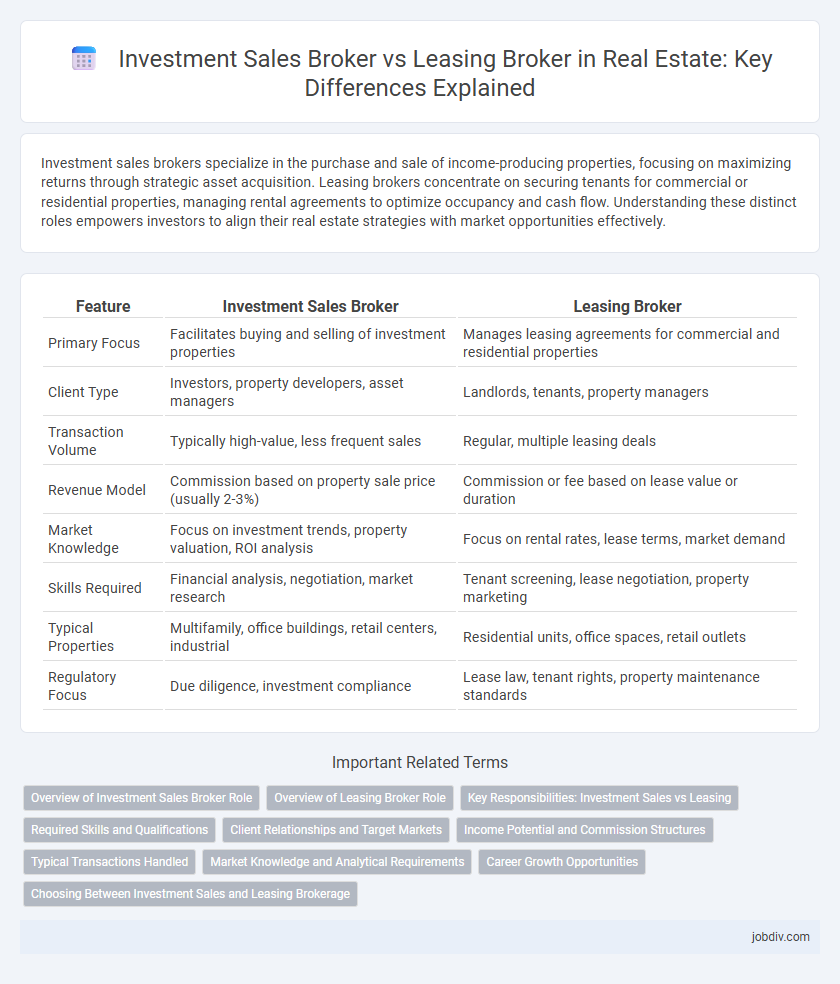

Investment sales brokers specialize in the purchase and sale of income-producing properties, focusing on maximizing returns through strategic asset acquisition. Leasing brokers concentrate on securing tenants for commercial or residential properties, managing rental agreements to optimize occupancy and cash flow. Understanding these distinct roles empowers investors to align their real estate strategies with market opportunities effectively.

Table of Comparison

| Feature | Investment Sales Broker | Leasing Broker |

|---|---|---|

| Primary Focus | Facilitates buying and selling of investment properties | Manages leasing agreements for commercial and residential properties |

| Client Type | Investors, property developers, asset managers | Landlords, tenants, property managers |

| Transaction Volume | Typically high-value, less frequent sales | Regular, multiple leasing deals |

| Revenue Model | Commission based on property sale price (usually 2-3%) | Commission or fee based on lease value or duration |

| Market Knowledge | Focus on investment trends, property valuation, ROI analysis | Focus on rental rates, lease terms, market demand |

| Skills Required | Financial analysis, negotiation, market research | Tenant screening, lease negotiation, property marketing |

| Typical Properties | Multifamily, office buildings, retail centers, industrial | Residential units, office spaces, retail outlets |

| Regulatory Focus | Due diligence, investment compliance | Lease law, tenant rights, property maintenance standards |

Overview of Investment Sales Broker Role

Investment sales brokers specialize in marketing and selling income-producing properties, focusing on maximizing returns for investors through thorough market analysis, valuation, and negotiation. Their expertise includes handling complex transactions involving commercial real estate, multifamily, retail, and industrial assets, often managing due diligence and financial modeling. Investment brokers play a crucial role in advising clients on market trends, risk assessment, and portfolio diversification strategies to optimize investment performance.

Overview of Leasing Broker Role

A leasing broker specializes in securing tenants for commercial or residential properties, managing lease negotiations, and ensuring occupancy rates remain high to maximize owner revenue. They analyze market trends, conduct property tours, and prepare lease agreements tailored to client needs. Their expertise in tenant relations and lease structuring directly impacts portfolio performance and asset value in competitive real estate markets.

Key Responsibilities: Investment Sales vs Leasing

Investment sales brokers specialize in the acquisition and disposition of income-producing properties, conducting market analysis, financial underwriting, and negotiating sale contracts to maximize investment returns. Leasing brokers focus on tenant representation or landlord leasing, managing lease negotiations, renewal agreements, and space optimization to enhance occupancy rates and cash flow. Both roles require deep market knowledge, but investment sales demand expertise in capital markets, whereas leasing emphasizes tenant-landlord relationship management.

Required Skills and Qualifications

Investment sales brokers require strong financial analysis skills, deep knowledge of market trends, and expertise in structuring complex transactions to maximize property value and return on investment. Leasing brokers focus on excellent negotiation abilities, tenant relationship management, and understanding lease agreements to secure optimal occupancy rates and rental terms. Both roles demand strong communication skills and a thorough understanding of local real estate laws and regulations.

Client Relationships and Target Markets

Investment sales brokers specialize in transactions involving property acquisitions and dispositions, cultivating long-term relationships with investors, institutional clients, and fund managers who prioritize asset appreciation and capital growth. Leasing brokers focus on securing tenants for commercial or residential properties, maintaining strong connections with property owners, property managers, and occupiers seeking flexible space solutions and occupancy stability. Both brokers tailor their client engagement strategies to address the unique demands of their target markets, ensuring value creation and sustained portfolio performance.

Income Potential and Commission Structures

Investment sales brokers typically earn higher commissions due to larger transaction values, often receiving 2-3% of the sale price, which can result in substantial income from single deals. Leasing brokers usually work with lower commission rates, often a percentage of the lease value spread over the lease term, leading to steady but comparatively lower income streams. The income potential of investment sales brokers is more variable but can be significantly higher during active market cycles, whereas leasing brokers benefit from consistent, recurring commissions.

Typical Transactions Handled

Investment sales brokers primarily handle transactions involving the purchase and sale of income-producing properties such as office buildings, retail centers, and multifamily complexes. Leasing brokers specialize in securing tenants for commercial spaces, negotiating lease agreements for office, industrial, and retail properties. Both roles require expertise in market analysis and client representation but differ in transaction focus, with investment sales centered on ownership transfer and leasing brokers focused on occupancy agreements.

Market Knowledge and Analytical Requirements

Investment sales brokers must possess in-depth market knowledge to assess property values, identify investment opportunities, and analyze financial performance metrics such as cap rates and ROI, enabling precise valuations and strategic sales. Leasing brokers require expertise in market rent trends, tenant demand, and lease terms, focusing on vacancy rates, absorption data, and competitive positioning to maximize occupancy and rental income. Analytical skills for investment sales emphasize financial modeling and market forecasting, while leasing brokers prioritize tenant mix analysis and lease comparables to optimize lease negotiations and portfolio performance.

Career Growth Opportunities

Investment sales brokers in real estate typically experience faster career growth due to higher commission structures and the complexity of large-scale property transactions, attracting professionals aiming for substantial financial rewards and leadership roles. Leasing brokers often face steadier but slower career progression, focusing on volume-based deals with frequent client interactions that build long-term relationships and market expertise. Choosing between these paths depends on prioritizing either rapid advancement in high-stake environments or consistent growth through client service and market knowledge development.

Choosing Between Investment Sales and Leasing Brokerage

Investment sales brokers specialize in transactions involving the purchase and sale of income-producing properties, focusing on maximizing return on investment and analyzing market trends. Leasing brokers facilitate tenant representation and landlord leasing transactions, prioritizing occupancy rates and lease term negotiations to optimize property cash flow. Selecting between investment sales and leasing brokerage depends on client goals, whether targeting capital appreciation through property acquisition or steady income through lease management.

Investment Sales Broker vs Leasing Broker Infographic

jobdiv.com

jobdiv.com