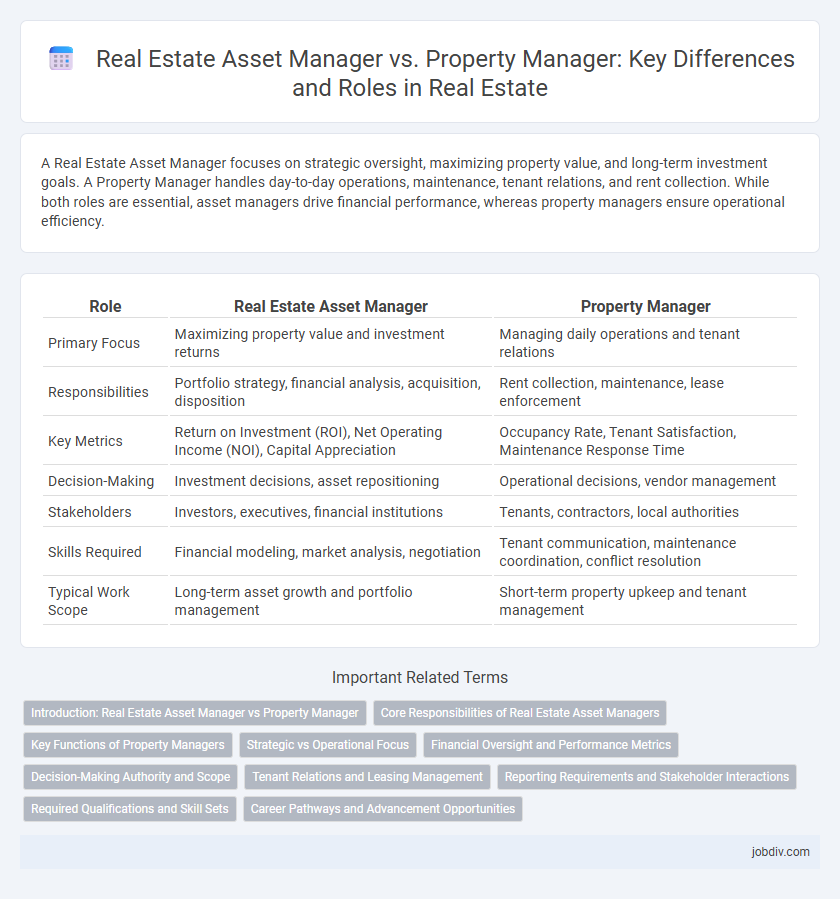

A Real Estate Asset Manager focuses on strategic oversight, maximizing property value, and long-term investment goals. A Property Manager handles day-to-day operations, maintenance, tenant relations, and rent collection. While both roles are essential, asset managers drive financial performance, whereas property managers ensure operational efficiency.

Table of Comparison

| Role | Real Estate Asset Manager | Property Manager |

|---|---|---|

| Primary Focus | Maximizing property value and investment returns | Managing daily operations and tenant relations |

| Responsibilities | Portfolio strategy, financial analysis, acquisition, disposition | Rent collection, maintenance, lease enforcement |

| Key Metrics | Return on Investment (ROI), Net Operating Income (NOI), Capital Appreciation | Occupancy Rate, Tenant Satisfaction, Maintenance Response Time |

| Decision-Making | Investment decisions, asset repositioning | Operational decisions, vendor management |

| Stakeholders | Investors, executives, financial institutions | Tenants, contractors, local authorities |

| Skills Required | Financial modeling, market analysis, negotiation | Tenant communication, maintenance coordination, conflict resolution |

| Typical Work Scope | Long-term asset growth and portfolio management | Short-term property upkeep and tenant management |

Introduction: Real Estate Asset Manager vs Property Manager

Real Estate Asset Managers oversee a portfolio of properties with a focus on maximizing investment returns through strategic planning, financial analysis, and long-term asset growth. Property Managers handle the day-to-day operations of individual properties, including tenant relations, maintenance, and rent collection to ensure smooth property functionality. Both roles are essential but differ in scope, with Asset Managers concentrating on overall investment performance and Property Managers prioritizing operational efficiency.

Core Responsibilities of Real Estate Asset Managers

Real estate asset managers focus on maximizing property value through strategic planning, financial analysis, and portfolio optimization, overseeing investments to ensure long-term profitability. They work closely with stakeholders to develop asset-specific business plans, manage capital expenditures, and assess market trends for informed decision-making. Unlike property managers, asset managers prioritize investment performance and hold responsibility for acquisitions, dispositions, and overall asset allocation.

Key Functions of Property Managers

Property managers handle day-to-day operations of real estate assets, including tenant relations, rent collection, maintenance coordination, and lease enforcement. They ensure properties remain well-maintained and compliant with local regulations while addressing tenant inquiries and resolving issues promptly. Their role is critical in maximizing occupancy rates and maintaining property value through effective operational management.

Strategic vs Operational Focus

Real Estate Asset Managers prioritize strategic planning, portfolio optimization, and maximizing investment returns by analyzing market trends and financial performance. Property Managers focus on the operational management of day-to-day activities such as tenant relations, maintenance oversight, and lease administration. The distinction lies in asset managers driving long-term value creation, while property managers ensure effective property operations and tenant satisfaction.

Financial Oversight and Performance Metrics

Real estate asset managers focus on financial oversight by analyzing investment performance, optimizing property value, and managing portfolio risk to maximize returns for investors. Property managers handle day-to-day operations such as rent collection, maintenance coordination, and tenant relations, ensuring operational efficiency but with limited involvement in strategic financial decisions. Performance metrics for asset managers include net operating income (NOI), internal rate of return (IRR), and cash-on-cash return, while property managers are evaluated on vacancy rates, tenant satisfaction, and maintenance response times.

Decision-Making Authority and Scope

Real Estate Asset Managers oversee the strategic decision-making process, focusing on maximizing investment value and portfolio performance across multiple properties or assets. Property Managers handle day-to-day operations, tenant relations, and maintenance within individual properties, executing decisions made by asset managers. The asset manager's scope is broader, involving financial analysis, market positioning, and long-term planning, whereas property managers have operational authority limited to property-level management tasks.

Tenant Relations and Leasing Management

Real Estate Asset Managers strategically oversee tenant relations by analyzing lease performance and optimizing occupancy rates to maximize asset value, while Property Managers handle day-to-day tenant interactions, issue resolutions, and lease enforcement. Leasing management for Asset Managers involves long-term portfolio planning and rental market analysis to enhance property income, whereas Property Managers focus on executing leasing agreements, tenant screenings, and lease renewals. Tenant relations under Asset Managers are more data-driven and financially oriented, contrasting with the operational and service-focused approach of Property Managers.

Reporting Requirements and Stakeholder Interactions

Real Estate Asset Managers concentrate on high-level financial reporting, analyzing investment performance metrics such as ROI, cash flow, and market trends to inform strategic decisions for investors and ownership stakeholders. Property Managers focus on operational reporting, including maintenance schedules, lease compliance, and tenant relations, providing actionable updates to onsite teams and property owners. Stakeholder interactions for Asset Managers involve collaboration with investors, financial analysts, and executive teams, while Property Managers primarily engage with tenants, vendors, and onsite personnel to ensure smooth property operations.

Required Qualifications and Skill Sets

Real Estate Asset Managers require strong financial analysis skills, expertise in market trends, and proficiency in portfolio management to maximize property value and investment returns. Property Managers need hands-on experience in property maintenance, tenant relations, and operational management, along with knowledge of leasing laws and conflict resolution. Both roles demand excellent communication skills, but Asset Managers typically hold advanced degrees in finance or real estate, whereas Property Managers often have certifications like CPM or RPA focused on property operations.

Career Pathways and Advancement Opportunities

Real Estate Asset Managers focus on maximizing property portfolio value through strategic planning, financial analysis, and investment decisions, leading to advancement opportunities in senior asset management or executive roles within real estate firms. Property Managers concentrate on the operational side, handling tenant relations, maintenance, and day-to-day property operations, with career growth often progressing into regional or facilities management roles. Transitioning from Property Manager to Asset Manager typically requires gaining financial acumen and investment expertise to shift from operational management to strategic asset oversight.

Real Estate Asset Manager vs Property Manager Infographic

jobdiv.com

jobdiv.com