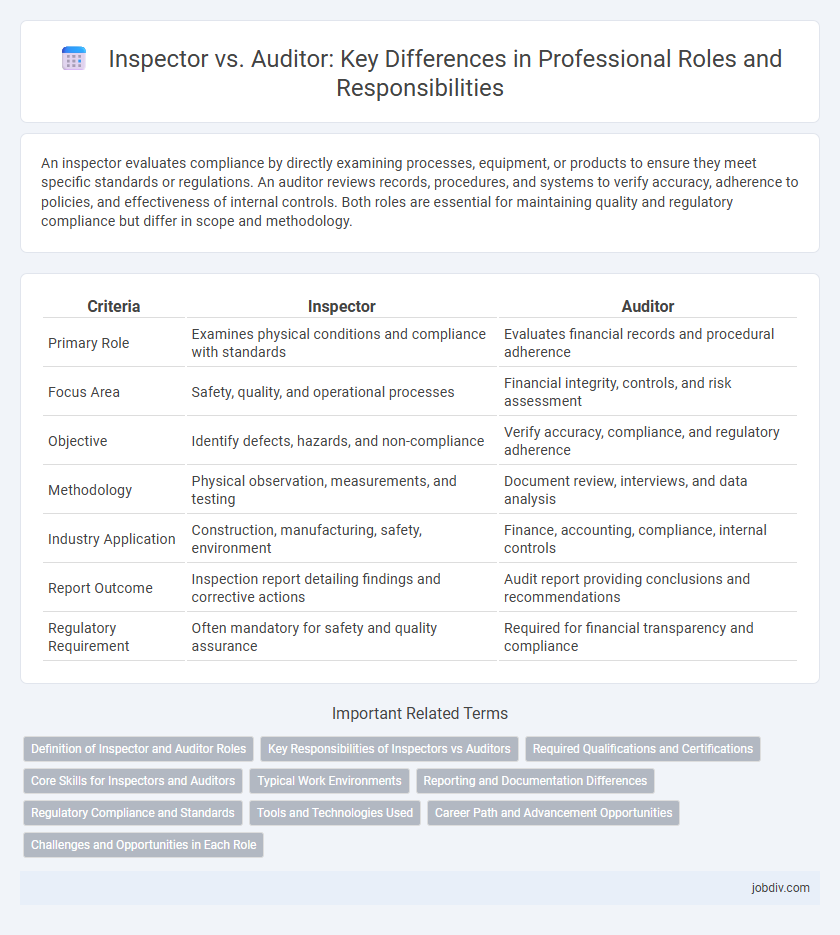

An inspector evaluates compliance by directly examining processes, equipment, or products to ensure they meet specific standards or regulations. An auditor reviews records, procedures, and systems to verify accuracy, adherence to policies, and effectiveness of internal controls. Both roles are essential for maintaining quality and regulatory compliance but differ in scope and methodology.

Table of Comparison

| Criteria | Inspector | Auditor |

|---|---|---|

| Primary Role | Examines physical conditions and compliance with standards | Evaluates financial records and procedural adherence |

| Focus Area | Safety, quality, and operational processes | Financial integrity, controls, and risk assessment |

| Objective | Identify defects, hazards, and non-compliance | Verify accuracy, compliance, and regulatory adherence |

| Methodology | Physical observation, measurements, and testing | Document review, interviews, and data analysis |

| Industry Application | Construction, manufacturing, safety, environment | Finance, accounting, compliance, internal controls |

| Report Outcome | Inspection report detailing findings and corrective actions | Audit report providing conclusions and recommendations |

| Regulatory Requirement | Often mandatory for safety and quality assurance | Required for financial transparency and compliance |

Definition of Inspector and Auditor Roles

Inspectors evaluate compliance with specific standards, regulations, or protocols through direct observation and testing, often in industries like manufacturing, construction, or health and safety. Auditors assess financial records, operational processes, or systems to ensure accuracy, transparency, and adherence to established policies, frequently within accounting, corporate governance, or regulatory frameworks. Both roles require specialized knowledge but differ in scope, with inspectors focusing on physical inspections and auditors emphasizing systematic evaluations.

Key Responsibilities of Inspectors vs Auditors

Inspectors primarily focus on examining physical conditions, processes, and compliance with safety or quality standards through on-site evaluations and inspections. Auditors concentrate on reviewing financial records, internal controls, and organizational adherence to regulatory requirements, ensuring accuracy and transparency in reporting. Both roles require detailed documentation, but inspectors emphasize operational conformity while auditors target fiscal integrity and procedural accountability.

Required Qualifications and Certifications

Inspectors typically require specialized certifications relevant to their industry, such as Certified Safety Inspector (CSI) or Certified Quality Auditor (CQA), emphasizing hands-on technical skills and compliance knowledge. Auditors often need credentials like Certified Internal Auditor (CIA) or Certified Public Accountant (CPA), highlighting expertise in financial analysis, risk assessment, and regulatory standards. Both roles demand strong attention to detail, analytical abilities, and adherence to professional standards, but auditors focus more on financial accuracy while inspectors prioritize operational and safety compliance.

Core Skills for Inspectors and Auditors

Inspectors excel in keen observation, adherence to regulatory standards, and meticulous documentation to identify non-compliance in physical environments. Auditors demonstrate strong analytical abilities, risk assessment expertise, and proficiency in financial or process evaluations to ensure accuracy and integrity in reports. Both roles require critical thinking and effective communication, yet inspectors focus more on operational compliance while auditors emphasize systematic review and verification.

Typical Work Environments

Inspectors typically operate in manufacturing plants, construction sites, and regulatory agencies where hands-on evaluation of processes, equipment, and adherence to safety standards is crucial. Auditors commonly work within corporate offices, financial institutions, and government bodies, conducting detailed reviews of financial records, compliance documentation, and operational procedures to ensure regulatory adherence and accuracy. Both roles demand strong analytical skills but differ in their primary focus on physical inspections versus document and process evaluations.

Reporting and Documentation Differences

Inspectors generate detailed reports emphasizing physical conditions, compliance status, and immediate corrective actions, often including visual evidence such as photographs. Auditors produce comprehensive documentation focused on financial data accuracy, regulatory adherence, and process evaluations, highlighting discrepancies and recommendations for system improvements. Reporting by inspectors is typically concise and observation-based, whereas auditors provide extensive narratives supported by data analysis and validation.

Regulatory Compliance and Standards

Inspectors assess regulatory compliance by conducting on-site evaluations to verify adherence to specific industry standards and identifying any deviations or risks. Auditors perform systematic reviews of documents, processes, and financial records to ensure organizational standards align with regulatory requirements and internal controls. Both roles are critical in maintaining transparency and ensuring continuous compliance within regulated industries.

Tools and Technologies Used

Inspectors primarily use specialized measurement instruments, visual inspection tools, and non-destructive testing (NDT) technologies like ultrasonic and radiographic devices to assess physical conditions and compliance. Auditors leverage data analytics software, automated audit management systems, and enterprise resource planning (ERP) tools to evaluate financial records, operational processes, and regulatory adherence. Both roles increasingly incorporate AI-driven technologies to enhance accuracy, efficiency, and risk detection capabilities in their respective assessments.

Career Path and Advancement Opportunities

Inspectors often begin their careers in specialized fields such as construction, manufacturing, or safety, with advancement opportunities leading to senior inspection roles or compliance management positions. Auditors typically start in accounting or finance and can progress to senior auditor, audit manager, or chief audit executive roles, often gaining credentials like CPA or CIA to enhance career growth. Both career paths offer potential transitions into consultancy, regulatory agencies, or corporate governance, leveraging their expertise in risk assessment and regulatory compliance.

Challenges and Opportunities in Each Role

Inspectors often face challenges related to maintaining compliance with strict regulatory standards and managing extensive documentation under tight deadlines, while auditors navigate complexities in evaluating financial records and identifying discrepancies within large datasets. Opportunities for inspectors include enhancing operational efficiency through advanced inspection technologies and real-time data collection, whereas auditors benefit from technological advancements in data analytics and artificial intelligence to improve risk assessment accuracy. Both roles demand strong attention to detail and evolving skill sets to adapt to regulatory changes and emerging industry trends.

Inspector vs Auditor Infographic

jobdiv.com

jobdiv.com