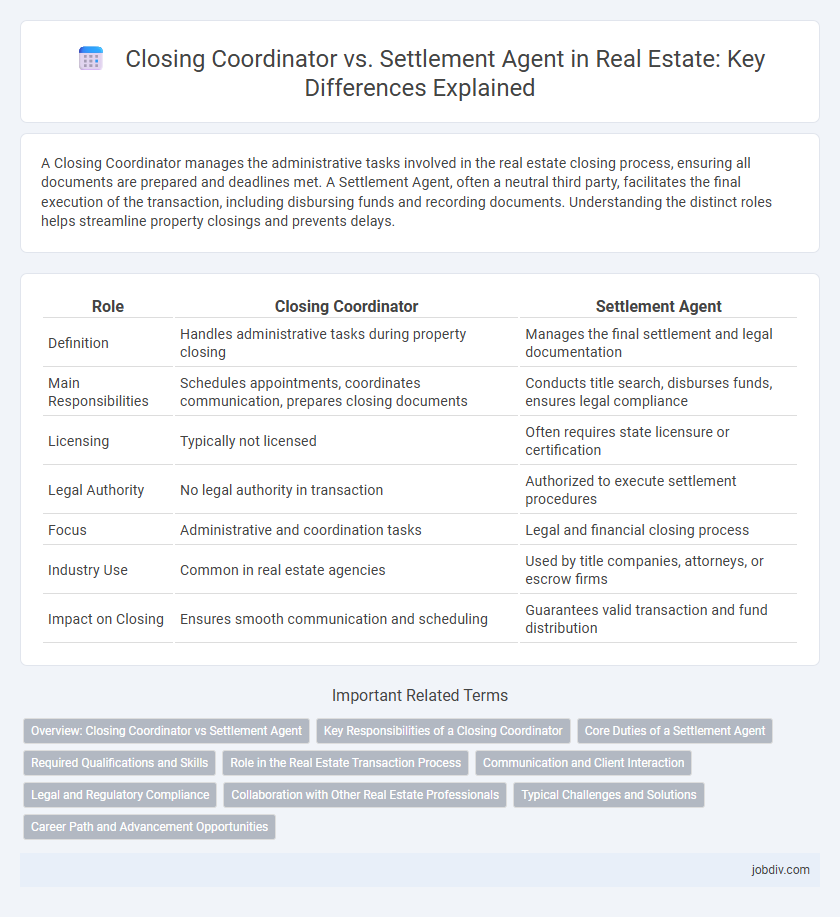

A Closing Coordinator manages the administrative tasks involved in the real estate closing process, ensuring all documents are prepared and deadlines met. A Settlement Agent, often a neutral third party, facilitates the final execution of the transaction, including disbursing funds and recording documents. Understanding the distinct roles helps streamline property closings and prevents delays.

Table of Comparison

| Role | Closing Coordinator | Settlement Agent |

|---|---|---|

| Definition | Handles administrative tasks during property closing | Manages the final settlement and legal documentation |

| Main Responsibilities | Schedules appointments, coordinates communication, prepares closing documents | Conducts title search, disburses funds, ensures legal compliance |

| Licensing | Typically not licensed | Often requires state licensure or certification |

| Legal Authority | No legal authority in transaction | Authorized to execute settlement procedures |

| Focus | Administrative and coordination tasks | Legal and financial closing process |

| Industry Use | Common in real estate agencies | Used by title companies, attorneys, or escrow firms |

| Impact on Closing | Ensures smooth communication and scheduling | Guarantees valid transaction and fund distribution |

Overview: Closing Coordinator vs Settlement Agent

A Closing Coordinator manages the administrative tasks and communication between parties to ensure a smooth real estate transaction, handling paperwork and scheduling. A Settlement Agent, often a licensed professional or attorney, oversees the actual closing process, including the disbursement of funds and legal documentation execution. Both roles are crucial but differ in scope, with the Closing Coordinator focusing on coordination and the Settlement Agent ensuring compliance and finalizing the sale.

Key Responsibilities of a Closing Coordinator

A Closing Coordinator manages all logistical aspects of the real estate closing, including scheduling inspections, coordinating with lenders, title companies, and escrow agents, and preparing necessary documents to ensure a smooth transaction. They serve as the primary point of contact for all parties involved, tracking deadlines and facilitating communication to prevent delays. Unlike a Settlement Agent who oversees the actual funds disbursement and legal closing, the Closing Coordinator focuses on administrative coordination and procedural compliance throughout the closing process.

Core Duties of a Settlement Agent

A Settlement Agent primarily manages the final stages of a real estate transaction, including document preparation, title verification, and coordinating the transfer of funds to ensure a smooth closing process. They are responsible for ensuring compliance with local laws, overseeing the signing of all required documents, and distributing keys and property deeds to new owners. Unlike Closing Coordinators who focus on scheduling and administrative tasks, Settlement Agents handle the legal and financial complexities critical to closing escrow successfully.

Required Qualifications and Skills

Closing Coordinators require strong organizational skills, attention to detail, and proficiency in managing real estate transaction documents, typically holding certifications such as Certified Closing Coordinator (CCC). Settlement Agents must possess in-depth knowledge of local real estate laws, title insurance, and escrow procedures, often being licensed attorneys or title company representatives with formal training in settlement processes. Both roles demand excellent communication skills and the ability to resolve issues promptly to ensure smooth property closings.

Role in the Real Estate Transaction Process

A Closing Coordinator manages communication between buyers, sellers, and agents, ensuring all documents are prepared and deadlines met for a smooth real estate transaction. A Settlement Agent, often a title company or attorney, handles the legal and financial aspects, including title searches, escrow management, and disbursement of funds at closing. Both roles are crucial, with the coordinator focused on logistics and client coordination, while the agent ensures legal compliance and finalizes the transfer of property ownership.

Communication and Client Interaction

Closing Coordinators specialize in managing communication among lenders, agents, and clients to ensure all documentation is accurate and deadlines are met. Settlement Agents focus on facilitating the final transaction, interacting directly with buyers and sellers to confirm funds transfer and legal compliance. Effective communication from both roles is crucial for a seamless real estate closing experience.

Legal and Regulatory Compliance

Closing Coordinators ensure real estate transactions comply with contract terms but do not provide legal advice or oversee regulatory compliance. Settlement Agents hold fiduciary responsibility for handling funds and recording legal documents, ensuring strict adherence to state laws and regulations throughout the closing process. Understanding the distinct legal roles protects all parties and mitigates risks of noncompliance in property transfers.

Collaboration with Other Real Estate Professionals

Closing coordinators maintain seamless communication with real estate agents, lenders, and title companies to ensure all necessary documents are prepared and deadlines met. Settlement agents collaborate closely with escrow officers, attorneys, and mortgage brokers to facilitate the final transaction, verifying funds and managing legal requirements. Both roles require effective teamwork to guarantee a smooth, timely closing process in real estate transactions.

Typical Challenges and Solutions

Closing coordinators often face challenges managing communication between multiple parties, leading to delays and errors in document handling. Settlement agents frequently encounter issues with ensuring compliance and accuracy in final transaction settlements, which can cause last-minute complications. Streamlining workflows through integrated software systems and clear role definitions effectively minimizes miscommunication and enhances the accuracy of closing procedures.

Career Path and Advancement Opportunities

Closing coordinators typically begin their careers handling administrative tasks and document preparation, offering a solid foundation in real estate transactions. Settlement agents often advance by obtaining certifications and licenses, enabling them to oversee the legal and financial aspects of closing deals. Career progression for settlement agents can lead to roles such as escrow officers or title company managers, while closing coordinators may move into project management or real estate brokerage support positions.

Closing Coordinator vs Settlement Agent Infographic

jobdiv.com

jobdiv.com