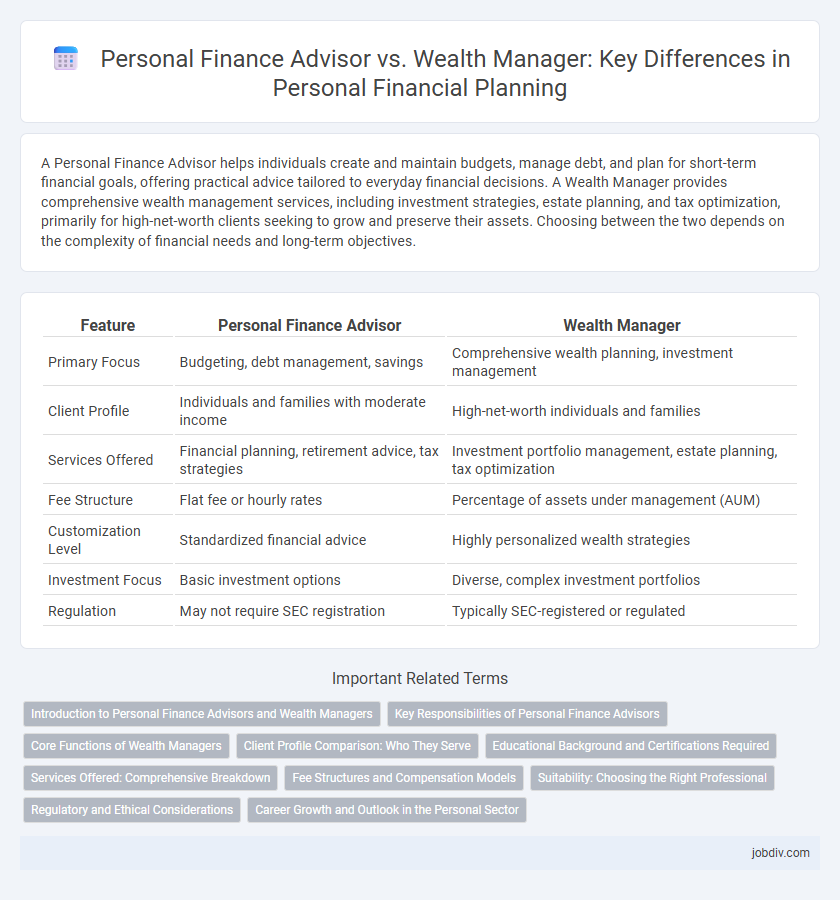

A Personal Finance Advisor helps individuals create and maintain budgets, manage debt, and plan for short-term financial goals, offering practical advice tailored to everyday financial decisions. A Wealth Manager provides comprehensive wealth management services, including investment strategies, estate planning, and tax optimization, primarily for high-net-worth clients seeking to grow and preserve their assets. Choosing between the two depends on the complexity of financial needs and long-term objectives.

Table of Comparison

| Feature | Personal Finance Advisor | Wealth Manager |

|---|---|---|

| Primary Focus | Budgeting, debt management, savings | Comprehensive wealth planning, investment management |

| Client Profile | Individuals and families with moderate income | High-net-worth individuals and families |

| Services Offered | Financial planning, retirement advice, tax strategies | Investment portfolio management, estate planning, tax optimization |

| Fee Structure | Flat fee or hourly rates | Percentage of assets under management (AUM) |

| Customization Level | Standardized financial advice | Highly personalized wealth strategies |

| Investment Focus | Basic investment options | Diverse, complex investment portfolios |

| Regulation | May not require SEC registration | Typically SEC-registered or regulated |

Introduction to Personal Finance Advisors and Wealth Managers

Personal Finance Advisors specialize in helping individuals create budgets, manage debt, and plan for short-term financial goals, offering tailored advice on savings, insurance, and retirement planning. Wealth Managers cater to high-net-worth clients, providing comprehensive services that include investment management, estate planning, tax optimization, and philanthropic strategies. Both professionals aim to enhance financial health, but Wealth Managers address more complex financial needs through integrated, long-term wealth preservation and growth plans.

Key Responsibilities of Personal Finance Advisors

Personal finance advisors specialize in creating tailored financial plans, managing budgets, and advising on investments, retirement planning, and debt management to help clients achieve short- and medium-term financial goals. Their key responsibilities include assessing clients' financial situations, recommending strategies for savings and insurance, and monitoring cash flow and expenses to ensure financial stability. Unlike wealth managers who generally focus on high-net-worth individuals and complex asset management, personal finance advisors prioritize practical guidance for everyday financial decisions.

Core Functions of Wealth Managers

Wealth managers provide comprehensive financial planning, investment management, tax optimization, and estate planning tailored to high-net-worth clients. Their core functions include coordinating a wide range of financial services to grow and protect client wealth over the long term. Wealth managers also offer personalized strategies addressing retirement planning, risk management, and legacy preservation, differentiating them from personal finance advisors.

Client Profile Comparison: Who They Serve

Personal finance advisors primarily serve individuals and families seeking guidance on budgeting, debt management, retirement planning, and daily financial decisions. Wealth managers cater to high-net-worth clients requiring comprehensive wealth preservation, investment strategies, tax planning, and estate planning. The client profile difference lies mainly in asset size and complexity, with personal finance advisors focusing on broader financial wellness and wealth managers addressing sophisticated financial needs.

Educational Background and Certifications Required

A Personal Finance Advisor typically holds a bachelor's degree in finance, accounting, or economics and may acquire certifications such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC) to demonstrate expertise in individual financial planning. Wealth Managers often possess advanced degrees like an MBA or a Master's in Finance and acquire certifications including Certified Wealth Strategist (CWS) or Chartered Financial Analyst (CFA) to manage high-net-worth clients' complex portfolios. Both roles require rigorous educational backgrounds and certifications to ensure proficiency in financial advice and asset management, with Wealth Managers usually emphasizing investment strategies and tax planning at a more sophisticated level.

Services Offered: Comprehensive Breakdown

Personal Finance Advisors provide tailored guidance on budgeting, debt management, retirement planning, and insurance needs, focusing on building a solid financial foundation. Wealth Managers offer a broader range of services including investment management, estate planning, tax optimization, and portfolio diversification aimed at affluent clients with complex financial situations. Both professionals aim to enhance financial well-being but differ significantly in scope, clientele, and strategic services delivered.

Fee Structures and Compensation Models

Personal finance advisors typically charge hourly rates, flat fees, or a percentage of assets under management (AUM), often ranging from 0.5% to 2% annually, aligning compensation directly with client investment size. Wealth managers usually adopt a similar AUM model but may include performance-based incentives or bundled service fees that encompass tax planning, estate guidance, and investment strategy. Transparent fee structures help clients weigh ongoing costs against the breadth of services offered by personal finance advisors and wealth managers.

Suitability: Choosing the Right Professional

A Personal Finance Advisor is best suited for individuals seeking guidance on budgeting, debt management, and retirement planning, offering tailored strategies for everyday financial decisions. Wealth Managers cater to high-net-worth clients who require comprehensive services, including investment management, estate planning, and tax optimization. Selecting the right professional depends on your asset complexity and financial goals, ensuring you receive expertise aligned with your specific financial needs.

Regulatory and Ethical Considerations

Personal Finance Advisors are typically regulated under state securities laws or insurance regulations, ensuring a fiduciary duty to act in clients' best interests, while Wealth Managers often face broader regulatory oversight due to managing larger investment portfolios and complex financial planning. Ethical considerations for both roles emphasize transparency, conflict of interest disclosures, and adherence to standards set by governing bodies like FINRA for advisors and the CFP Board for planners. Compliance with these regulations and ethical guidelines ensures protection for clients seeking tailored financial strategies or comprehensive wealth management services.

Career Growth and Outlook in the Personal Sector

Career growth for Personal Finance Advisors typically involves progressing from entry-level client advisory roles to senior planning positions, with an emphasis on certifications like CFP to enhance credibility. Wealth Managers often experience broader growth opportunities by managing high-net-worth client portfolios, integrating investment strategies, tax planning, and estate management. The outlook in the personal finance sector indicates strong demand for both roles, driven by increasing financial literacy and growing wealth accumulation in the retail market.

Personal Finance Advisor vs Wealth Manager Infographic

jobdiv.com

jobdiv.com