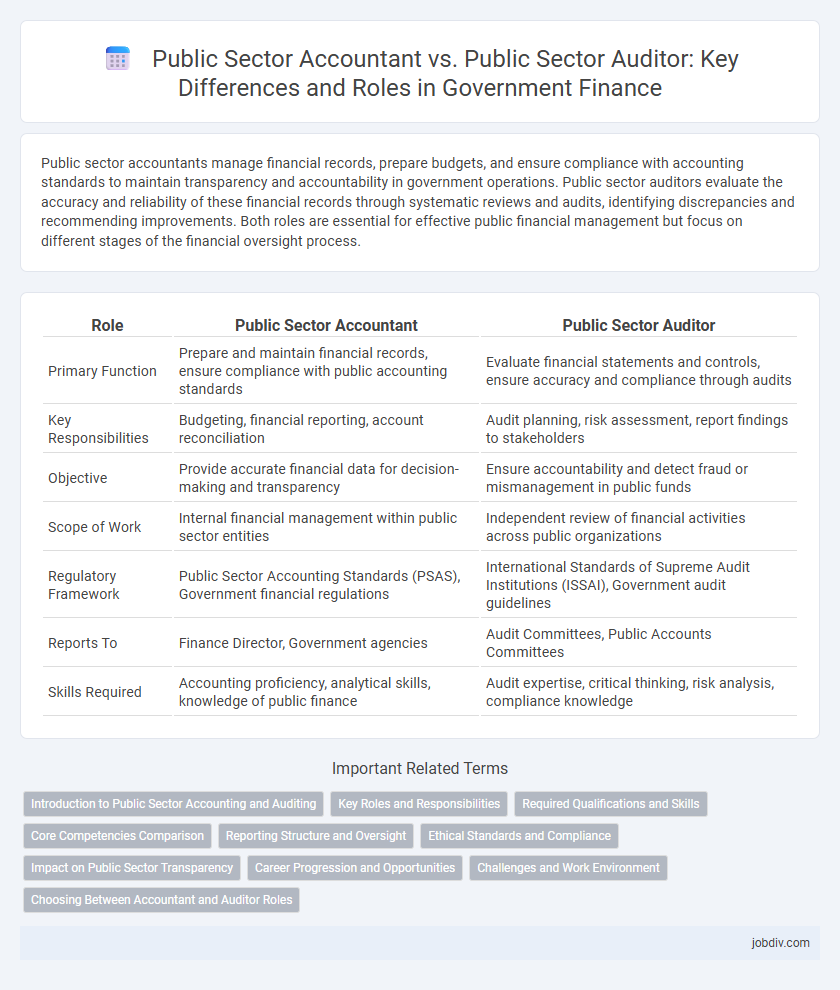

Public sector accountants manage financial records, prepare budgets, and ensure compliance with accounting standards to maintain transparency and accountability in government operations. Public sector auditors evaluate the accuracy and reliability of these financial records through systematic reviews and audits, identifying discrepancies and recommending improvements. Both roles are essential for effective public financial management but focus on different stages of the financial oversight process.

Table of Comparison

| Role | Public Sector Accountant | Public Sector Auditor |

|---|---|---|

| Primary Function | Prepare and maintain financial records, ensure compliance with public accounting standards | Evaluate financial statements and controls, ensure accuracy and compliance through audits |

| Key Responsibilities | Budgeting, financial reporting, account reconciliation | Audit planning, risk assessment, report findings to stakeholders |

| Objective | Provide accurate financial data for decision-making and transparency | Ensure accountability and detect fraud or mismanagement in public funds |

| Scope of Work | Internal financial management within public sector entities | Independent review of financial activities across public organizations |

| Regulatory Framework | Public Sector Accounting Standards (PSAS), Government financial regulations | International Standards of Supreme Audit Institutions (ISSAI), Government audit guidelines |

| Reports To | Finance Director, Government agencies | Audit Committees, Public Accounts Committees |

| Skills Required | Accounting proficiency, analytical skills, knowledge of public finance | Audit expertise, critical thinking, risk analysis, compliance knowledge |

Introduction to Public Sector Accounting and Auditing

Public Sector Accounting involves recording, classifying, and reporting financial transactions of government entities, ensuring transparency and accountability in the use of public funds. Public Sector Auditing examines and evaluates these financial records and systems to verify accuracy, compliance with laws, and efficiency in resource utilization. Both roles are critical in maintaining fiscal discipline and promoting good governance within public institutions.

Key Roles and Responsibilities

Public Sector Accountants manage financial records, prepare budgets, and ensure compliance with government accounting standards to maintain transparency and fiscal accountability. Public Sector Auditors conduct independent evaluations of financial statements, assess internal controls, and verify adherence to regulatory policies to detect fraud and improve efficiency. Both roles are essential for safeguarding public funds and promoting ethical financial management within government agencies.

Required Qualifications and Skills

Public sector accountants typically require a bachelor's degree in accounting or finance, along with certifications such as CPA (Certified Public Accountant) to ensure proficiency in financial reporting, budgeting, and compliance with government regulations. Public sector auditors must possess rigorous analytical skills and a strong understanding of auditing standards, often mandating certifications like CIA (Certified Internal Auditor) or CISA (Certified Information Systems Auditor) to conduct thorough examinations of financial statements and internal controls. Both roles demand expertise in government accounting principles, strong attention to detail, and the ability to interpret complex regulatory frameworks for effective public financial management.

Core Competencies Comparison

Public Sector Accountants specialize in financial reporting, budgeting, and ensuring compliance with government accounting standards, excelling in accuracy and financial data management. Public Sector Auditors focus on evaluating internal controls, risk assessment, and regulatory compliance, demonstrating expertise in detecting fraud and improving operational efficiency. Both roles require strong analytical skills, knowledge of public financial regulations, and proficiency in government accounting software.

Reporting Structure and Oversight

Public Sector Accountants report to finance managers or chief accountants, ensuring accuracy in financial records and compliance with government regulations. Public Sector Auditors typically operate within independent audit offices or oversight bodies, providing objective evaluations of financial statements and operational efficiency. The reporting structure for auditors emphasizes independence to maintain impartial oversight, whereas accountants are integrated within departmental finance teams.

Ethical Standards and Compliance

Public Sector Accountants ensure accurate financial reporting and adherence to governmental accounting standards, maintaining transparency and accountability in public funds management. Public Sector Auditors independently evaluate compliance with ethical guidelines, internal controls, and statutory regulations to detect fraud and mismanagement. Both roles uphold integrity by enforcing strict ethical standards to safeguard public trust and promote fiscal responsibility.

Impact on Public Sector Transparency

Public sector accountants play a critical role in enhancing transparency by accurately recording and reporting government financial data, ensuring budgetary compliance and fiscal responsibility. Public sector auditors independently verify these financial records, identifying discrepancies and promoting accountability through comprehensive audits and performance evaluations. Together, their efforts significantly strengthen public trust and improve the transparency of government operations.

Career Progression and Opportunities

Public sector accountants typically advance through roles such as junior accountant, senior accountant, and finance manager, focusing on budgeting, financial reporting, and compliance within government agencies. Public sector auditors progress from audit associate to senior auditor and audit manager, specializing in evaluating government financial operations, ensuring accountability, and detecting fraud. Career opportunities for accountants often involve financial planning and policy advisory positions, while auditors may transition to risk management, internal control consulting, or external audit firms serving public institutions.

Challenges and Work Environment

Public Sector Accountants often face challenges like managing complex government budgets and ensuring compliance with stringent financial regulations, working in structured environments with high accountability. Public Sector Auditors encounter difficulties in detecting fraud and inefficiencies within diverse public programs, requiring thorough investigative skills and adaptability in dynamic audit settings. Both roles demand strong analytical abilities and resilience in environments dominated by public scrutiny and regulatory oversight.

Choosing Between Accountant and Auditor Roles

Choosing between a public sector accountant and auditor depends on career interests and skills; accountants focus on preparing and managing financial records, ensuring compliance with governmental regulations, and budgeting, whereas auditors specialize in examining financial statements, assessing internal controls, and detecting fraud or discrepancies. Public sector accountants typically work on ongoing financial management tasks crucial for transparent public service budgeting, while auditors provide independent evaluations that reinforce accountability and trust in public institutions. Understanding the distinct responsibilities and impact of each role aids professionals in aligning their career goals with public sector financial oversight needs.

Public Sector Accountant vs Public Sector Auditor Infographic

jobdiv.com

jobdiv.com