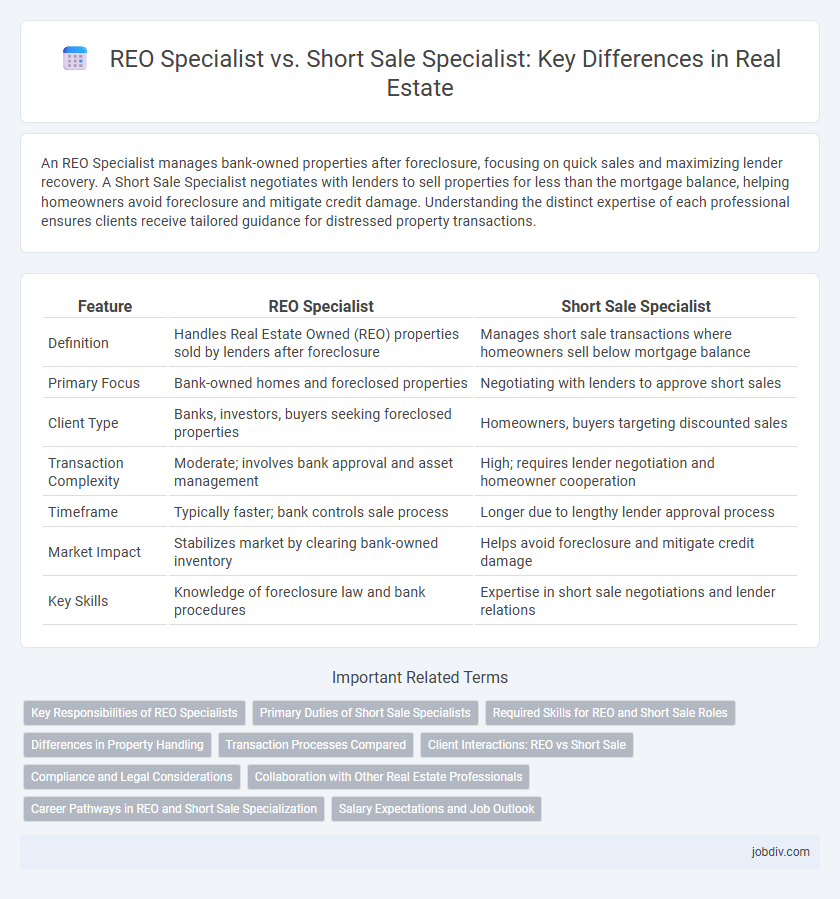

An REO Specialist manages bank-owned properties after foreclosure, focusing on quick sales and maximizing lender recovery. A Short Sale Specialist negotiates with lenders to sell properties for less than the mortgage balance, helping homeowners avoid foreclosure and mitigate credit damage. Understanding the distinct expertise of each professional ensures clients receive tailored guidance for distressed property transactions.

Table of Comparison

| Feature | REO Specialist | Short Sale Specialist |

|---|---|---|

| Definition | Handles Real Estate Owned (REO) properties sold by lenders after foreclosure | Manages short sale transactions where homeowners sell below mortgage balance |

| Primary Focus | Bank-owned homes and foreclosed properties | Negotiating with lenders to approve short sales |

| Client Type | Banks, investors, buyers seeking foreclosed properties | Homeowners, buyers targeting discounted sales |

| Transaction Complexity | Moderate; involves bank approval and asset management | High; requires lender negotiation and homeowner cooperation |

| Timeframe | Typically faster; bank controls sale process | Longer due to lengthy lender approval process |

| Market Impact | Stabilizes market by clearing bank-owned inventory | Helps avoid foreclosure and mitigate credit damage |

| Key Skills | Knowledge of foreclosure law and bank procedures | Expertise in short sale negotiations and lender relations |

Key Responsibilities of REO Specialists

REO specialists manage properties owned by lenders after foreclosure, handling property acquisition, maintenance, and resale to maximize lender recovery. They coordinate inspections, repairs, and marketing efforts while ensuring compliance with real estate laws and lender guidelines. These experts focus on streamlining the asset disposition process to minimize losses and expedite property turnover.

Primary Duties of Short Sale Specialists

Short Sale Specialists primarily negotiate with lenders to approve property sales below the outstanding mortgage balance, facilitating transactions for homeowners facing financial hardship. They analyze financial documents to prepare hardship packages that demonstrate borrowers' inability to repay their loans, ensuring lender cooperation. Their expertise includes managing timelines and communications to navigate the complexities of short sale approvals efficiently.

Required Skills for REO and Short Sale Roles

REO specialists require expertise in property valuation, foreclosure processes, and negotiation skills to manage bank-owned real estate efficiently. Short sale specialists must excel in lender communication, financial analysis, and buyer qualification to facilitate transactions that avoid foreclosure. Both roles demand strong knowledge of local real estate laws and market trends to maximize transaction success.

Differences in Property Handling

REO specialists manage bank-owned properties after foreclosure, focusing on securing, repairing, and marketing homes to investors or buyers. Short sale specialists negotiate with lenders to approve sales below the mortgage balance, working closely with distressed homeowners to avoid foreclosure. These distinct approaches affect timelines, approval processes, and the condition of properties available in the real estate market.

Transaction Processes Compared

REO specialists manage real estate owned properties that have reverted to lenders after foreclosure, streamlining transactions through direct bank negotiations and standardized approval processes, often leading to quicker closings. Short sale specialists handle properties where the sale price is less than the mortgage balance, requiring coordination with multiple lien holders and extensive lender approval, which can prolong the transaction timeline. Both roles demand expertise in negotiating with financial institutions, but REO transactions typically involve fewer contingencies and reduced risk of last-minute denials compared to short sales.

Client Interactions: REO vs Short Sale

An REO specialist manages bank-owned properties, offering clients streamlined transactions with less negotiation since the lender holds the title. A short sale specialist guides clients through lender negotiations to approve sales below mortgage balances, requiring careful communication and documentation. Client interactions with REO specialists are generally faster and more predictable, whereas short sale specialists provide more personalized support to navigate complex approval processes.

Compliance and Legal Considerations

REO Specialists navigate foreclosure properties owned by lenders, requiring strict adherence to bank regulations, eviction laws, and disclosure requirements to ensure compliance throughout the transaction. Short Sale Specialists handle properties under mortgage default, where legal considerations involve lender approval, negotiating debt reductions, and managing potential deficiency judgments. Both roles demand comprehensive knowledge of state-specific foreclosure laws and federal regulations such as RESPA and TILA to mitigate legal risks and protect client interests.

Collaboration with Other Real Estate Professionals

REO specialists collaborate closely with lenders, asset managers, and foreclosure attorneys to efficiently manage bank-owned properties, ensuring smooth transaction processes. Short sale specialists work directly with homeowners, mortgage servicers, and real estate agents to negotiate debt reductions and secure lender approvals. Effective communication between these professionals is essential to expedite sales and maximize value for all parties involved.

Career Pathways in REO and Short Sale Specialization

REO Specialists focus on managing real estate owned properties, often working with banks and lenders to streamline foreclosed property sales, which requires expertise in asset management and foreclosure regulations. Short Sale Specialists negotiate with lenders and buyers to facilitate sales that prevent foreclosure, demanding strong skills in negotiation and financial analysis. Career pathways in these specializations lead to roles in mortgage servicing companies, real estate investment firms, and financial institutions, offering opportunities for advancement in asset disposition and distressed property management.

Salary Expectations and Job Outlook

REO specialists typically earn higher salaries, averaging between $60,000 and $90,000 annually, due to their focus on bank-owned properties and complex foreclosure processes. Short sale specialists often make between $50,000 and $75,000, reflecting the negotiation skills and market knowledge required to manage distressed property sales effectively. Job outlook for REO specialists remains strong because of consistent foreclosure rates, while short sale specialists face fluctuating demand tied to economic cycles and housing market conditions.

REO Specialist vs Short Sale Specialist Infographic

jobdiv.com

jobdiv.com